On the hourly chart, the GBP/USD pair on Thursday continued to rise after rebounding from the 200.0% retracement level at 1.3024. By the end of the day, the pair had reached the resistance level of 1.3110–1.3139. Securing the pair above this level will increase the likelihood of further growth toward the next Fibonacci level of 127.2% – 1.3186. A rebound from this level would favor the U.S. dollar and signal a new decline toward the 1.3024 level.

The wave structure still remains bearish. The last completed upward wave broke the previous peak, while the most recent downward wave (which developed over three weeks) had already broken the previous low. The news background in recent weeks has been negative for the U.S. dollar, but bullish traders have not taken advantage of the opportunities for an advance. To end the bearish trend, the pair needs to rise above the 1.3470 level or form two consecutive bullish waves.

On Thursday, many traders were expecting a new decline in the pound, as there was a chance the Bank of England might ease its monetary policy settings. However, by a one-vote margin, the MPC committee decided to keep the interest rate unchanged at 4%. Still, traders had hoped for a more hawkish outcome, given the persistently high inflation in the U.K.

Andrew Bailey stated that inflation had already peaked and would continue to slow throughout 2025–2026, eventually reaching 2%. These optimistic forecasts give the regulator the flexibility to gradually lower interest rates. However, in my view, the Bank of England will first wait for a clear slowdown in inflation before initiating a new round of monetary easing. Bears continued to retreat yesterday, even though they still had reasons to attack. But in recent weeks, they seem to have exhausted all available selling factors. I believe that a bullish trend should begin soon — though it must first be confirmed by chart analysis, and later by wave structure.

On the 4-hour chart, the pair continues to decline within a downward trend channel. If a new bullish trend is beginning, we will gradually see confirmation of it. I will start counting on a strong rise in the pound only after the quotes close above the channel. Today, a close above the 1.3140 level would allow expectations for further growth in the pair.

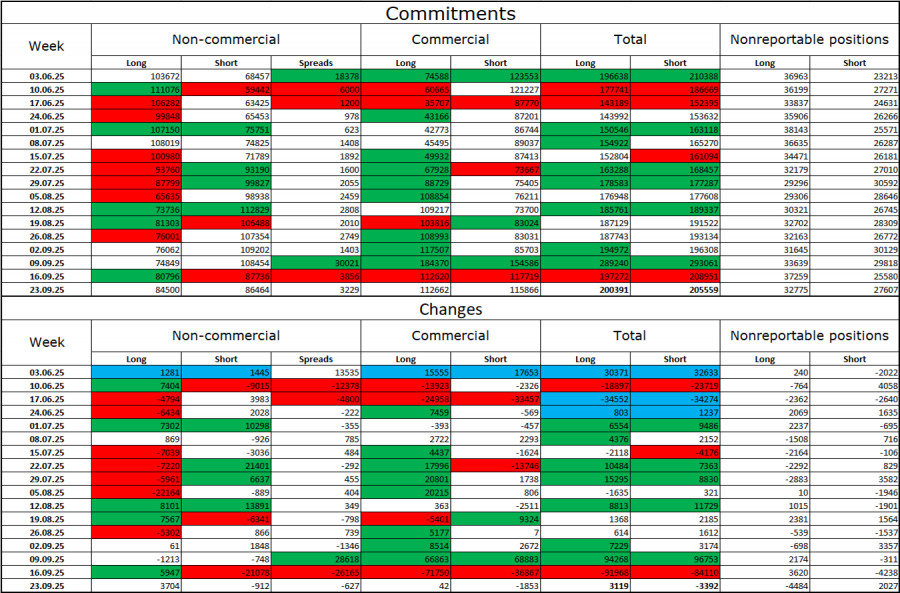

Commitments of Traders (COT) Report

The sentiment of the Non-commercial category became more bullish in the latest reporting week — although that report is already a month old. The number of long positions held by speculators increased by 3,704, while the number of short positions decreased by 912. The gap between long and short positions now stands at roughly 85,000 vs. 86,000. Bullish traders are once again tipping the balance in their favor.

In my opinion, the pound still retains downward potential, but with each passing month, the U.S. dollar looks increasingly weak. Whereas earlier traders worried about the protectionist policies of Donald Trump, uncertain about their long-term effects, now they may fear the consequences — a possible recession, the continuous introduction of new tariffs, and Trump's confrontation with the Fed, which could make the regulator politically compromised. Thus, the pound currently looks far less risky than the U.S. currency.

News Calendar for the U.S. and the U.K.:

The November 7 economic calendar contains just one notable release. The impact of the news background on market sentiment Friday may be very weak, and I would not expect a logical market reaction to this single report.

GBP/USD Forecast and Trader Recommendations:

Sales of the pair were possible after a close below the 1.3354–1.3357 level on the hourly chart, with targets at 1.3313, 1.3247, and 1.3186 — all of which have been successfully achieved. At this point, I am not considering new short positions, as I believe the pound has fallen sufficiently in recent weeks.

Buy positions could have been opened after a rebound from the 1.3024 level on the hourly chart, with targets at 1.3110 and 1.3186. The first target has already been reached — long positions can remain open.

The Fibonacci grids are built from 1.3247–1.3470 on the hourly chart and from 1.3431–1.2104 on the 4-hour chart.

SZYBKIE LINKI