Saúdská Arábie, největší vývozce ropy na světě a de facto lídr OPEC, vykázala za první čtvrtletí 2025 rozpočtový deficit ve výši 58,701 miliardy rijálů (15,65 miliardy dolarů), uvedlo v pondělí ministerstvo financí.

Deficit je důsledkem výrazného 18% meziročního poklesu příjmů z ropy, které činily 149,810 miliardy rijálů.

Celkové příjmy země za dané období dosáhly 263,616 miliardy rijálů, zatímco vládní výdaje činily 322,317 miliardy rijálů.

Tato čísla ukazují na výzvy, kterým čelí saúdská ekonomika, jež je silně závislá na příjmech z vývozu ropy.

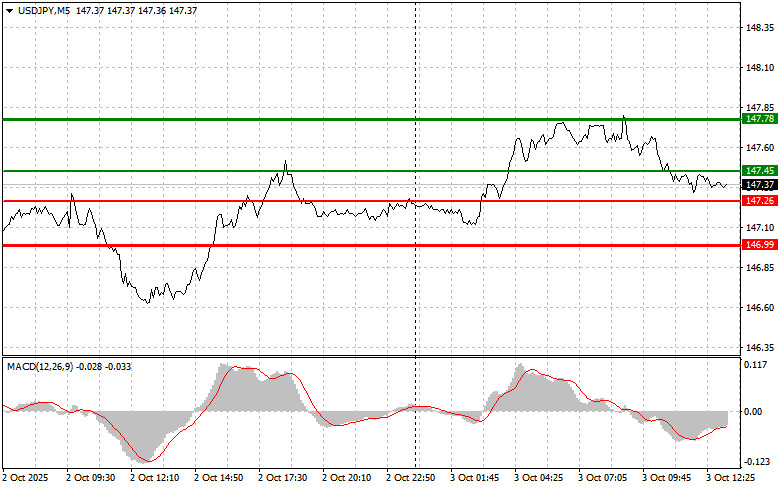

The test of 147.60 in the first half of the day coincided with the moment when the MACD indicator had just started moving downward from the zero mark, confirming the correct entry point for selling the dollar. As a result, the pair fell by more than 30 points.

During the U.S. trading session, the main focus will be on FOMC member John Williams' speech and the ISM Services PMI report. The absence of U.S. labor market data is certainly disappointing, so market participants will likely scrutinize Williams' remarks in hopes of clues regarding the Fed's next steps in monetary policy. A more dovish tone, indicating a possible rate cut in October, could negatively affect the U.S. dollar.

The ISM Services PMI publication will also be an important indicator of the U.S. economy's health. A drop in the index below forecasts may signal slowing growth, which would further weigh on the dollar. If Williams' speech is interpreted as a sign of Fed dovishness and ISM data disappoint, the yen will once again receive strong support.

For intraday strategy, I will focus mainly on Scenarios #1 and #2.

Buy Signal

Scenario #1: I plan to buy USD/JPY today at the entry point of 147.45 (green line on the chart), targeting growth to 147.78 (thicker green line on the chart). Around 147.78, I will exit buy trades and open sales in the opposite direction (expecting a 30–35-point reversal from the level). A rally in the pair can only be expected on very strong U.S. data.Important: Before buying, make sure the MACD indicator is above the zero mark and just starting to rise from it.

Scenario #2: I also plan to buy USD/JPY today if there are two consecutive tests of 147.26 while the MACD is in the oversold zone. This will limit the pair's downward potential and trigger a reversal upward. Growth toward 147.45 and 147.78 can be expected.

Sell Signal

Scenario #1: I plan to sell USD/JPY today after a breakout below 147.26 (red line on the chart), which should lead to a quick decline. The key target for sellers will be 146.99, where I will exit sales and immediately open buys in the opposite direction (expecting a 20–25-point rebound). Selling pressure on the pair may persist if U.S. data are weak.Important: Before selling, make sure the MACD indicator is below the zero mark and just starting to decline from it.

Scenario #2: I also plan to sell USD/JPY today if there are two consecutive tests of 147.45 while the MACD is in the overbought zone. This will limit the pair's upward potential and trigger a reversal downward. A decline toward 147.26 and 146.99 can be expected.

Chart Guide

Important: Beginner Forex traders should be very cautious when deciding on market entries. Before major fundamental reports are released, it is best to stay out of the market to avoid sharp volatility. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without them, you can quickly lose your entire deposit, especially if you ignore money management and trade with large volumes.

And remember: successful trading requires a clear trading plan, like the one presented above. Spontaneous decisions based only on the current market situation are a losing strategy for intraday traders.

ລິ້ງດ່ວນ