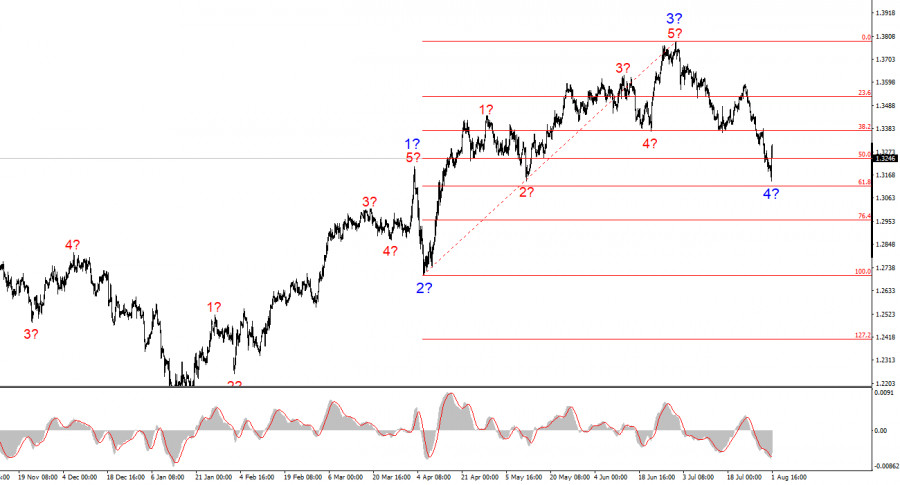

The wave pattern for GBP/USD continues to indicate the formation of an upward impulse wave pattern. The wave configuration closely resembles that of EUR/USD, as the dollar remains the key factor across the board. Demand for the dollar is decreasing in the medium term across the market, leading to similar dynamics in various instruments. Currently, a corrective wave set within wave 4 is still developing. If this assumption holds, the pair's decline may soon end, as the structure has taken on a classic and seemingly complete three-wave form.

It is important to keep in mind that much of the currency market right now depends on the policies of Donald Trump—not just in trade. While positive news still occasionally emerges from the U.S., the market remains cautious due to persistent uncertainty in the economy, contradictory statements and decisions by Trump, and a generally hostile and protectionist stance from the White House. As a result, even favorable data may fail to generate renewed demand for the dollar.

The GBP/USD pair rose by just 20 basis points on Friday. For most of the day, demand for the British pound remained weak and only dropped sharply during the release of U.S. data. As previously mentioned, a single Nonfarm Payrolls report was sufficient to trigger a significant decline in the U.S. currency. However, while the dollar clearly fell against the euro, it dropped and then almost immediately rebounded against the pound. The British currency currently appears weaker than the euro.

The Federal Reserve has stated that it is prepared to resume a monetary policy easing cycle only if the labor market shows significant signs of cooling or if the U.S. economy moves toward recession. The latest GDP report (for Q2) showed that a recession is not imminent (thanks in part to Trump's tariffs). However, the labor market has clearly been slowing over the past three months. This slowdown is further highlighted by an increase in the unemployment rate from 4.1% to 4.2% (with June revised to 4.1%) and weak ISM Manufacturing PMI data (48 points), painting an unfavorable picture. Business activity is declining, inflation is rising, and the labor market is weakening. Economic growth is certainly a positive, but what is driving it if job creation is stalling and prices are climbing?

In my view, Donald Trump places importance on GDP figures, while other indicators are secondary. The Fed, however, may soon be forced to intervene by cutting interest rates, despite Jerome Powell's firm refusal to commit to such action on Wednesday evening. It was clear from the start that Trump's bold trade deals had potential drawbacks—and we saw that downside on Friday. In my opinion, demand for the U.S. dollar cannot grow sustainably in the medium term. Incidentally, that would not benefit Trump either. Nevertheless, the Fed may be forced to cut rates twice this year, which would be a negative factor for the dollar.

The wave structure for GBP/USD remains unchanged. We are observing the formation of an upward impulse trend. Under Donald Trump, markets may continue to face shocks and reversals that could significantly affect wave patterns. However, for now, the working scenario remains intact. The targets for the upward trend segment are located near the 1.4017 mark. A corrective wave set within wave 4 is currently unfolding. According to classical wave theory, this should consist of three waves, and we are currently seeing the development of wave c.

Core principles of my analysis:

فوری رابطے