On the hourly chart, the GBP/USD pair on Friday formed a rebound from the 161.8% retracement level at 1.3110 and a bounce from the 127.2% retracement level at 1.3186 on the same candle. The pair has been trading between these two levels for an entire week, which allows for a clear conclusion — a sideways trend. Thus, in the coming days these same levels can be used for trading.

The wave situation remains bearish. The new upward wave has not yet broken the previous peak, while the latest downward wave (which formed over three weeks) did break the previous low. In recent weeks, the news background has been negative for the US dollar (in my opinion), but bullish traders did not take advantage of the opportunities for offensive moves. Unfortunately for the pound, the news background has deteriorated recently, and now it is the bulls who are finding it difficult to launch attacks. To complete the bearish trend, the price needs to rise above 1.3470 or form two consecutive bullish waves.

For five days in a row, the pound has been stuck between 1.3110 and 1.3186. The pound is struggling to hold on to its regained positions, but last week showed that traders are more inclined toward buying than selling at this moment. Undoubtedly, before the missing US labor market and unemployment reports are released, it is too early to draw conclusions, as market sentiment may change very quickly once that data appears. However, last week the UK published several very important reports — all of which were weaker than the market expected. Thus, the pound had every reason to fall, but the level of 1.3110 held back the bearish attacks, which were not strong enough. Last week, the price rebounded from this level four times. I believe the bears have had their fill — they exceeded their goals in September–October, and now it is the bulls' time. Unless the news background turns sharply against them. This week's background will be weak, but there is a chance that the US might start releasing the reports that were skipped in September. And those could give traders plenty to think about.

On the 4-hour chart, the pair continues to fall within the descending trend channel. If a new bullish trend is starting now, we will gradually begin to receive confirmations of it. I will begin expecting a strong rise in the pound only after the price closes above the channel. A consolidation below the 76.4% retracement level at 1.3118 will again allow us to anticipate a decline toward the 61.8% Fibonacci level at 1.2925. No emerging divergences are observed today.

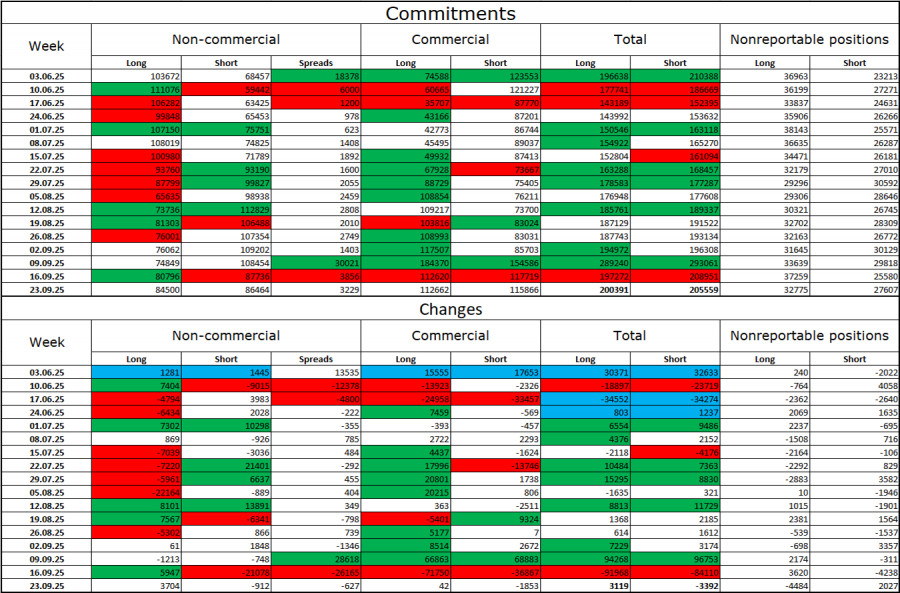

The sentiment of the Non-commercial traders category became more bullish in the last reporting week — but that report is from a month and a half ago. The number of long positions held by speculators increased by 3,704, while short positions decreased by 912. The spread between long and short positions is currently approximately: 85,000 vs. 86,000. Bullish traders are once again tipping the scales in their favor.

In my opinion, the pound still faces downside prospects, but each new month makes the US dollar appear weaker and weaker. If earlier traders were worried about Donald Trump's protectionist policies, uncertain of what results they would bring, now they may be worried about the consequences of those policies: a potential recession, constant introduction of new tariffs, and Trump's fight against the Federal Reserve, due to which the regulator may become "politically biased." Thus, the pound currently appears much less risky than the US dollar.

On November 17, the economic calendar contains no noteworthy entries. The news background will not influence market sentiment on Friday.

Sell positions are possible today if the price closes below 1.3110 on the hourly chart with a target of 1.3024, or on a rebound from 1.3186 with a target of 1.3110. Buy positions can be opened on a rebound from 1.3110 with targets at 1.3186 and 1.3247.

Fibonacci grids are built from 1.3247–1.3470 on the hourly chart and from 1.3431–1.2104 on the 4-hour chart.

ລິ້ງດ່ວນ