The euro has quickly and easily formed its first corrective wave. It is important to remember that there can be several corrective waves, and the structure of the last upward trend is corrective in nature. Consequently, the downward structure can also be corrective, and such a structure can contain even more than three waves. However, the wave analysis of the GBP/USD instrument indicates that the upward structure is impulsive. Therefore, after its completion, three corrective waves should be formed. These three corrective waves are already visible for the British pound. Based on all of the above, I believe it is already wise to establish long positions at current levels.

Let's turn to the news background. Last week, it became known that the European Central Bank not only did not cut interest rates following the first meeting of 2026 but also does not intend to do so at the next meetings. Christine Lagarde made it clear that the drop in inflation to 1.7% in January is not an annualized figure, but rather just for that one month. Therefore, the central bank does not believe inflation has fallen below the target level and does not require intervention from the central bank. As a result, the euro did not decline further.

Next week will begin with a speech by Christine Lagarde, who may reiterate that the ECB does not intend to change its monetary policy in the near future. As with Thursday, there will likely be no reaction to such statements. For the remainder of the week, there will be no significant economic news or speeches in the Eurozone. Therefore, as is often the case, all market attention will turn to U.S. news. It should be noted that important events in the U.S. will occur even without potential speeches from Donald Trump.

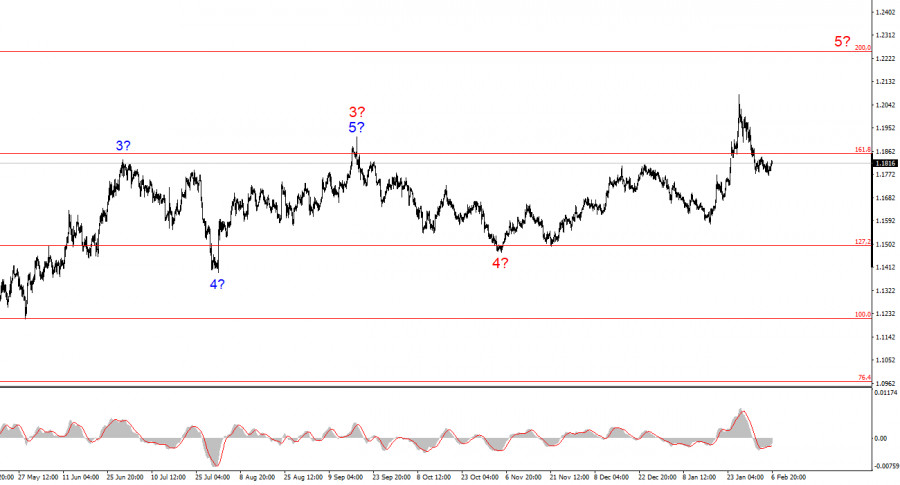

Based on the analysis of EUR/USD, I conclude that the instrument continues to build an upward trend. Trump's policies and the Federal Reserve's monetary policy remain significant factors affecting the long-term decline of the U.S. dollar. The targets for the current trend section could extend to the 25th figure. At this moment, I believe global wave 5 has begun and is continuing, so I expect prices to rise in the first half of 2026. However, in the near term, I anticipate a downward wave (or series of waves), as the a-b-c-d-e structure also appears to be complete. In the near future, my readers can look for areas and levels for new purchases.

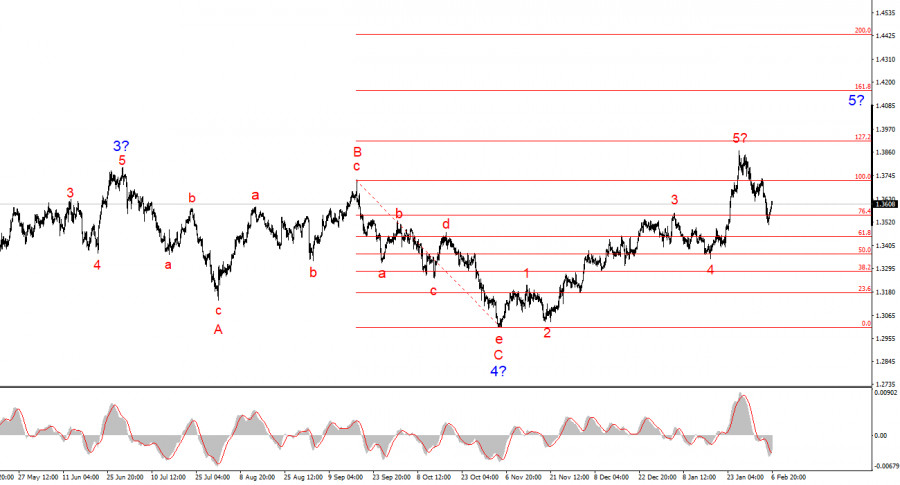

The wave pattern for GBP/USD appears quite clear. The five-wave upward structure has completed its formation, but global wave 5 may take on a much more extended appearance. I believe that a corrective set of waves may be formed in the near future, after which the upward trend will resume. Therefore, in the coming weeks, I suggest seeking opportunities for new purchases. In my opinion, under Trump, the British pound has a good chance of trading at $1.45-$1.50. Trump himself welcomes the decline in the dollar's exchange rate. All his actions have a dual effect: a weaker dollar and the resolution of internal, external, trade, and geopolitical issues.

ລິ້ງດ່ວນ