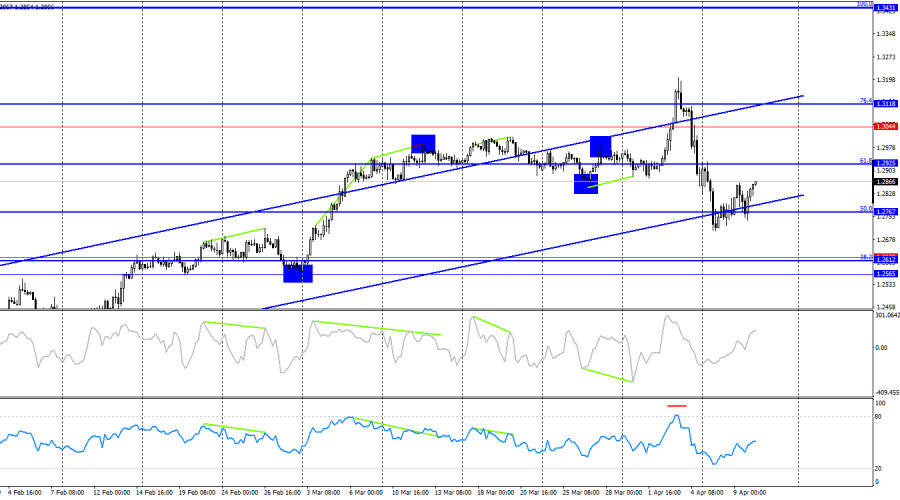

On the hourly chart, the GBP/USD pair rebounded from the 1.2865 level on Wednesday, experienced a slight decline, and today returned to that same level. Another rebound from this level would favor the U.S. dollar and signal a decline toward the 1.2709 level. A consolidation above 1.2865 would increase the likelihood of further growth toward the next resistance level at 1.2931.

The wave situation has become confusing recently. The last completed upward wave broke the previous wave's peak, while the new downward wave easily broke the previous low. This may suggest a trend reversal to bearish, but considering the latest events, the strength of price moves, and the frequency of directional changes, I would refrain from drawing such conclusions. In my view, market sentiment could shift multiple times again. Everything will depend on how the trade war develops.

The informational background on Wednesday supported the dollar—but only briefly. Bears welcomed the news of Donald Trump announcing a grace period, but their joy was short-lived. Understandably so: the trade war is far from over, and Trump could reverse his decision at any moment, as he's done many times before. Many are used to governmental decisions having a clear duration or at least a specific timeframe. But Trump can introduce tariffs and revoke them within the same day. China barely had time to receive an additional 50% tariff before another one followed. Now the U.S. import duty on Chinese goods stands at 125%, while China's tariff on U.S. goods is 84%. Who's leading? Today, a lot of news is expected once again. The U.S. will also release an inflation report, which could show one of the last low readings before a renewed rise in consumer prices. I doubt this data will help the bears.

On the 4-hour chart, the pair maintains a bullish trend. Even a consolidation below the rising channel won't convince me the trend has reversed. The trade war continues to escalate, and over recent months, this has only led to a weakening of the dollar. Either way, chart analysis alone can't answer what to expect next—the informational background drives the market now.

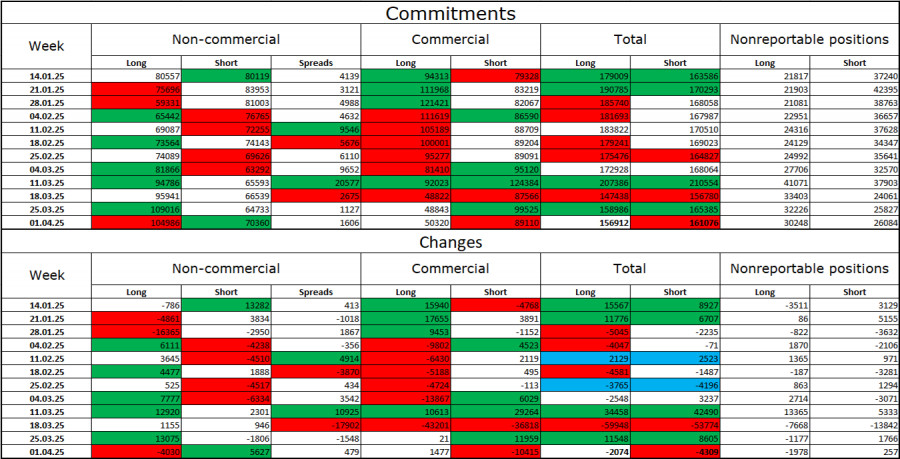

Commitments of Traders (COT) Report:

Sentiment in the "Non-commercial" trader category became less bullish over the last reporting week. The number of long positions held by speculators decreased by 4,030, while short positions increased by 5,627. Bears have lost their market advantage. The gap between long and short positions now stands at 35,000 in favor of the bulls: 105,000 versus 70,000.

In my opinion, the pound still has downside potential, but recent developments could push the market into a long-term reversal. Over the last three months, the number of long positions has risen from 80,000 to 105,000, while short positions have fallen from 80,000 to 70,000. More importantly, over the past nine weeks, long positions have increased from 59,000 to 105,000, while short ones have dropped from 81,000 to 70,000. Let me remind you—this has all happened during "nine weeks of Trump's rule."

Economic Calendar for the U.S. and the UK:

Thursday's economic calendar includes two U.S. events, one of which is quite important. Thus, the informational background will influence trader sentiment during the second half of the day. Any new developments in the trade war will also have an impact.

GBP/USD Forecast and Trading Tips:

Selling the pair is advisable today upon a second rebound from the 1.2865 level, targeting 1.2709. Buying opportunities were available after a close above 1.2810 on the hourly chart, with targets at 1.2865 and 1.2931. The first target has been reached. Positions can be held if the price closes above 1.2865.

Fibonacci levels are built from 1.2809–1.2100 on the hourly chart and from 1.3431–1.2104 on the 4-hour chart.

QUICK LINKS