The rapid rally of American stock indices ahead of Thanksgiving has completely dispelled investor fears. The Federal Reserve is set to cut interest rates, and it will do so aggressively, thanks in part to the influence of Hassett. The US economy is more likely to please than to disappoint. Donald Trump will continue to support the stock market, and the artificial intelligence bubble is no more than a myth. It is no surprise that the S&P 500 is rising, with the Nasdaq Composite showing its best performance since 2008.

The good news is that stock indices typically rise after Thanksgiving until the end of the year. The bad news is that they do so less eagerly than before. Moreover, in 2015, 2018, and 2022, there were declines in the S&P 500.

Stock Index Dynamics After Thanksgiving

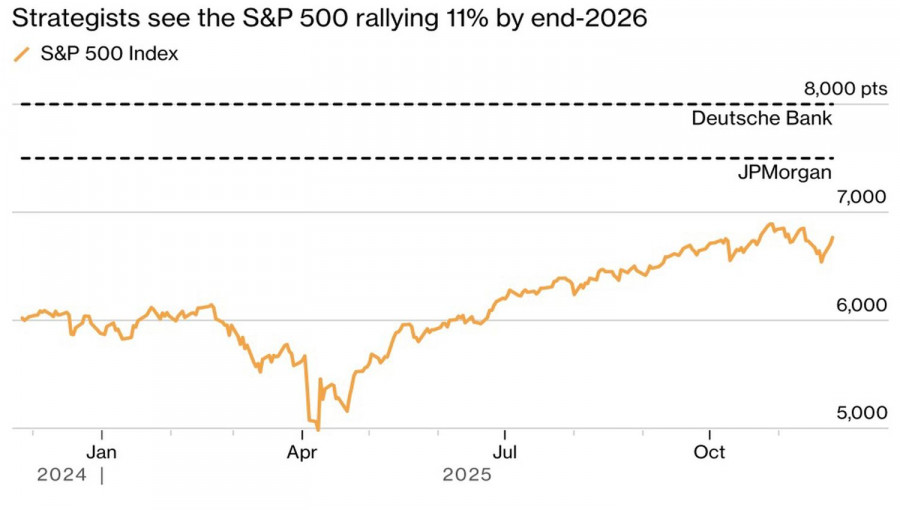

The swift recovery in the American stock market is prompting major banks to abandon cautious forecasts. Previously calling for patience, JP Morgan now asserts that the S&P 500 will jump 11% to 7,500 by the end of 2026, thanks to the strength of the US economy, impressive corporate earnings, artificial intelligence, and the easing of Fed monetary policy. If the central bank acts aggressively and cuts the federal funds rate in half, the broad stock index could soar above the 8,000 mark.

Such forecasts are not surprising. Many banks, including UBS Group, HSBC Holding, Deutsche Bank, and Morgan Stanley, expect to see double-digit gains for the S&P 500 next year. They are unfazed by the issue of inflated fundamental valuations of tech giants and their inability to generate significant profits from colossal investments.

Dynamics of S&P 500 and Broad Index Predictions

In reality, the massive investment in artificial intelligence is a necessity. As OpenAI CEO Sam Altman noted, people can either reinvest in AI technologies and lose money or underinvest and miss out on income.

Thus, investor fears in the stock market have quickly been forgotten. Greed has returned. Traders are preparing for the Christmas rally and actively buying stocks. Meanwhile, disappointing statistics on private sector employment from ADP, initial jobless claims, consumer confidence, and retail sales are seen as reasons for easing Fed monetary policy, providing support for the S&P 500.

Interestingly, the Fed's Beige Book demonstrates a K-shaped development of the US economy. The rich are getting richer thanks to artificial intelligence and tech stocks, while the poor are spending less. The gap is widening, but there is no talk of a recession.

Technically, the daily chart of the S&P 500 has shown a breakout of the key pivot level at 6,770. This has enabled traders to open long positions. If the price breaks above the fair value of 6,845, buying activity could intensify.

PAUTAN SEGERA