The GBP/USD currency pair also traded calmly for the majority of Wednesday. Today, two central bank meetings are scheduled, and many traders are likely anticipating a strong market reaction to these events. We believe that both events will remain largely unnoticed. There are several reasons for this.

First, nearly all market attention over the past year has been focused on the US dollar. Of course, it is not just the dollar, but rather events related to it. Nevertheless, the market is trading the dollar, while other currencies are beneficiaries of these trades. Once again, it should be noted that in the first half of 2025, the ECB cut rates at every meeting, yet the European currency still rose. Why? Because the Trump factor and the trade war are significantly more relevant to the market.

Secondly, neither the ECB nor the Bank of England will make any important decisions today. Certainly, surprises are always possible, but what surprises can one expect right now? The BoE is not abandoning its goal to cut the key rate in 2026, but intends to do so gradually, in accordance with inflation data. The ECB may resume easing monetary policy, but, as we have already determined, the "Fed factor," the "Trump factor," and other global events are more important to the market. Thus, in the worst-case scenario for the British currency, the Monetary Policy Committee may vote more members in favor of a rate cut than the market is expecting, which is only two votes. It will be easy to exceed this forecast.

The British pound may drop a few dozen pips, but what will that change? The global fundamental backdrop, based on which the dollar has been falling for an entire year, and the global upward trend (in the GBP/USD pair), under which the dollar has been falling for three years, will not change because of this. It is also worth mentioning the shutdown. The market demonstrated last fall that it is not interested in such a "trivial matter," but it will likely mean that the Non-Farm Payrolls and unemployment reports will not be published on Friday. Is this a good or bad thing for the dollar? You decide. However, the continuous "shutdowns," the lack of scheduled reports, and Trump's control over the Bureau of Labor Statistics certainly do not encourage investors to engage with the American currency.

Thus, we believe the BoE meeting will not have a significant impact. Locally, its results could provoke both increases and decreases; however, globally, nothing will change.

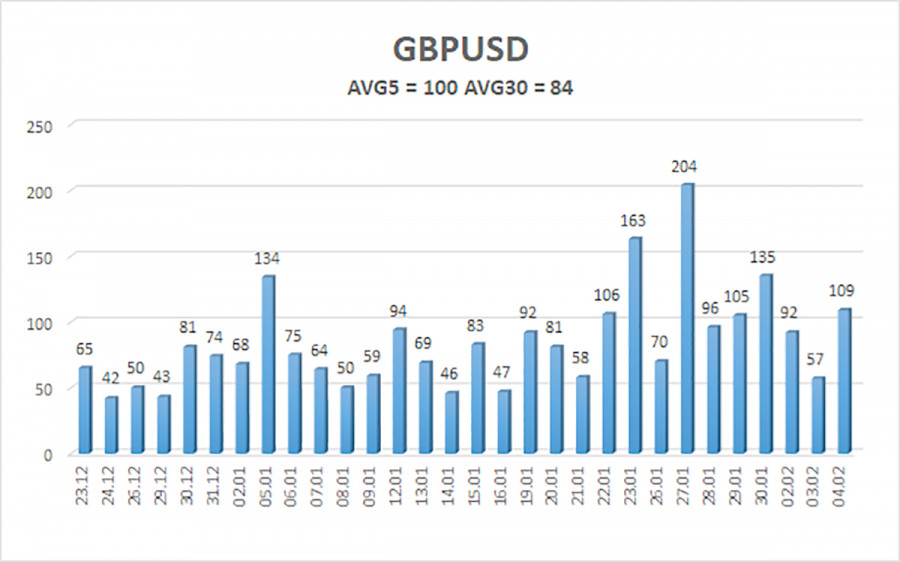

The average volatility of the GBP/USD pair over the last five trading days is 100 pips. On Thursday, February 5, we expect movement within the range limited by levels 1.3546 and 1.3746. The upper linear regression channel is directed upwards, indicating a trend recovery. The CCI indicator has entered the overbought area 6 times in recent months and has formed numerous "bullish" divergences, consistently signaling the impending resumption of the upward trend. An entry into the overbought area warned of the beginning of a correction.

S1 – 1.3550

S2 – 1.3428

S3 – 1.3306

R1 – 1.3672

R2 – 1.3794

R3 – 1.3916

The GBP/USD pair appears set to continue its 2025 upward trend, and its long-term prospects remain unchanged. Donald Trump's policies will continue to exert pressure on the US economy, so we do not anticipate the US currency appreciating in 2026. Even its status as a "reserve currency" no longer matters to traders. Therefore, long positions with targets of 1.3916 and above remain relevant in the near term when the price is above the moving average. If the price is below the moving average, small short positions may be considered, targeting 1.3550 on technical (corrective) grounds. From time to time, the American currency may demonstrate corrections on a global scale, but for trend growth, it requires global positive factors.

PAUTAN SEGERA