The test of the 1.2213 price level in the second half of the day coincided with the MACD indicator starting its upward movement from the zero mark. This confirmed a valid entry point for buying GBP, and as a result, the pair climbed over 70 pips.

Today, the GBP may continue to rise against the USD, depending on the strength of the labor market data from the UK. The outcomes of this data will significantly influence the Bank of England's decision-making process. If the figures exceed expectations, the GBP could strengthen as the market anticipates a more aggressive monetary policy from the BoE. A reduction in unemployment claims would suggest a more stable labor market. Additionally, stable wage growth could enhance investor confidence, as higher incomes drive consumer demand and support the broader economy. However, if the data falls short of expectations, it could weaken the GBP and increase volatility. Traders should be prepared for potential surprises and closely monitor additional market cues, such as comments from BoE representatives or other economic indicators.

I will concentrate on executing Scenario #1 and Scenario #2 for both purchasing and selling opportunities.

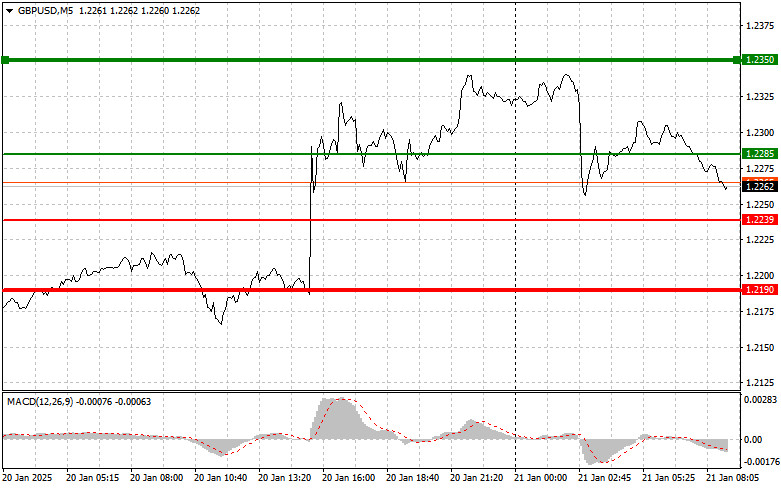

Scenario #1: Buy GBP near 1.2285 (green line on the chart) with a target of 1.2350 (thicker green line). Around 1.2350, I plan to exit the buy trade and initiate a sell trade in the opposite direction, aiming for a retracement of 30–35 pips. Consider this strategy if unemployment data is strong. Important! Before entering, ensure the MACD indicator is above the zero mark and beginning its upward movement.

Scenario #2: Buy GBP if the price tests 1.2239 twice consecutively while the MACD indicator is in the oversold area. This will limit the pair's downside potential and likely trigger a reversal upward. Expected targets: 1.2285 and 1.2350.

Scenario #1: Sell GBP after a break below 1.2239 (red line on the chart), which should trigger a quick decline. The key target for sellers is 1.2190, where I plan to exit the sell trade and immediately initiate a buy trade in the opposite direction, aiming for a retracement of 20–25 pips. Selling GBP at higher levels is better, and we are expecting a return to the bearish trend. Important! Before entering, ensure the MACD indicator is below the zero mark and starting to decline.

Scenario #2: Sell GBP if the price tests 1.2285 twice consecutively while the MACD indicator is in the overbought area. This will limit the upside potential of the pair and likely trigger a downward reversal. Expected targets: 1.2239 and 1.2190.

LINKS RÁPIDOS