Trade Analysis and Guidance for Trading the Japanese Yen

The test of the 142.69 level occurred when the MACD had already moved significantly below the zero line, which limited the pair's downward potential. For this reason, I chose not to sell the dollar—and it was the right decision. Upon updating the daily low, selling pressure on the pair eased.

Today's defining event for the currency market will be the speeches from FOMC members Thomas Barkin and Christopher Waller. This is especially true for the USD/JPY pair, where the contrast in central bank policies is stark—and currently favors the Japanese yen. Investors will be paying close attention to every word, looking for clues about the Federal Reserve's monetary policy path. Barkin, known for his pragmatic approach, is expected to address inflation and employment, analyzing recent data and its potential impact on economic growth. He may also discuss interest rate policy and the timeline for adjustments. Waller, meanwhile, could share his views on global economic risks and their impact on the U.S. economy.

His comments regarding Trump's tariffs will be of particular interest to market participants.

If no dollar-positive messages emerge, USD/JPY is likely to remain under pressure.

As for the intraday strategy, I'll primarily rely on the execution of scenarios #1 and #2.

Buy Signal

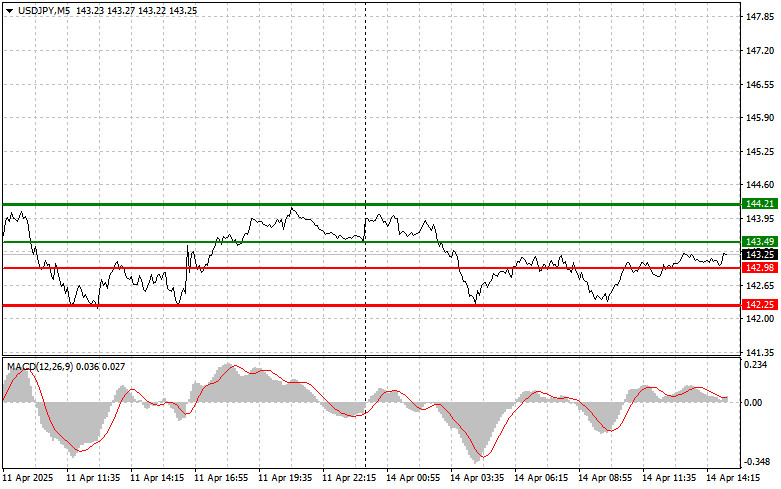

Scenario #1: I plan to buy USD/JPY today at the 143.49 entry point (green line on the chart), targeting a rise to 144.21 (thicker green line on the chart). At 144.21, I'll exit my long positions and open short trades in the opposite direction, aiming for a 30–35 point correction. Buying the pair is only advisable if the Fed takes a hawkish stance. Important: Before buying, ensure the MACD is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy USD/JPY if the price tests 142.98 twice, while the MACD is in the oversold zone. This would limit the downward potential and prompt a reversal upward. A rise toward 143.49 and 144.21 can then be expected.

Scenario #1: I plan to sell USD/JPY after a break below 142.98 (red line on the chart), which should trigger a rapid decline. The key target for sellers will be 142.25, where I'll exit shorts and open long positions in the opposite direction (aiming for a 20–25 point rebound). Selling pressure can return at any time today. Important: Before selling, ensure the MACD is below the zero line and just starting to decline.

Scenario #2: I also plan to sell USD/JPY if the price tests 143.49 twice, while the MACD is in the overbought zone. This would limit the pair's upward potential and trigger a reversal downward. A decline toward 142.98 and 142.25 is then likely.

Chart Key:

Important Note for Beginner Forex Traders:

Beginner traders must be extremely cautious when entering the market. It is best to stay out before major economic reports to avoid sharp price swings. If you choose to trade during news releases, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit—especially if you don't follow money management rules and trade with large volumes.

And remember: Successful trading requires a clear plan, like the one I've presented above. Spontaneous decisions based on current market conditions are inherently a losing strategy for intraday traders.

QUICK LINKS