Scheduled Maintenance

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

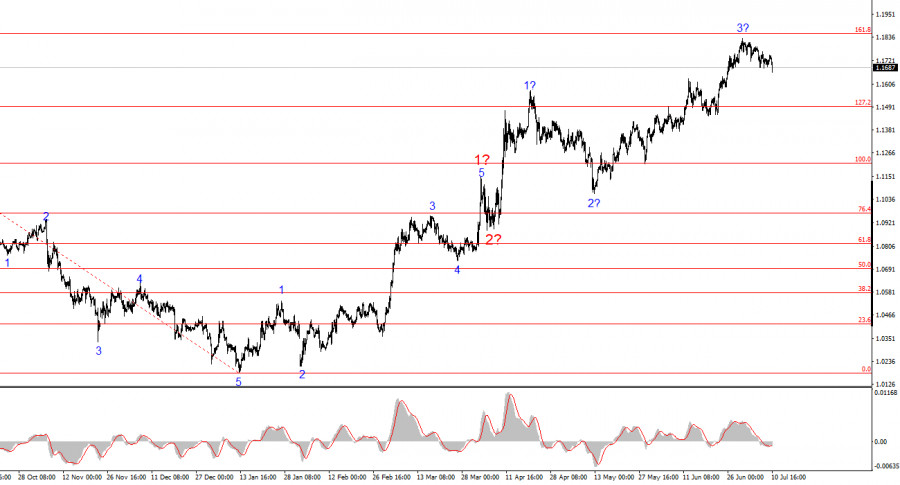

The wave pattern on the 4-hour EUR/USD chart has not changed for several consecutive months. The formation of the upward trend section continues, while the news background still supports all currencies except the dollar. The trade war initiated by Donald Trump was intended to boost budget revenues and reduce the trade deficit. However, these targets have yet to be achieved, trade deals are being signed with great difficulty, and Trump's "One Big Law" will increase the U.S. national debt by 3 trillion dollars in the coming years. The market has given a rather poor assessment of Trump's first six months, viewing his actions as a threat to American stability and prosperity.

At present, wave 3 is likely still developing, and it could extend significantly beyond its current form. However, its internal structure has taken on a five-wave shape, which may indicate its completion. If the current wave pattern is correct, the upward movement in quotes should continue in the coming months, but in the short term, we may see a corrective set of waves. There is virtually no chance that Trump will abandon his new trade policy.

The EUR/USD pair remained almost unchanged again on Thursday. In fact, the dollar has been strengthening for the eighth consecutive day, but if you look at a larger or smaller timeframe, you'll see what kind of movement this really is. On average, the dollar gains about 15 basis points per day. Frankly, I'm not even sure if this can be called "growth" or a "wave."

However, let me remind you that everything is going according to plan. This plan will be very difficult for sellers to implement because this week's news flow has been overwhelmingly negative for the dollar. Despite an empty economic calendar, nearly every day brings news of new tariffs. I say "new tariffs," but in reality, this refers both to increases on existing tariffs and the introduction of new ones. Nevertheless, market participants understand exactly what is meant and who is imposing these tariffs.

By the sixth month, attitudes toward Trump's trade policy have become mixed. On the one hand, his actions are clearly an escalation. On the other hand, Trump is arguably pursuing the mildest form of trade expansionism. Almost all of the announced tariffs are scheduled to take effect at a later date, effectively giving other countries time to resolve the issues—created by Trump himself—through negotiations. In practice, the approach has been as follows: "We're imposing tariffs, but you have three months to propose a deal that suits us." When no deal is reached: "Here are additional tariffs, along with another three weeks to negotiate." For this reason, I have little doubt that Trump will once again postpone the tariff increases at the start of next month. In any case, the overall impact remains negative for the dollar.

Based on the analysis of EUR/USD, I conclude that the instrument continues to build an upward trend segment. The wave pattern remains entirely dependent on the news background related to Trump's decisions and U.S. foreign policy, with no positive developments in sight. The targets for wave 3 may extend as far as the 1.25 level. Therefore, I continue to consider long positions with targets around the 1.1875 level, which corresponds to 161.8% on the Fibonacci scale. In the near future, a corrective wave pattern is expected to form, so new euro purchases should be considered only after this correction is complete.

Key principles of my analysis:

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

ລິ້ງດ່ວນ