Trade analysis and guidance for trading the British pound

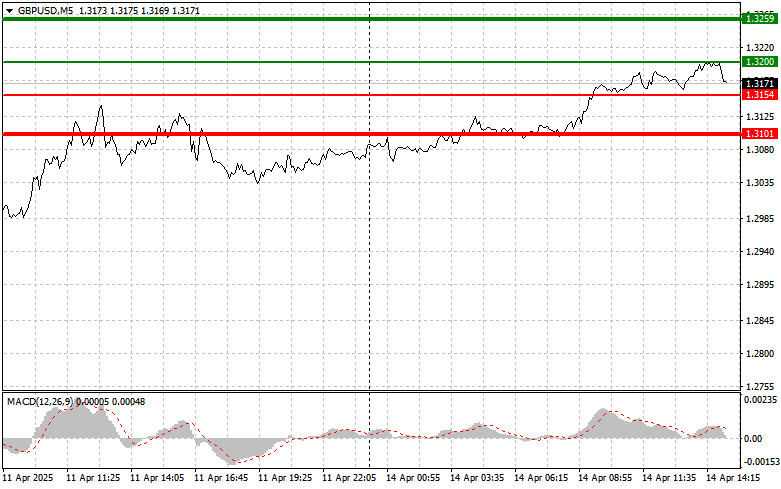

The test of the 1.3136 level occurred when the MACD indicator had already moved far above the zero line, which limited the pair's upward potential. Given the lack of UK statistics, I decided not to buy the pound—and it turned out to be the right call, as there was no sustainable upward movement.

The market will closely monitor the statements from FOMC members Thomas Barkin and Christopher Waller, paying attention to their rhetoric to assess how much the latest data has influenced expectations regarding the Fed's future actions. Any hints of a more hawkish stance could strengthen the dollar. Otherwise, the British pound may continue its bullish rally. As there is no other data scheduled, the U.S. session may remain relatively calm.

As for the intraday strategy, I'll primarily rely on the execution of scenarios #1 and #2.

Buy Signal

Scenario #1: I plan to buy the pound today at the 1.3200 entry point (green line on the chart), targeting a rise to 1.3259 (thicker green line on the chart). At 1.3259, I'll exit my long positions and open shorts in the opposite direction, aiming for a 30–35 point pullback. Today's pound rally can be expected to continue as part of the ongoing bullish trend. Important: Before buying, make sure the MACD is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy the pound if the price tests 1.3154 twice and the MACD is in the oversold zone. This would limit the pair's downside and trigger a reversal to the upside. A rise toward 1.3200 and 1.3259 can be expected.

Sell Signal

Scenario #1: I plan to sell the pound after it breaks below 1.3154 (red line on the chart), which should trigger a sharp decline. The main target for sellers will be 1.3101, where I'll exit shorts and immediately open long positions in the opposite direction (aiming for a 20–25 point bounce from that level). Sellers will likely show strength if the Fed comments are hawkish. Important: Before selling, make sure the MACD is below the zero line and just starting to decline.

Scenario #2: I also plan to sell the pound if the price tests 1.3200 twice, while the MACD is in the overbought zone. This would limit the upward potential and trigger a reversal downward. A decline toward 1.3154 and 1.3101 can then be expected.

Chart Key:

Important Note for Beginner Forex Traders:

When trading on the Forex market, beginners should exercise extreme caution when deciding to enter a position. It's best to stay out of the market ahead of major economic reports to avoid sharp volatility. If you choose to trade during news releases, always place stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit—especially if you skip proper money management and trade large volumes.

And remember: To trade successfully, you need a clear trading plan, like the one outlined above. Spontaneous decisions based on current market sentiment are a fundamentally losing strategy for intraday trading.

QUICK LINKS