The price test at 1.1631 coincided with the MACD indicator just beginning to move up from the zero mark, which confirmed a good entry point to buy euros. As a result, there was a gain of about 20 pips.

Recent comments from officials at the U.S. Federal Reserve, indicating uncertainty regarding future policy on the key interest rate, triggered a strengthening of the dollar in the afternoon. Traders always respond keenly to every statement and signal from the Fed representatives, as a shift in tone can precede a change in monetary policy. Clearly, the current uncertainty regarding the future trajectory of interest rates continues to generate turbulence in the financial markets.

Today, attention will be focused on the release of the consumer price index (CPI) in Italy. Simultaneously, the European Commission is expected to release an economic forecast. Although Italian inflation does not significantly affect the currency market, a substantial deviation between actual data and expected values could lead to volatility, especially in the EUR/USD pair. In turn, the European Commission's forecast provides a comprehensive analysis of Europe's economic development prospects. Special attention will be given to forecasts for leading economies such as Germany and France. The upcoming forecast will serve as an important guideline for the governments of EU member states in shaping and adjusting their economic strategies, and it will also indirectly influence the European Central Bank's interest rate decisions.

Regarding the intraday strategy, I will rely more on scenarios #1 and #2.

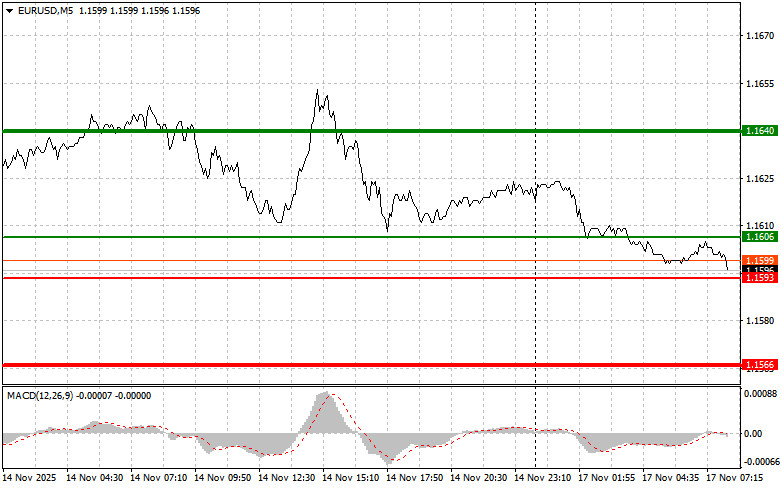

Scenario #1: Today, you can buy euros when the price reaches around 1.1606 (green line on the chart), targeting an increase to 1.1640. At the point of 1.1640, I plan to exit the market and sell euros in the opposite direction, expecting a move of 30-35 pips from the entry point. A rise in the euro can be anticipated after good data. Important! Before buying, ensure that the MACD indicator is above the zero mark and is just starting to rise from it.

Scenario #2: I also plan to buy euros today if the price tests 1.1593 twice in a row while the MACD indicator is in the oversold area. This will limit the downside potential of the pair and lead to a market reversal upwards. A rise to the opposing levels of 1.1606 and 1.1640 can be expected.

Scenario #1: I plan to sell euros once the price reaches 1.1593 (red line on the chart). The target will be the level of 1.1566, where I intend to exit the market and buy immediately in the opposite direction (expecting a movement of 20-25 pips in the opposite direction from that level). Pressure on the pair will return with weak data. Important! Before selling, ensure that the MACD indicator is below the zero mark and is just beginning to decline from it.

Scenario #2: I also plan to sell euros today if the price tests 1.1606 twice in a row while the MACD indicator is in the overbought area. This will limit the pair's upside potential and lead to a market reversal. A decline to the opposing levels of 1.1593 and 1.1566 can be expected.

Important: Beginner traders in the Forex market must be very cautious when making trading entry decisions. It is best to remain out of the market before the release of important fundamental reports to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade with large volumes.

And remember that successful trading requires having a clear trading plan, similar to the one I presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for intraday traders.

فوری رابطے