Trade Analysis and Tips for the British Pound

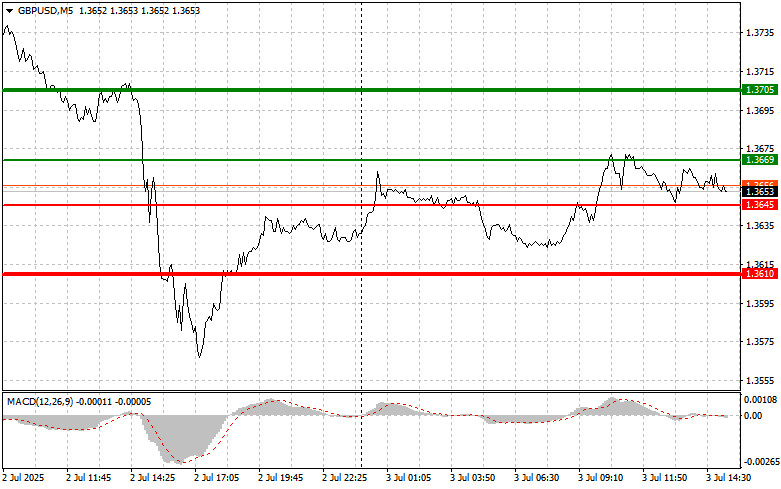

The test of the 1.3638 level occurred just as the MACD indicator began to rise from the zero line, confirming a valid entry point for buying the pound, which led to a 30-point increase.

The British pound strengthened in the first half of the day following a solid reading of the UK services PMI. The impact of the PMI on the pound is due to the service sector being a key component of the UK economy. Growth in this sector signals broader economic recovery and increases the pound's appeal to investors. However, it's important to remember that the PMI is just one of many factors influencing exchange rates. In the long term, the pound's movement will depend on factors such as inflation, interest rates, labor market conditions, and geopolitical developments.

The pair's movements in the second half of the day will be driven by U.S. labor market data. The change in nonfarm payrolls and the unemployment rate act as key indicators of global economic direction and will be the market's focus today. Nonfarm Payrolls reflect the change in the number of jobs created or lost in the non-agricultural sector, excluding farms, private households, and non-profit workers. The unemployment rate represents the percentage of job seekers in the labor force. A low unemployment rate signals a healthy economy with strong job creation, while a high rate indicates weakness and job shortages.

In addition, U.S. services PMI and ISM indices will offer insight into this key sector of the U.S. economy. Growth in service activity generally points to economic recovery, while a decline may signal slowing growth. These figures could also influence the Fed's decisions—especially if they contradict the labor data.

For intraday strategy, I will primarily rely on executing Scenario #1 and Scenario #2.

Buy Signal

Scenario #1:Today, I plan to buy the pound around 1.3669 (green line on the chart), targeting a rise toward 1.3705 (thicker green line). At 1.3705, I will exit long positions and consider selling in the opposite direction, anticipating a 30–35 point correction. A rise in the pound is more likely following weak U.S. data.Important: Before entering a buy, make sure the MACD is above the zero line and just beginning to rise.

Scenario #2:I also plan to buy the pound if there are two consecutive tests of the 1.3645 level while the MACD is in oversold territory. This would limit downward potential and signal a market reversal to the upside. Targets would be 1.3669 and 1.3705.

Sell Signal

Scenario #1:Today, I plan to sell the pound after a breakdown of the 1.3645 level (red line on the chart), which could lead to a sharp drop. The main target for sellers will be 1.3610, where I will exit and consider buying in the opposite direction, anticipating a 20–25 point reversal. Sellers will be active in response to strong U.S. data.Important: Before selling, make sure the MACD is below the zero line and just beginning to decline.

Scenario #2:I also plan to sell the pound after two consecutive tests of the 1.3669 level while the MACD is in overbought territory. This would limit upward potential and trigger a market reversal to the downside. The expected targets are 1.3645 and 1.3610.

Chart Key:

Important Notice for Beginner Forex Traders:Always be extremely cautious when entering the market. It's best to avoid trading before major economic reports to prevent being caught in sharp price swings. If you choose to trade during news releases, always set stop-loss orders to limit potential losses. Trading without stop-losses can quickly deplete your account, especially if you lack proper money management and trade large volumes.

Finally, remember that successful trading requires a clear trading plan, like the one presented above. Making spontaneous decisions based on short-term market noise is an inherently losing strategy for intraday traders.

SZYBKIE LINKI