Podle lobbistů, manažerů, analytiků a odborníků na zdravotnickou politiku americký farmaceutický průmysl usiluje o změnu nového zákona, který po nástupu zvoleného prezidenta Donalda Trumpa do funkce umožňuje systému Medicare vyjednávat o cenách nejnákladnějších léků na předpis.

Winter in 2023 arrived too early. Typically, American stock indices rise towards the end of December, a phenomenon known as the Santa Claus rally. However, the S&P 500 already gained about 9% in November amid an increased probability of the Federal Reserve's monetary policy easing in 2024. As a result, global risk appetite increased, and EUR/USD quotes soared to three-month highs. Whether the upward movement will continue depends on investors' Greed.

MUFG notes the seasonal strength of the euro in December. Over the last 20 years, the average increase in the main currency pair at the end of the first month of winter has been 2.6%. Even if we exclude its surge by 10.1% in 2008, the indicator will still exceed 2%. In 8 out of 11 cases when EUR/USD closed in the green zone in November, it increased in value in December. This rally is usually driven by an improvement in global risk appetite, rebalancing of investment portfolios, and an influx of travelers to Europe for Christmas. All these factors may come into play in 2023, but MUFG still advises paying attention to new macroeconomic statistics.

Investors expected Fed Chairman Jerome Powell to throw a wrench into the S&P 500 and EUR/USD. However, Powell did not say anything new in his speech at the end of the week by December 1. Interest rates are in a range that limits economic growth. They may rise if necessary. It is too early to talk about easing monetary policy. We've heard all this before. Should it be surprising that U.S. stock indices rose, allowing them to close the fifth consecutive week in the green zone?

Dynamics of market expectations and the Fed's monetary expansion in different cycles

Derivatives increased the chances of the first rate cut in federal funds in March from less than 50% to 60%. They expect borrowing costs to fall by 125 basis points in 2024. And these are not the most aggressive forecasts. On average, six months passed between the last rate hike and its cut. In most cases, except perhaps 1995, the Fed eased monetary policy faster than investors currently expect.

In conditions of market Greed, EUR/USD quotes should have risen higher. However, investors are betting that the ECB will start the monetary expansion cycle earlier than the Fed against the backdrop of a faster slowdown in inflation in the eurozone than in the United States. Being the first is not very pleasant, making the euro one of the outsiders in Forex. It is not surprising that the major currency pair is trying to find a consolidation range. The tops cannot, the bottoms do not want to.

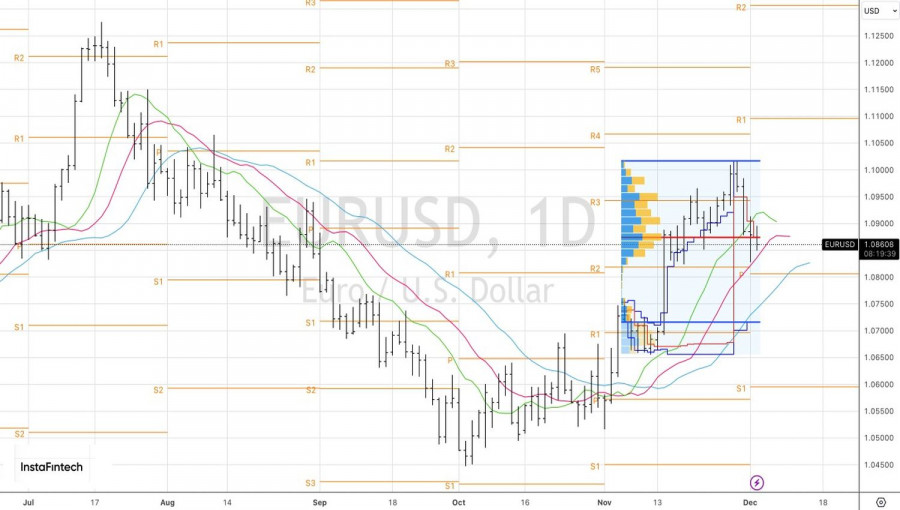

Technically, on the daily chart, the formation of a doji bar with a large lower shadow indicates the weakness of the bears. Breaking its high at 1.0915 is a reason to form long positions. However, if the bulls fail to grasp the fair value at 1.0875, this will be a signal of their extremely vulnerable position. At the same time, a drop below 1.085 will provide an opportunity to increase the shorts formed from 1.094.

SZYBKIE LINKI