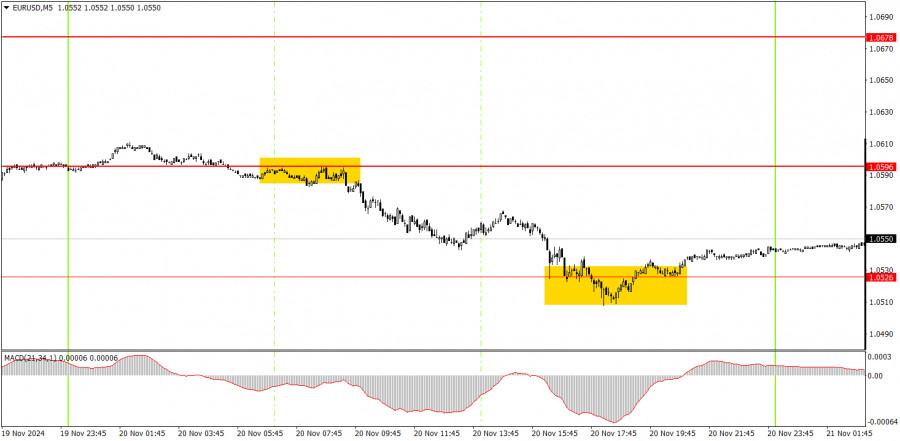

The EUR/USD pair attempted to start an upward correction on Wednesday but failed to break through the nearest resistance level of 1.0596. For the third or fourth time, a bounce from this level led to the euro falling back. The pair remains inside a horizontal channel, so a deeper decline is not yet on the table. However, the fact that the price cannot even correct after a reasonably strong drop speaks volumes. Notably, yesterday's decline in the euro was not influenced by any macroeconomic or fundamental factors. Neither the Eurozone nor the U.S. experienced events that could have triggered a euro sell-off. Thus, the pair's movement within the horizontal channel seems to be purely technical.

On Wednesday, two trading signals were formed on the 5-minute timeframe. First, the price made a precise bounce from the 1.0596 level, followed by a much less precise bounce from 1.0526. Novice traders could have acted on the first signal, which was in line with the trend. The second signal, a buy signal during a strong downtrend, could have been ignored due to its lack of precision.

The EUR/USD pair struggles to initiate a correction in the hourly timeframe. The market shows no signs of buying the euro or taking profits in short positions. We believe any new correction is unlikely to be strong and would require news supporting the euro. However, even favorable news might not help much, as the market focuses on buying the dollar.

We believe the downtrend might resume on Thursday, especially as the price cannot even overcome the nearest resistance at 1.0596. Given the lack of significant events this week, a continuation of the flat pattern is also possible.

On the 5-minute TF, the levels of 1.0433-1.0451, 1.0526, 1.0596, 1.0678, 1.0726-1.0733, 1.0797-1.0804, 1.0845-1.0851, 1.0888-1.0896, 1.0940-1.0951 should be considered. No major events are scheduled in the Eurozone for Thursday, while the U.S. will only release a few minor reports. As such, the likelihood of the pair breaking out of the horizontal channel is extremely low today.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

SZYBKIE LINKI