The EUR/USD currency pair traded fairly calmly on Tuesday, despite the US inflation report. In just the first two weeks of the new year, so many events have occurred in the US that we would not be surprised if the pair were 300 pips above or below the current price. However, in fact, we saw only two out of nine days with any real strength. Overall, the market continues to show it is not interested in active trading, and the flat on the daily TF between 1.1400 and 1.1830 has lasted six months. Thus, each new day brings nothing new.

At the start of the year, Trump carried out a military operation in Venezuela, and he may soon strike Iran and annex Greenland. Look at the charts — do you get the sense that global events are taking place? Granted, the dollar and markets do not like geopolitics. Early in the year, important US business activity indices (ISM), Non-Farm Payrolls, and the unemployment rate were already published. And yesterday, the inflation report arrived. So what? The market is still standing still, showing average daily movements of about 50 pips and mostly trading sideways. Therefore, it is currently pointless to talk about market preferences. What preferences can there be if the pair has been stationary for six months?

Donald Trump intends to "finish off" Jerome Powell and force him to resign in disgrace. That is another event that would deserve a storm in the FX market. Clearly, the US president will not relent on the Fed and will do everything to "rework" the FOMC's composition. Every novice trader already knows about direct interference in the Fed's work. Everyone understands that the sole purpose of the criminal investigation against Jerome Powell is to effect a demonstrative removal from office and to send a warning to other Fed officials that Trump is not to be trifled with.

However, ironically, it will be much easier for Trump to take Greenland than to force the Fed to vote the way he wants on rates. Suppose Powell resigns tomorrow — what would that change? A new chair would arrive, and Trump would have four "doves" on the FOMC. That is still not enough to cut the key rate to 1% or 2%. There are 12 voting members on the FOMC, so at least six would need to be wholly aligned with Trump's view.

Thus, Trump will be fighting the Fed for a long time. He may ultimately prevail. Even without that event, we believe the dollar will continue to fall in the medium term. If Trump begins to control the Fed as well, it will be easier for the Republican to set the dollar's course against the euro, pound, or yen. And what is the problem? Why can't the US president decide what the exchange rate of his national currency should be?

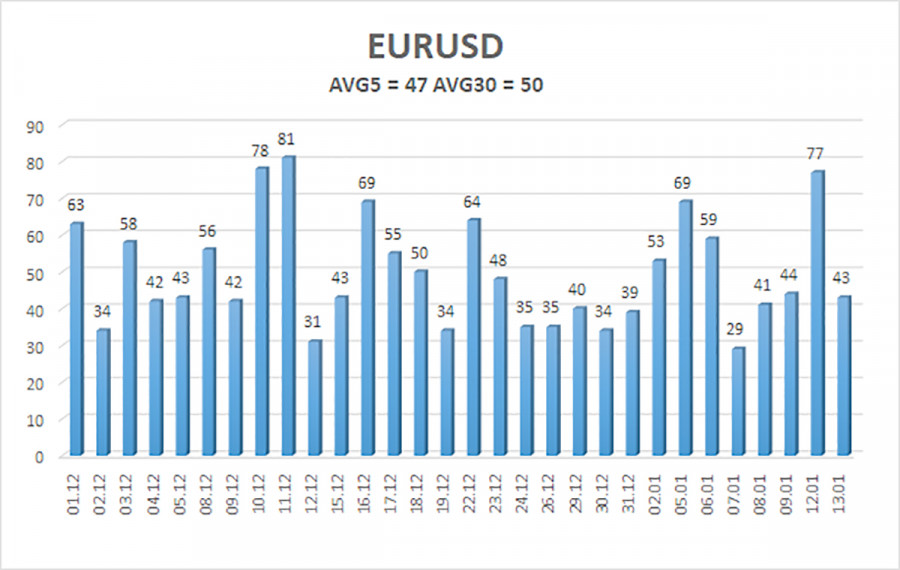

Average volatility of the EUR/USD pair over the last 5 trading days as of January 14 is 47 pips and is characterized as "low." We expect the pair to move between 1.1597 and 1.1691 on Wednesday. The higher linear regression channel points upward, but the daily TF remains flat. The CCI indicator recently formed another bullish divergence, which again points to a resumption of the uptrend. However, the key point remains the flat on the daily TF.

S1 – 1.1597

S2 – 1.1536

S3 – 1.1475

R1 – 1.1658

R2 – 1.1719

R3 – 1.1780

The EUR/USD pair remains below the moving average, but on all higher TFs the uptrend is preserved, and on the daily TF the flat continues for the sixth month in a row. The global fundamental background still matters greatly to the market, and it remains negative for the dollar. Over the past six months, the dollar has occasionally shown weak gains, but exclusively within the sideways channel. It has no fundamental basis for long-term strengthening. With the price below the moving average, small shorts can be considered with a target of 1.1597 on purely technical grounds. Above the moving average line, long positions remain relevant with a target of 1.1830 (the upper line of the daily TF flat), which has already been effectively tested and not overcome.

SZYBKIE LINKI