Euro and pound buyers continue to stay active, suggesting a slight recovery in risk assets might be seen by the end of the year. However, amid the empty economic calendar and high-impact news, the market is unlikely to show strong, directional movement.

Today, the only economic release is Spain's Consumer Price Index (CPI) data, which is unlikely to trigger robust market moves. Investors are generally more focused on overall eurozone data rather than statistics from individual member states. While CPI data is important, it often represents just one of many factors influencing market dynamics. Of course, changes in CPIs preface inflationary changes, but under the current uncertain conditions, this is merely a small piece of the broader picture. Given the lack of other statistics or comments by central bank policymakers, there is little reason to expect anything noteworthy today, although risk assets still hold some chances for further recovery.

If the data aligns with the consensus, the best approach is to follow a Mean Reversion strategy. If the data significantly deviates from expectations, the Momentum strategy is recommended.

Momentum strategy (breakout):

EUR/USD

Buying on a breakout above 1.0446 could lead to euro growth toward 1.0476 and 1.0508.

Selling on a breakout below 1.0413 could lead to a euro decline toward 1.0380 and 1.0347.

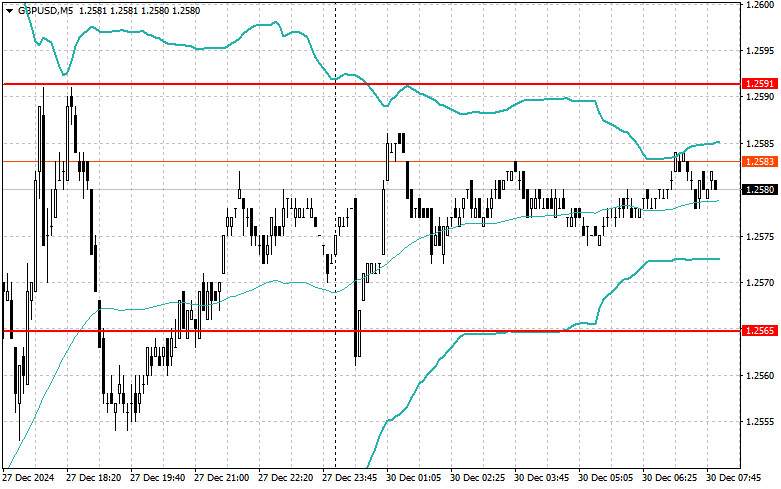

GBP/USD

Buying on a breakout above 1.2611 could lead to pound sterling growth toward 1.2638 and 1.2664.

Selling on a breakout below 1.2563 could lead to a pound sterling decline toward 1.2536 and 1.2506.

USD/JPY

Buying on a breakout above 158.04 could push the dollar up toward 158.46 and 158.82.

Selling on a breakout below 157.70 could trigger dollar selling toward 157.28 and 156.94.

Mean Reversion Strategy (opposite moves):

EUR/USD

I will look for short positions after an unsuccessful breakout above 1.0437, bearing in mind a drop below this level.

I will look for long positions after an unsuccessful breakout below 1.0419, bearing in mind rebounding to this level.

GBP/USD

I will plan short positions after an unsuccessful breakout above 1.2591, bearing in mind a drop below this level.

I will consider long positions after an unsuccessful breakout below 1.2565, bearing in mind rebounding to this level.

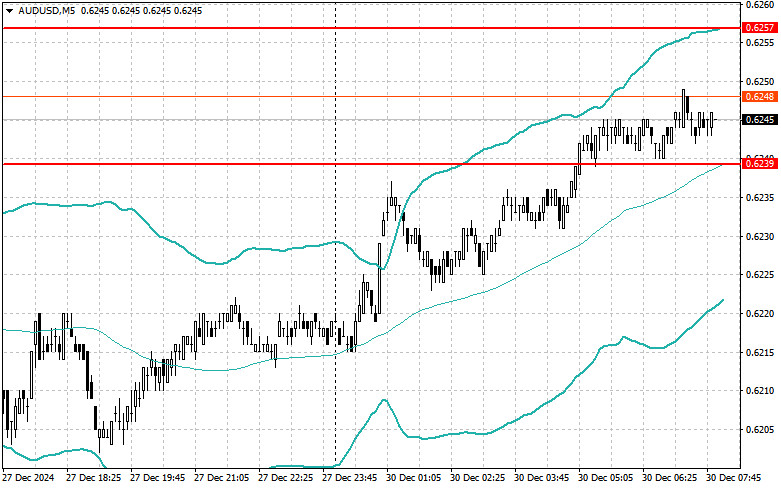

AUD/USD

I will look for sell positions after an unsuccessful breakout above 0.6257, bearing in mind a drop below this level.

I will look for buy positions after an unsuccessful breakout below 0.6239, bearing in mind a rebound to this level.

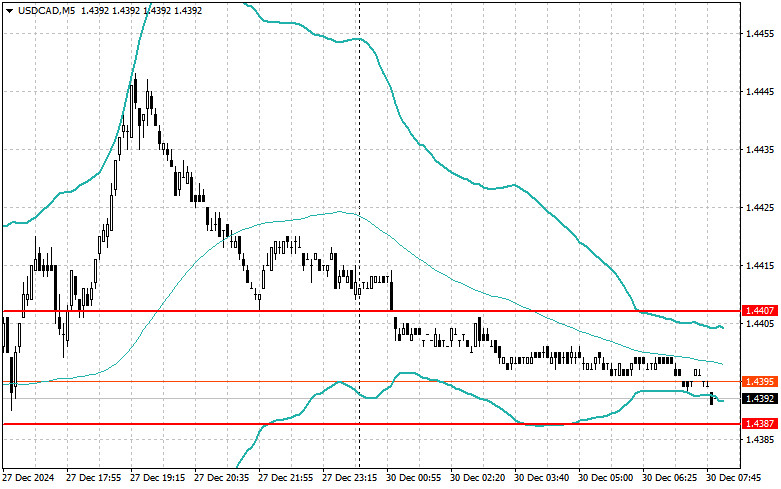

USD/CAD

I will look for short positions after an unsuccessful breakout above 1.4407, bearing in mind a drop below this level.

I will look for buy positions after an unsuccessful breakout below 1.4387, bearing in mind a rebound to this level.

SZYBKIE LINKI