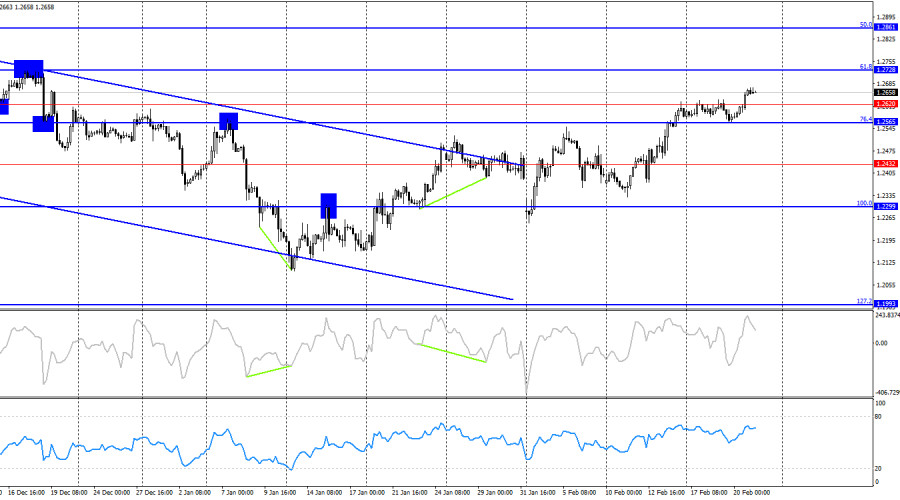

On the hourly chart, the GBP/USD pair secured itself above the resistance zone of 1.2611–1.2642 on Thursday, allowing for expectations of further growth towards the next resistance area at 1.2709–1.2734. A rebound from this zone could halt the bulls' advance.

The wave situation remains clear. The last completed downward wave did not break below the previous low, while the last upward wave surpassed the prior peak. Thus, the formation of a bullish trend appears to be ongoing. However, recent waves differ significantly in size and present multiple possible structures. I am not fully convinced that we are in a sustained bullish trend, but at the same time, the strong rally in the pound in recent weeks cannot be ignored.

Thursday's fundamental backdrop offered no particular support for the pound, as no major economic reports were released. However, earlier in the week, the UK saw a strong inflation report, a decent unemployment report, and solid wage growth figures. Bulls had the opportunity to push the pair higher on Tuesday and Wednesday but only managed to break through the 1.2611–1.2620 zone on Thursday.

Today, the first new support factors for the pound have emerged. The UK retail sales report released in the morning showed a 1.7% m/m increase and a 1.0% y/y rise, significantly surpassing expectations. Later in the day, the PMI indices for the manufacturing and services sectors, along with the composite index, will be released. In the second half of the day, the U.S. will publish similar PMI data, supplemented by two additional reports on new home sales and consumer sentiment. If the upcoming reports match or exceed expectations, the pound may continue to rise into Friday.

Overall, this week has been highly favorable for pound bulls, while the U.S. economic backdrop remains relatively weak, failing to support bearish traders.

On the 4-hour chart, the pair continues to rise and has firmly established itself above the 1.2565–1.2620 resistance zone. If bullish traders persist in their advance, even without fundamental support, the pound could climb to any level. The next upside target is the 61.8% Fibonacci retracement level at 1.2728. No developing divergences are currently visible on any indicators.

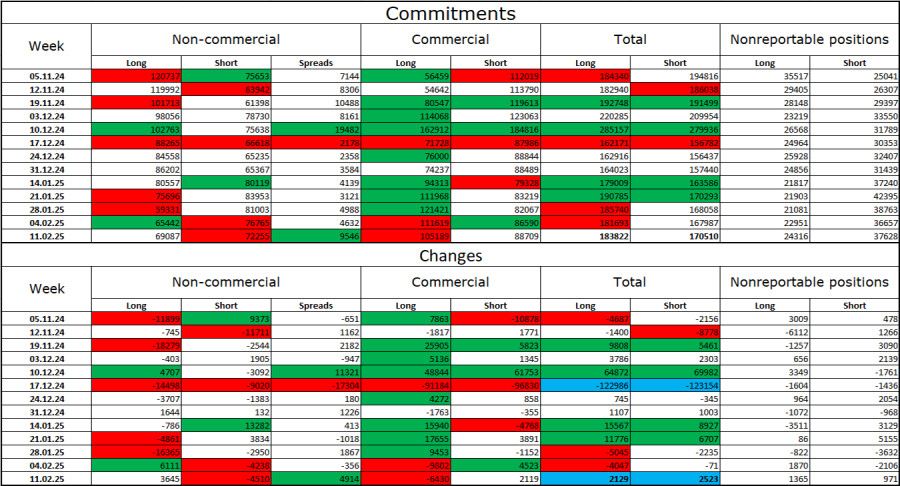

The latest COT report for the "Non-commercial" category of traders indicates a less bearish sentiment. The number of long positions increased by 3,645, while short positions decreased by 4,510. Although bulls have lost their earlier dominance in the market, bears have yet to strengthen their grip. The spread between long and short positions remains in favor of bears: 69,000 vs. 72,000.

I still believe the GBP has downward potential, as COT data suggests a slow but steady increase in bearish positions. Over the past three months, long contracts have dropped from 120,000 to 69,000, while short positions have remained stable, decreasing slightly from 75,000 to 72,000. As market conditions evolve, institutional players will likely continue reducing their long positions or increasing their short exposure, as most bullish factors for the pound have already been priced in.

UK Data Releases:

U.S. Data Releases:

Friday's economic calendar is packed with data releases of similar significance, meaning the impact of fundamental events on market sentiment will likely be moderate.

Short positions may be considered if the pair rebounds from 1.2709 on the hourly chart, targeting 1.2642.

Long positions were previously viable upon a breakout above 1.2363–1.2370, with targets at 1.2488–1.2508, which have already been achieved. For now, new long entries should be approached with caution, though bulls remain in control.

QUICK LINKS