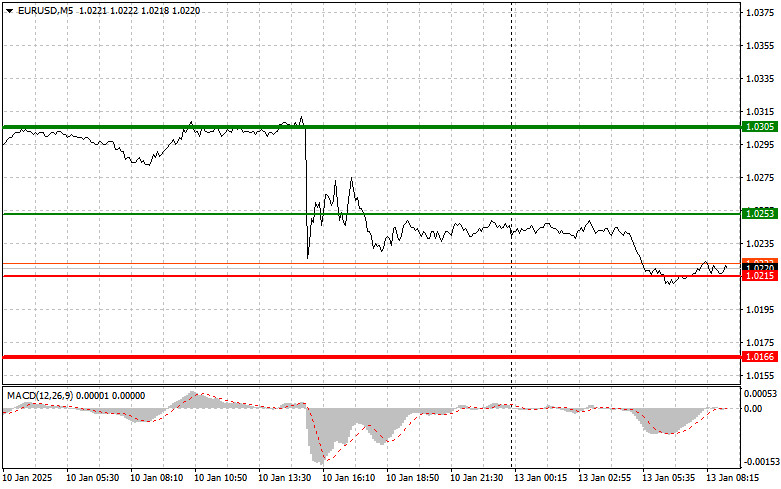

A test of the 1.0295 level in the afternoon coincided with the MACD indicator beginning its downward movement from the zero mark, which confirmed a valid entry point for selling the euro. Consequently, the pair dropped by more than 50 pips.

Last week left no doubt about the robustness of the U.S. economy and its capacity to deliver strong performance metrics. The decline in the U.S. unemployment rate has shifted investor expectations for further rate cuts to a later date, which has strengthened the dollar. Given the latest data, euro buyers are unlikely to be as active as they were earlier this year.

Today, the lack of economic data from the Eurozone will not inspire confidence among euro buyers, and the best-case scenario may be a slight upward correction in the pair during the first half of the day.

For my intraday strategy, I will primarily focus on implementing Scenario #1 and Scenario #2.

Scenario #1:

Buy the euro at around 1.0253 (green line on the chart), targeting a rise to 1.0305. At 1.0305, exit the market and sell the euro in the opposite direction, expecting a 30–35 pips movement from the entry point. Note that any upward movement is likely to be corrective. Important: Before buying, ensure that the MACD indicator is above the zero mark and starting to rise.

Scenario #2:

Also, consider buying the euro if the price undergoes two consecutive tests of the 1.0215 level while the MACD indicator is in the oversold zone. This will limit the pair's downside potential and trigger an upward market reversal. Expect a rise toward the opposite levels of 1.0253 and 1.0305.

Scenario #1:

Sell the euro after the price reaches 1.0215 (red line). Target the 1.0166 level, where you plan to exit the market and immediately buy in the opposite direction, anticipating a rebound of 20–25 pips from the level. Pressure on the pair could return at any moment. Important: Before selling, ensure that the MACD indicator is below the zero mark and starting to decline.

Scenario #2:

Also, consider selling the euro if the price undergoes two consecutive tests of the 1.0253 level while the MACD indicator is in the overbought zone. This will limit the pair's upside potential and trigger a downward market reversal. Expect a decline toward the opposite levels of 1.0215 and 1.0166.

QUICK LINKS