Prodeje nových vozů Tesla ve Španělsku v dubnu klesly meziročně o 36 % na 571 vozů, jak ukazují údaje zveřejněné v pondělí průmyslovou skupinou ANFAC. Mezitím prodeje elektromobilů jiných značek prudce vzrostly.

Za první čtyři měsíce roku 2025 prodeje vozů Tesla ve Španělsku klesly meziročně o 17 %, zatímco prodeje elektrifikovaných vozidel (včetně plně elektrických i hybridů) vzrostly o 54 %.

Prodeje Tesly v Evropě klesají, protože výrobce vlastněný miliardářem Elonem Muskem čelí rostoucí konkurenci zejména ze strany evropských a čínských značek elektromobilů.

Muskovo veřejné přiklánění se k krajní pravici v Evropě vedlo také k protestům proti jeho osobě i společnosti, a to včetně vandalismu na showroomech a dobíjecích stanicích po celých Spojených státech i Evropě. Musk před dvěma týdny uvedl, že omezí čas, který věnuje Trumpově administrativě, a více se bude věnovat řízení společnosti Tesla (NASDAQ:TSLA).

Ve Španělsku podle údajů ANFAC vzrostly od začátku roku prodeje čínských výrobců BYD (SZ:002594) o 644 %, MG o 80 % a Omoda o 346 %.

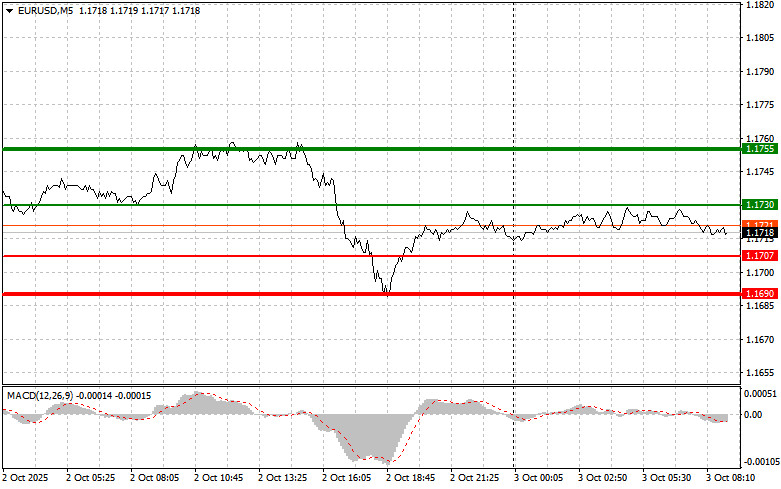

The test of the 1.1746 price level occurred just as the MACD indicator began moving down from the zero line, confirming a valid entry point for selling the euro. As a result, the pair fell toward the target area near 1.1712.

Yesterday's statements from Federal Reserve officials—that the U.S. economy is in good shape and that the fight against inflation is far from over—spurred U.S. dollar buying. However, today brings important data releases, including the Eurozone services PMI, composite PMI, and producer price index (PPI), all of which could significantly impact the market.

The significance of the upcoming reports cannot be overstated, as they will serve as a litmus test for assessing the current state of the Eurozone economy and help determine the future direction of the EUR/USD currency pair.

Weak reports will not only increase pressure on EUR/USD but could also trigger a full-scale euro sell-off. A decline in services PMI below the 50 mark would indicate a contraction in business activity. A negative composite index reading would confirm widespread economic weakness.

The producer price index, in turn, will indicate how effectively the European Central Bank is managing inflation. If price growth accelerates, the ECB will face a difficult choice: continue fighting inflation or protect fragile economic growth. Any negative surprises will heighten investor concerns and lead to euro weakness.

As for today's intraday strategy, I will primarily rely on the execution of Scenarios #1 and #2.

Scenario #1: Buying the euro today is possible if the price reaches the area around 1.1730 (indicated by the green line on the chart), targeting a rise toward 1.1755. At the 1.1755 level, I plan to exit long positions and open short positions in the opposite direction, targeting a 30–35 pip retracement. A bullish euro outlook is only reasonable if very strong economic data is released. Important: Before initiating a buy trade, ensure that the MACD indicator is above the zero line and just starting to move upward.

Scenario #2: I also plan to buy the euro if the price tests the 1.1707 level twice, at a time when the MACD indicator is in oversold territory. This would limit the downside potential and lead to a market reversal to the upside. A rise toward the opposite levels of 1.1730 and 1.1755 can be expected.

Scenario #1: I plan to sell the euro after the price drops to the 1.1707 level (indicated by the red line on the chart). The target is 1.1690, where I'll exit short positions and immediately open a buy trade, anticipating a return move of 20–25 pips. Selling pressure is likely to intensify with the release of weak economic data. Important: Before initiating a sell trade, ensure that the MACD indicator is below the zero line and just beginning to move downward.

Scenario #2: I will also consider selling the euro if the price tests the 1.1730 level twice, with the MACD indicator in overbought territory. This will limit the pair's upside potential and lead to a downward market reversal. A decline toward the 1.1707 and 1.1690 levels can be expected.

Beginner traders should exercise extreme caution when deciding to enter the market. It is best to avoid trading during important economic data releases to prevent being caught in sharp price movements.

If you choose to trade during news events, always use stop-loss orders to minimize potential losses. Without stop-losses, you can quickly lose your entire deposit—especially if you ignore money management and trade with large volume sizes.

And remember: to succeed in trading, you need to have a clear trading plan—just like the one I've outlined above. Making spontaneous trading decisions based on the current market situation is a losing strategy for intraday traders.

ລິ້ງດ່ວນ