The test of the price at 1.3695 coincided with the moment when the MACD indicator was just beginning its downward movement from the zero mark, confirming a valid entry point for selling the pound. As a result, the pair decreased by more than 30 pips.

Weak ADP labor market data was offset by a positive ISM report on US services activity. The labor market continues to show signs of weakness despite some positive signals. The ADP data, traditionally considered a preliminary indicator for official employment data, indicated a slight slowdown in hiring rates. However, investor optimism was supported by an unexpectedly strong ISM report for the services sector—a key component of the American economy.

Today, the PMI index for the UK, reflecting the state of the construction sector, is scheduled for publication. Additionally, the Bank of England's Monetary Policy Committee will announce its decision on the key interest rate, followed by a subsequent speech by the Bank's Governor, Andrew Bailey. These events are crucial for assessing the current state of the British economy and determining the direction of monetary policy in the near term.

The Bank of England's interest rate decision is one of the most significant events for financial markets. Given high inflation and slowing economic growth, the regulator is forced to balance controlling price growth with maintaining economic activity. Andrew Bailey's speech will undoubtedly be closely analyzed, as traders seek to understand the rationale for keeping rates unchanged and to predict the Bank of England's next steps.

Regarding the intraday strategy, I will focus more on implementing scenarios No. 1 and No. 2.

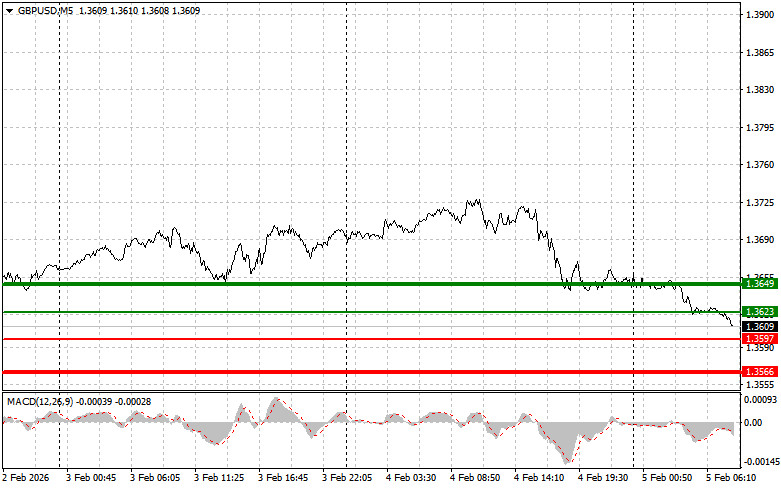

Scenario #1: I plan to buy the pound today when it reaches an entry point around 1.3623 (green line on the chart), targeting a move to 1.3649 (thicker green line on the chart). At level 1.3649, I plan to exit the long positions and immediately sell in the opposite direction (expecting a 30-35-pip move back from the level). Growth in the pound today can only be anticipated following strong data. Important! Before buying, ensure the MACD indicator is above the zero mark and just starting an upward move from it.

Scenario #2: I also plan to buy the pound today if the price tests 1.3597 twice in a row, when the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward market reversal. Growth can be expected towards the opposite levels of 1.3623 and 1.3649.

Scenario #1: I plan to sell the pound today after it reaches 1.3597 (red line on the chart), which will trigger a rapid decline in the pair. The key target for sellers will be 1.3566, where I intend to exit the short positions and immediately buy in the opposite direction (expecting a 20-25-pip move back from the level). Sellers will show themselves if the pair makes a strong recovery towards larger resistance levels. Important! Before selling, ensure the MACD indicator is below the zero mark and just starting its downward move.

Scenario #2: I also plan to sell the pound today if there are two consecutive tests of 1.3623 when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline can be expected towards the opposite levels of 1.3597 and 1.3566.

The thin green line represents the entry price at which one can buy the trading instrument;

The thick green line represents the approximate price where one can set Take Profit or secure profits, as further growth above this level is unlikely;

The thin red line represents the entry price at which one can sell the trading instrument;

The thick red line represents the approximate price where one can set Take Profit or secure profits, as further decline below this level is unlikely;

The MACD indicator: when entering the market, it is important to consider overbought and oversold zones.

Important: Beginner traders in the Forex market should be very careful when making entry decisions. It is best to stay out of the market before important fundamental reports are released to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember, for successful trading, it is essential to have a clear trading plan, like the one presented above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for an intraday trader.

ລິ້ງດ່ວນ