Akcie asijské pojišťovny AIA Group vzrostly o 3 %, což je nejvyšší hodnota od 8. října 2024, poté, co skupina v pátek oznámila, že Mark Tucker z HSBC bude jmenován předsedou.

Tucker, který v letech 2010 až 2017 působil jako generální ředitel AIA Group, nastoupí do nové funkce 1. října.

HSBC uvedla, že Brendan Nelson, člen představenstva a předseda výboru pro audit skupiny, bude od 1. října působit jako prozatímní předseda. Nelson je bývalým partnerem společnosti KPMG.

Akcie HSBC kótované v Hongkongu po oznámení poklesly o 0,48 %.

Despite major banks' desire for a rally in EUR/USD, the main currency pair is heading south. The Federal Reserve is not planning to yield to White House pressure, and the weakness of the US dollar ultimately transforms into its strengthening. These conclusions can be drawn from the minutes of the January FOMC meeting and the Treasury Department's report on foreign investors' purchases of American assets. While major banks continue to remain "bullish" on EUR/USD, the decline in the main currency pair risks dragging on.

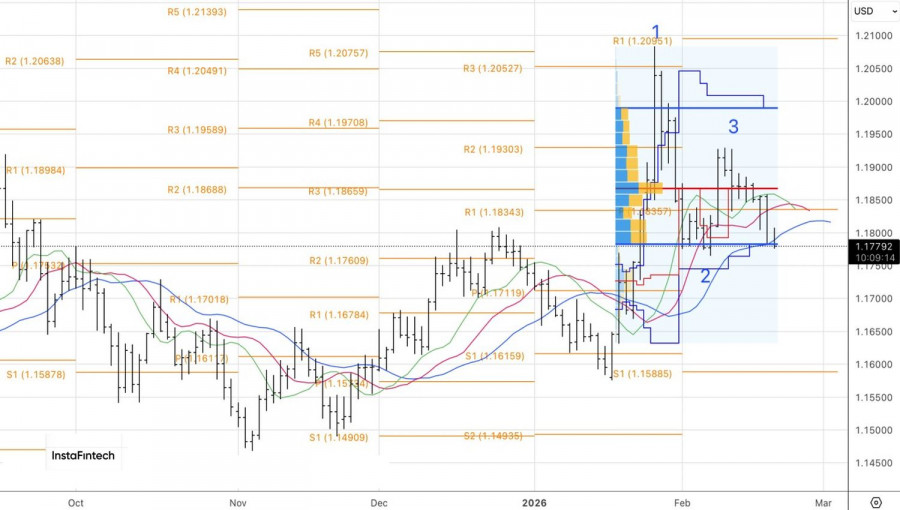

According to Goldman Sachs, the euro has not yet fully realized its potential, so it continues to trade near $1.180. Once this happens, the favorable wind from the easing US dollar will lift EUR/USD higher. Morgan Stanley is evaluating where to buy the regional currency and sees $1.175 as suitable for these purposes. Finally, JP Morgan expects an increase in currency risk hedging flows by non-residents acquiring American assets to be the primary reason for the resumption of the downward trend in the USD index.

Unfortunately, no matter how much major banks want to see the euro strengthen, the EUR/USD decline risks continuing. The reason is the confrontation between the Fed and the White House, which is boosting confidence in the US dollar. Following the January FOMC meeting, officials stated that the risks of a cooling labor market had receded, while the risks of rising inflation remained elevated. Some even mentioned the need to discuss raising the federal funds rate if prices do not return to the 2% target.

Such a clearly "hawkish" stance of the Fed contradicts the intentions of Donald Trump and his newly appointed Fed chair to ease monetary policy. The White House occupant even joked that he would sue Kevin Warsh if he did not lower rates. To the disappointment of the US president, the central bank is not a one-actor theater. Not everything is decided by the head of the institution. This circumstance instills confidence in investors regarding the Fed's independence and supports the US dollar.

The same applies to information from the Treasury Department regarding an increase in purchases of securities issued in the US by non-residents, rising from $1.18 trillion in 2024 to $1.55 trillion in 2025. According to BNY, the primary reason was the weakening of the greenback after the White House imposed tariffs on Independence Day. Foreign investors immediately started buying the significantly cheaper papers. This led to the stabilization of the USD index in the second half of the year. At the beginning of 2026, it is rising more frequently than falling.

Technically, on the daily chart of EUR/USD, we are testing the lower boundary of the fair value range of 1.1775-1.1990. If this important support level is breached successfully, traders will have the opportunity to increase shorts from 1.1835. As target levels for the downward movement of the euro against the US dollar, pivot levels of 1.1715 and 1.1615 are indicated.

SZYBKIE LINKI