The price test at 142.20 occurred when the MACD indicator had already moved significantly below the zero line, limiting the pair's downside potential. For this reason, I didn't sell the dollar. I also didn't receive any other valid entry signals for the day.

Today, the U.S. dollar posted a notable decline following reports that China is not ready to compromise with the U.S. in the ongoing trade standoff. Many analysts are now forecasting further downside in the USD/JPY pair—especially if trade negotiations between the U.S. and China drag on. The ongoing uncertainty around the leadership of the Federal Reserve also does little to inspire confidence, which is why investors continue to seek safe-haven assets, with the Japanese yen being one of the most favored.

For intraday strategy, I will focus primarily on implementing Scenarios #1 and #2.

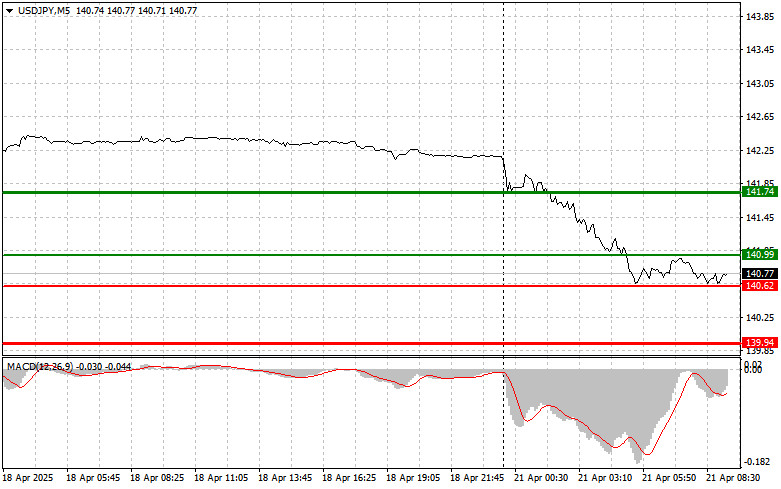

Scenario #1: I plan to buy USD/JPY today upon reaching the entry point around 140.99 (green line on the chart), targeting growth to the 141.74 level (thicker green line). Around 141.74, I intend to exit long positions and open short positions in the opposite direction (expecting a 30–35 pip reversal). It's best to re-enter long trades on corrections or significant pullbacks in USD/JPY.

Important: Before buying, ensure the MACD indicator is above the zero mark and beginning to rise.

Scenario #2: I also plan to buy USD/JPY if there are two consecutive tests of the 140.62 level while the MACD is in the oversold zone. This would limit the pair's downside and likely trigger an upward market reversal. A rebound toward the 140.99 and 141.74 levels may be expected.

Scenario #1: I will consider selling USD/JPY only after the price breaks below 140.62 (red line on the chart), which would likely trigger a sharp decline. The key target for sellers would be 139.94, where I plan to exit short positions and immediately open long positions in the opposite direction (expecting a 20–25 pip rebound).

Important: Before selling, ensure the MACD is below zero and just beginning to decline from that level.

Scenario #2: I also plan to sell USD/JPY if there are two consecutive tests of the 140.99 level when MACD is in the overbought zone. This would cap the pair's upward potential and may lead to a reversal downward. A decline toward the 140.62 and 139.94 levels can be expected in this case.

SZYBKIE LINKI