Buy or lose. Investors are preparing for a Christmas rally and are wondering whether a rate cut on federal funds at the FOMC meeting on December 10 will ensure this rally. The end of the year is traditionally a seasonally strong period for the S&P 500, so the proliferation of FOMO, or fear of missing out, is understandable. The question is whether the broad stock index has been driven too far by euphoria.

Markets are in a mode where downbeat economic data from the United States is perceived as good news for stocks. In this regard, the announcement by Challenger, Gray & Christmas that American employers plan to cut 71,300 employees in November is seen as a boon for the S&P 500, as it increases the chances of easing monetary policy by the Fed in December. The figure for the year-to-date stands at 1.17 million, the highest since 2020.

Dynamics of Planned Layoffs in US

On the other hand, the decline in jobless claims to a three-year low could become a trump card for the hawks at the FOMC. If the labor market is not cooling down, why lower rates? Stock indices reacted to mixed macro statistics with gains. Moreover, the leading dynamics of the Russell 2000 indicates that all is well. According to Globalt Investments, the growth of this stock index on a quiet day is the result of a broad influx of money into small-cap companies. Fundstrat Global Advisors recommends buying not only these but also the industrial sector and financials.

The process of leader rotation continues. The announcement from Meta Platforms about downsizing its building Metaverse group led to a 3.4% increase in the tech giant's stock prices. However, this was insufficient for the S&P 500 and the Nasdaq Composite to rise significantly.

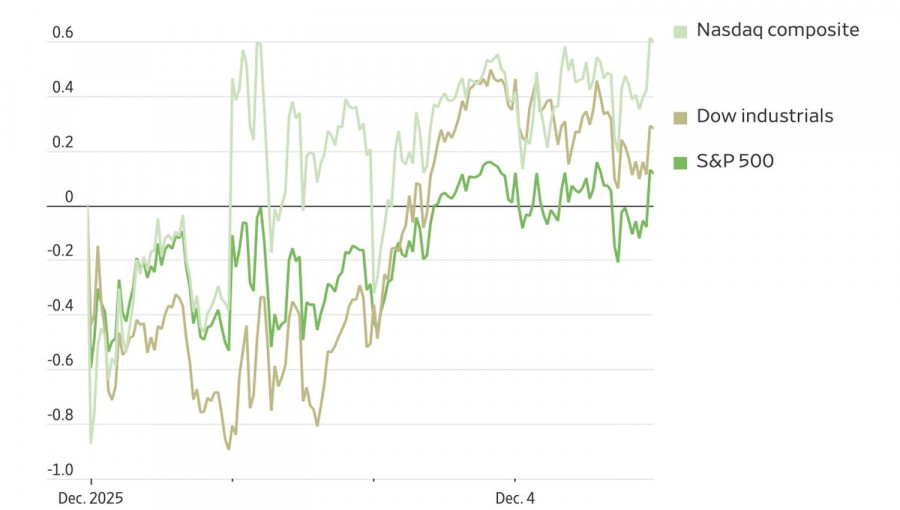

Dynamics of US Stock Indices

Rising Treasury yields are putting pressure on the stock market. Some associate this with doubts about whether Kevin Hassett can ensure the necessary cut in federal funds rates as the new Fed chairman. The official was outraged at the question of how low he could push borrowing costs. According to him, the central bank governor's task is to adjust monetary policy based on data, primarily regarding inflation and unemployment.

In my opinion, the rally in Treasury yields is an echo of events happening in Japan. There, the BoJ is set to resume tightening its monetary policy cycle, and bond market rates have surged to their highest levels since 2007.

Thus, investors are preparing for a Christmas rally in the broad stock index, anticipating a rate cut in federal funds, and rotating securities in their portfolios.

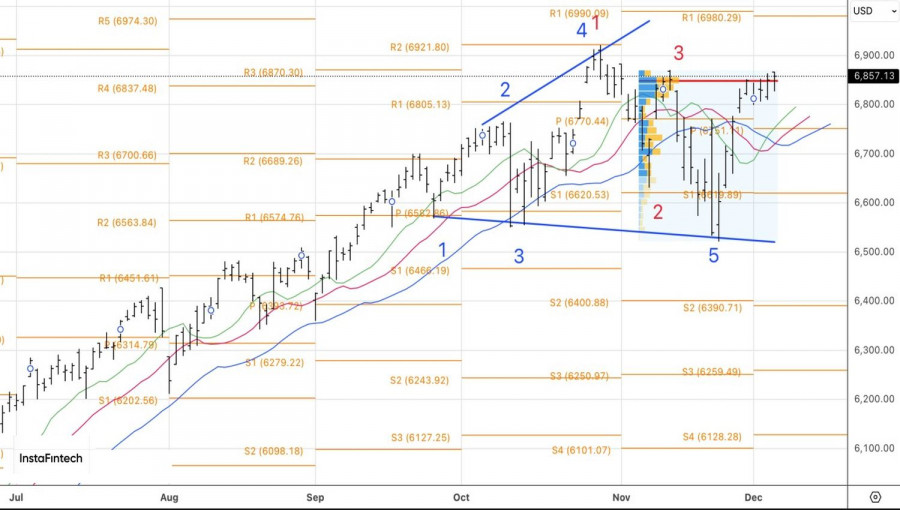

Technically, the daily chart of the S&P 500 showed another attempt to break through fair value at 6,845. The market closed above this level, but it is still premature to declare a victory for bulls. A rise above the local high of 6,870 would allow for additional long positions.