Last year, the leader and father of the American nation already threatened to withdraw from NATO. According to him, European Union countries spend too little on the Transatlantic alliance, so America is forced to bear this burden despite being the least interested in ensuring Europe's security. Naturally, the US president was disingenuous when he claimed to have no interest in influencing the European region. For example, right now we are seeing exactly the opposite picture. Trump does not want China or Russia to dominate the European continent, and therefore is doing everything he can to seize for himself, of all things, seemingly unwanted Greenland.

At the moment, Trump has announced new trade tariffs against European countries that are NATO partners of the US. It turns out that Trump is taking tough measures against his own allies, once again proving to anyone who cares to notice that nothing is sacred in business. Trump pursues his personal goals, which, in the view of many analysts, should be called "imperial." Haven't you noticed that most of Trump's actions are global in nature? And Trump (as he has often said himself) considers himself the best president in America's history. It is not surprising that he wants to enter that very history. But to do that, it is not enough simply to govern the country, as Joe Biden does. The annexation of territory the size of half the US—that will be remembered in a hundred years.

It is worth remembering that NATO's main protocol is the readiness of all other member states to defend any member of the organization. But what if one NATO member attacks another? That is exactly what would happen if Trump tried to take Greenland by force. This military intervention does not present any particular difficulty. Greenland's population is tiny, it has no army of its own, and European officials, after the threat of losing the island arose, deployed 50 troops to defend it. So, broadly speaking, Trump would only need to land his own forces on the island and declare it his. After that, the US would have to defend Greenland from European attempts to retake it. However, in that case, NATO would collapse, since the security guarantees that membership in the alliance provides for Europe would become simply meaningless.

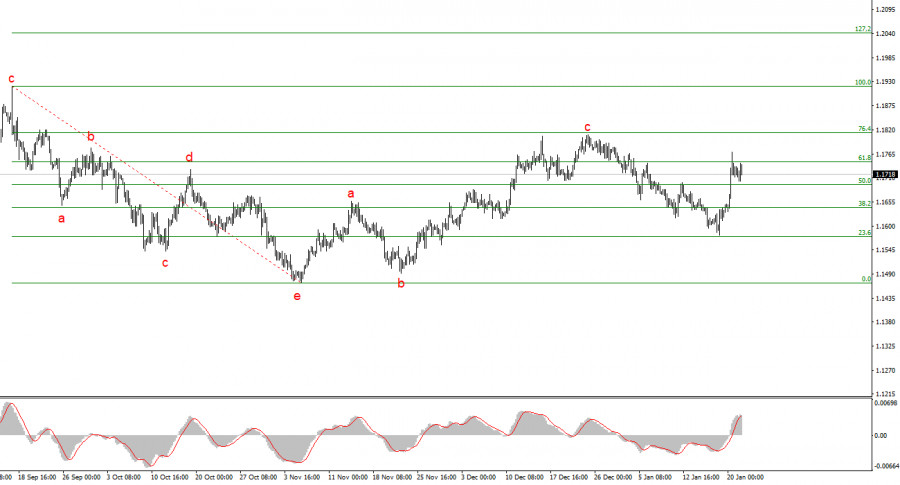

Based on the analysis of EUR/USD, I conclude that the instrument continues to build an upward trend segment. Donald Trump's policies and the Federal Reserve's monetary policy remain significant factors in the long-term decline of the US currency. The targets of the current trend segment could extend as far as the 1.25 figure. However, to reach those targets, the market must complete the construction of the extended wave 4. Right now, we only see the market's desire to keep this wave going. Therefore, in the near term, a decline to the 1.15 figure can be expected.

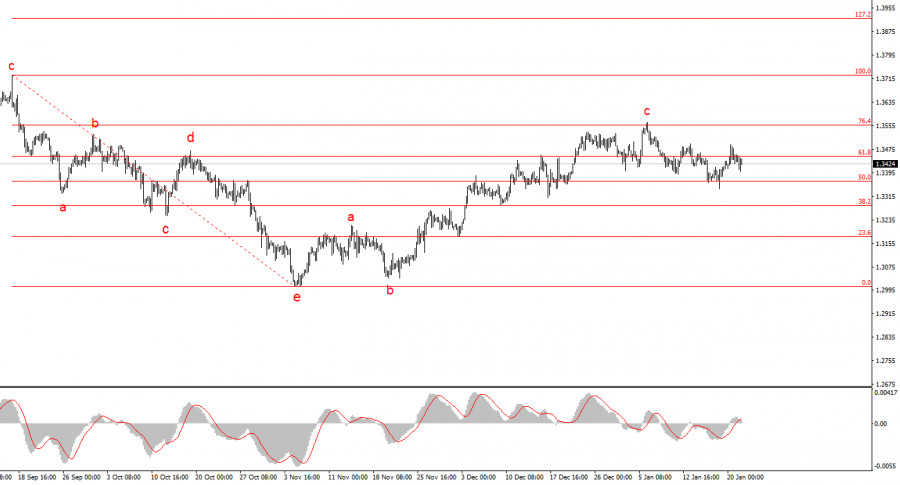

The wave picture of GBP/USD has changed. The downward corrective structure a-b-c-d-e in C of 4 appears complete, as does the entire wave 4. If this is indeed the case, I expect the main trend segment to resume its development, with initial targets around 1.38 and 1.40.

In the short term, I expected wave 3 or C to form, with targets around 1.3280 and 1.3360, which correspond to 76.4% and 61.8% of Fibonacci. These targets have been reached. Wave 3 or C has presumably completed its construction, so in the near term, a downward wave or a series of waves may form.

ລິ້ງດ່ວນ