Trade analysis and recommendations for trading the Japanese yen

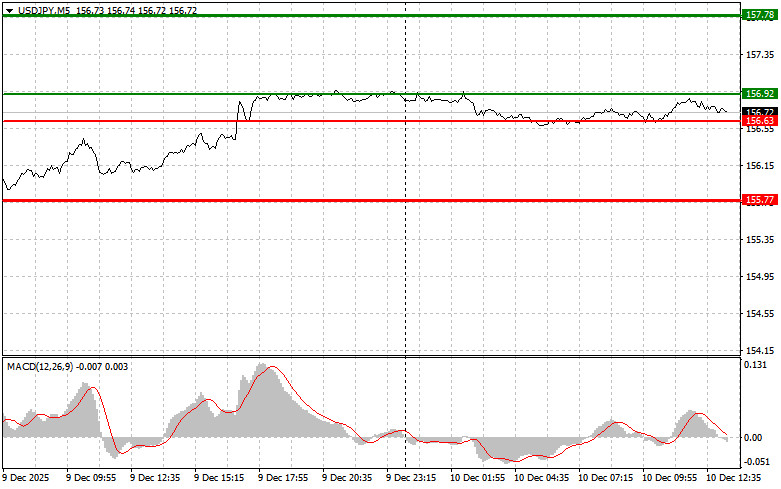

The price test of 156.63 occurred when the MACD indicator had just begun moving downward from the zero mark, which confirmed the correct entry point for selling the dollar. However, the trade resulted in a loss, as the pair never moved downward.

In the afternoon, market attention will be focused on the results of the FOMC meeting, where a decision to cut the key interest rate is expected. Since markets have already priced in the likelihood of a rate cut, the main interest lies in Powell's tone and his comments on future monetary policy. A key moment will be Powell's assessment of economic conditions and inflation forecasts. If he expresses concern about slowing economic growth or notes that inflation is moving toward the target level, this may reinforce market expectations of further rate cuts. Otherwise, if Powell emphasizes economic resilience and signs of rising inflationary pressure, this could strengthen the U.S. dollar and push the Japanese yen lower.

As for intraday strategy, I will mainly rely on scenarios No. 1 and No. 2.

Buy Signal

Scenario No. 1: I plan to buy USD/JPY today when the price reaches the entry point around 156.92 (green line on the chart), with the target at 157.78 (the thicker green line). Around 157.78, I will exit buy positions and open sell trades in the opposite direction (expecting a 30–35-point move in the opposite direction). A rise in the pair can be expected only after a hawkish stance from the Fed. Important! Before buying, make sure the MACD indicator is above the zero mark and just beginning its upward movement.

Scenario No. 2: I also plan to buy USD/JPY today in the case of two consecutive tests of 156.63 at a time when the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to a reversal upward. Growth can be expected toward the opposite levels of 156.92 and 157.78.

Sell Signal

Scenario No. 1: I plan to sell USD/JPY today after the price breaks below 156.63 (red line on the chart), which should lead to a rapid decline in the pair. The key target for sellers will be 155.77, where I will exit sell positions and also immediately open buy trades in the opposite direction (expecting a 20–25-point move upward). Pressure on the pair will return only if the Fed adopts a dovish stance. Important! Before selling, make sure the MACD indicator is below the zero mark and just beginning its downward movement.

Scenario No. 2: I also plan to sell USD/JPY today if the price tests 156.92 twice in a row while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a downward reversal. A decline can be expected toward 156.63 and 155.77.

What's on the chart:

Important

Beginner Forex traders must make entry decisions with great caution. Before major fundamental reports are released, it is best to stay out of the market to avoid sudden price swings. If you decide to trade during news releases, always place stop orders to minimize losses. Without stop orders, you can very quickly lose your entire deposit, especially if you ignore money management principles and trade large volumes.

And remember: successful trading requires having a clear trading plan, like the one outlined above. Spontaneous trading decisions based on the current market situation are, by default, a losing strategy for intraday traders.