The test of the 1.3529 level occurred when the MACD indicator had just started to move down from the zero line, confirming a valid entry point for selling the pound. As a result, the pair fell by more than 20 pips.

Yesterday's strong U.S. jobless claims data, coupled with weak U.K. services sector figures, allowed the dollar to rise confidently against the British pound. A noticeable decline in initial jobless claims, together with an unexpected increase in the U.S. services PMI, reinforced investor confidence in the resilience of the U.S. economy. These indicators reflected a strong labor market and ongoing growth in a key U.S. economic sector. The optimistic data prompted a reassessment of expectations regarding the Federal Reserve's policy trajectory, increasing the likelihood of a longer wait-and-see stance on interest rates. As a result, GBP/USD posted a significant decline, breaking through key support levels. Technical analysis suggests a potential for further pound weakness against the dollar.

This morning, the U.K. retail sales report (adjusted for fuel costs) will be released. The market eagerly awaits this data, as it provides key insights into consumer spending—a crucial driver of the British economy. If retail sales indeed show growth, this could slightly ease recession fears and support the pound. However, it's essential to note that a single positive report will not significantly alter the broader picture, particularly given the persistently high inflation and uncertainty surrounding future Bank of England policy. Investors should carefully evaluate the extent of retail sales growth and the factors that contributed to it. For instance, if the increase is driven solely by higher fuel prices, this might not be as positive, as it suggests rising inflationary pressure rather than genuine growth in consumer demand. If the data meets expectations, the pound could receive a short-term boost, but its further trajectory will depend on various other factors, including U.K. politics, global economic trends, and central bank decisions.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

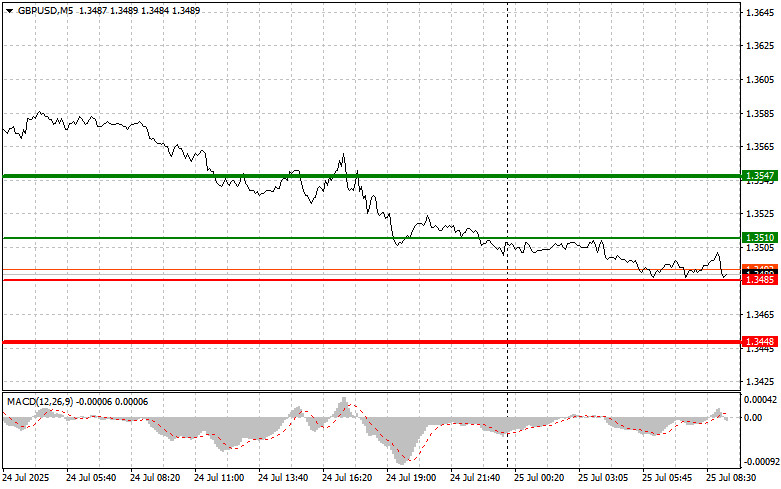

Scenario #1: I plan to buy the pound today when the price reaches 1.3510 (the green line on the chart), targeting a rise to 1.3547 (the thicker green line on the chart). Around 1.3547, I plan to exit long positions and open short ones in the opposite direction, expecting a 30–35 pip pullback from that level. A pound rally today is only realistic after strong data.

Important! Before buying, ensure the MACD indicator is above the zero line and is just starting to rise.

Scenario #2: I also plan to buy the pound today if the 1.3485 level is tested twice in a row while the MACD is in oversold territory. This would limit the pair's downside potential and trigger a reversal upward. A rise toward 1.3510 and 1.3547 can then be expected.

Scenario #1: I plan to sell the pound today after a move below 1.3485 (red line on the chart), which could lead to a sharp decline. The key target for sellers will be 1.3448, where I plan to exit short positions and open long positions in the opposite direction, expecting a 20–25 pip rebound from the level. Selling the pound today is justified after weak data.

Important! Before selling, ensure the MACD indicator is below the zero line and is just beginning to decline.

Scenario #2: I also plan to sell the pound today if the 1.3510 level is tested twice in a row while the MACD is in overbought territory. This would cap the pair's upside potential and lead to a reversal downward. A decline toward 1.3485 and 1.3448 can then be expected.

QUICK LINKS