A test of the 158.15 level occurred just as the MACD indicator began its upward movement from the zero mark, confirming a valid entry point for purchasing the dollar. Consequently, the pair rose sharply, reaching the target level of 158.66, where I sold immediately upon a rebound, anticipating a downward move.

Given the strong U.S. labor market data and the Federal Reserve's statements about delaying rate cuts, it's not surprising that traders began actively selling the yen and buying the U.S. dollar. However, unlike other risk assets, the yen did not experience a significant sell-off and remained within the channel established at the start of the year. This indicates that traders still expect decisive action from the Bank of Japan regarding interest rate hikes and are hesitant to sell off the yen.

Additionally, many view the current state of the currency market as an opportunity to accumulate assets amid uncertainty. Increased attention to Japan's economic data and its impact on the global economy further enhances interest in the yen as a safe haven.

It is important to note that the yen's strength depends not only on the BOJ's decisions but also on external factors such as U.S. economic policy and the conditions of other major global economies. Therefore, staying vigilant and ready to respond to changes in macroeconomic conditions is essential.

For my intraday strategy, I will focus primarily on implementing Scenario #1 and Scenario #2.

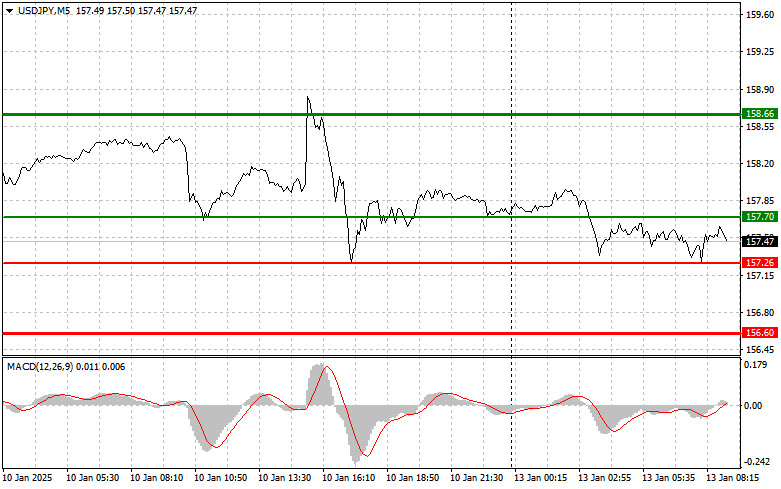

Scenario #1: Plan to buy USD/JPY at around 157.70 (green line on the chart), targeting a rise to 158.66 (thicker green line). Near 158.66, I plan to exit the buy position and open a sell position in the opposite direction, expecting a 30–35 pip downward move. Buying on corrections remains the best approach to capitalize on the pair's further growth. Important: Before buying, ensure that the MACD indicator is above the zero mark and just beginning to rise.

Scenario #2: I also plan to buy USD/JPY if the price tests the 157.26 level twice consecutively while the MACD indicator is in the oversold zone. This setup will limit the pair's downside potential and trigger an upward reversal. The target levels are 157.70 and 158.66.

Scenario #1: Plan to sell USD/JPY only after breaking below 157.26 (red line on the chart), expected to lead to a sharp decline. The key target for sellers will be 156.60, where I plan to exit the sell position and immediately open a buy position in the opposite direction, targeting a 20–25 pip upward rebound. Significant pressure on the pair is unlikely today. Important: Before selling, ensure that the MACD indicator is below the zero mark and beginning to decline.

Scenario #2: I also plan to sell USD/JPY if the price tests the 157.70 level twice consecutively while the MACD indicator is in the overbought zone. This will limit the pair's upside potential and trigger a downward reversal. The expected target levels are 157.26 and 156.60.

LINKS RÁPIDOS