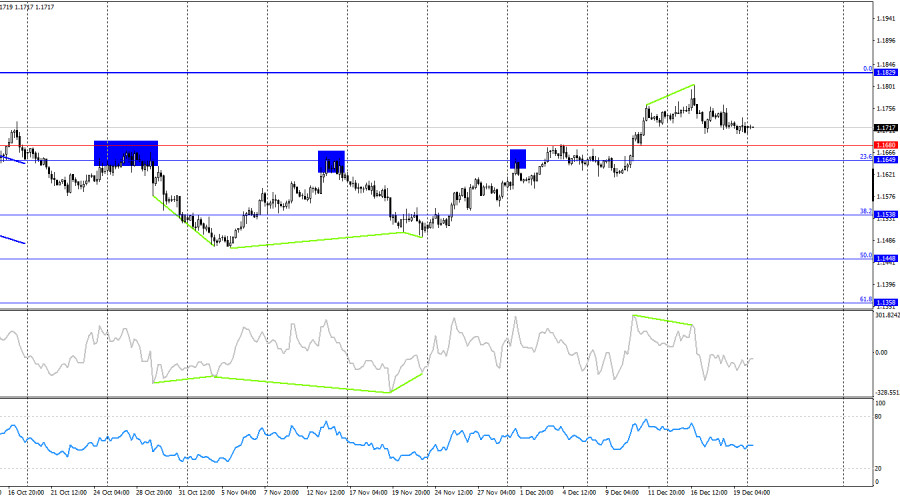

The EUR/USD pair traded sideways on Friday, paying no attention to the 38.2% Fibonacci corrective level at 1.1718, which had previously acted as a strong support level three times. Since traders have begun to ignore chart levels and their activity on Friday dropped to zero, I assume that the market has started actively preparing for the holidays. In this case, we are unlikely to see any significant moves before the end of the year. And if we do see any, forecasting them will be very difficult.

The wave picture on the hourly chart remains simple and clear. The most recent completed upward wave broke the high of the previous wave, while the new downward wave has not yet broken the previous low. Thus, the trend officially remains "bullish." It would be hard to call it strong, but in recent weeks bulls have regained confidence and attacked with renewed strength. The easing of the Fed's monetary policy supports further euro growth, and the ECB will not create any problems for the single currency in the near future.

On Friday, even judging by the charts, one could confidently say that there was no news background. In fact, that was not entirely the case, but what difference does it make whether there was news or not if the market showed no desire to trade? In reality, Germany released its consumer confidence index, while the U.S. published new home sales data and the University of Michigan consumer sentiment index. Both U.S. reports came in worse than traders had expected, but the bulls did not even try to use this information for a new attack. Thus, neither technically nor fundamentally are there grounds at the moment to expect a strong move up or down. This week, interesting events will occur only on Tuesday, after which the market will switch into Christmas preparation mode. Next week is New Year's.

On the 4-hour chart, the pair reversed in favor of the U.S. dollar after a bearish divergence formed on the CCI indicator. As a result, the decline may continue for some time toward the support level at 1.1649–1.1680. A rebound from this zone would favor the euro and a resumption of growth toward the 0.0% Fibonacci corrective level at 1.1829. A consolidation below the zone would increase the probability of a further decline toward the 38.2% Fibonacci level at 1.1538. No emerging divergences are observed today.

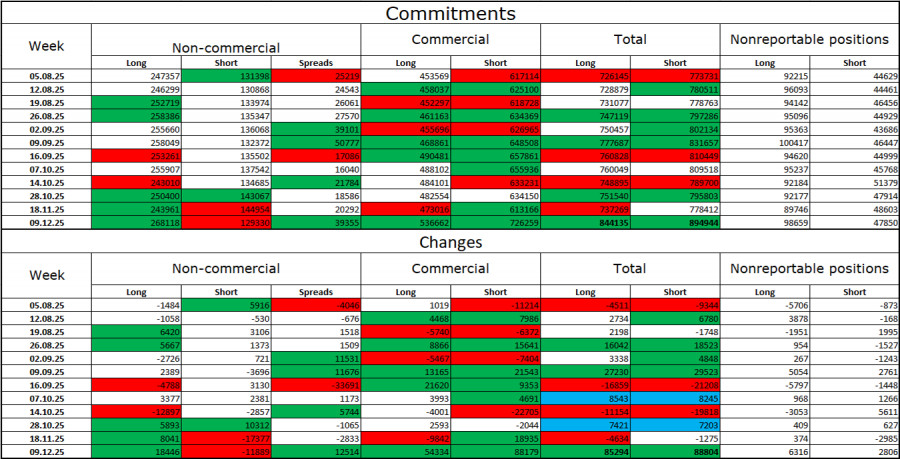

Commitments of Traders (COT) Report:

During the latest reporting week, professional players opened 18,446 long positions and closed 11,889 short positions. Sentiment among the "Non-commercial" group remains bullish thanks to Donald Trump and his policies, and it continues to strengthen over time. The total number of long positions held by speculators now stands at 268,000, while short positions amount to 129,000. This represents more than a twofold advantage for the bulls.

For thirty-three consecutive weeks, large players were reducing short positions and increasing long positions. Then the shutdown began, and now we see the same picture again: bulls continue to build long positions. Donald Trump's policies remain the most significant factor for traders, as they create numerous problems that will have long-term and structural consequences for the U.S. economy, such as the deterioration of the labor market. Despite the signing of several important trade agreements, analysts fear a recession in the U.S. economy, as well as a loss of the Fed's independence under pressure from Trump and against the backdrop of Jerome Powell's resignation in May of next year.

Economic Calendar for the U.S. and the Eurozone:

On December 22, the economic calendar contains no interesting entries, and traders can already begin preparing for the New Year. The impact of the news background on market sentiment on Monday will be absent.

EUR/USD Forecast and Trading Advice:

Sell positions are possible if prices consolidate below the 1.1718 level on the hourly chart, with a target at 1.1656. Buy positions can be opened on a rebound from the 1.1718 level with targets at 1.1795–1.1802. However, today traders may once again ignore the 1.1718 level.

Fibonacci grids are drawn from 1.1392–1.1919 on the hourly chart and from 1.1066–1.1829 on the 4-hour chart.