Chang-čou (Čína) – Čínská technologická společnost Alibaba zveřejnila svůj model umělé inteligence (AI) Wan2.1 generující obrázky a videa z textu jako takzvaný open-source neboli otevřený software, tedy pod licencí, jež poskytuje uživatelům práva neomezeně používat, studovat, měnit a šířit zdrojový kód za jakýmkoliv účelem. Firma to oznámila na síti X. Mluvčí společnosti potom agentuře Reuters sdělil, že podrobnosti firma uvede prostřednictvím videa, které zveřejní v 16:00 SEČ.

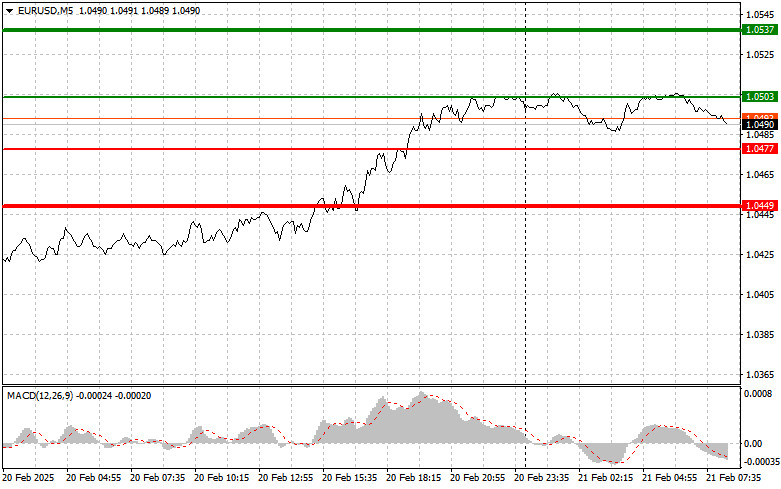

The price test at 1.0456 occurred when the MACD indicator had already moved significantly upward from the zero mark, limiting the pair's upside potential. For this reason, I did not buy the euro. Shortly afterward, the second test of 1.0456 occurred while the MACD was in the overbought zone, allowing for the realization of Scenario #2 for selling. However, the pair did not decline, which led to fixed losses.

Mixed labor market data from the U.S. and overall positive news related to Russia and Ukraine have sustained demand for risk assets. Inflation concerns in Europe, driven by high energy prices, continue to pressure the European Central Bank to halt interest rate cuts, which is a positive signal for the euro. Nevertheless, uncertainty about economic growth in the eurozone remains, indicating that any further growth in EUR/USD will more likely be due to a weakening dollar rather than strength in the euro.

Today, several Purchasing Managers' Index (PMI) reports from eurozone countries will be released. The manufacturing PMI is expected to show some growth, but it will likely remain below the 50-point mark, indicating a contraction in activity. In contrast, the services PMI may exceed expectations, reflecting a rebound in consumer demand. The composite PMI, which provides an overall view of economic activity, is expected to present a mixed picture for February. This highlights the ongoing economic weakness in the eurozone, despite the ECB's active efforts to cut interest rates.

Regarding the intraday strategy, I will rely more on executing Scenarios #1 and #2.

Scenario #1: Today, buying the euro is possible when the price reaches around 1.0503 (green line on the chart), targeting a rise to 1.0537. At 1.0537, I plan to exit the market and sell the euro in the opposite direction, aiming for a 30-35 pip move from the entry point. Expecting euro growth in the first half of the day is reasonable only if the eurozone's PMI data is very strong. Important! Before buying, ensure that the MACD indicator is above the zero mark and starting to rise.

Scenario #2: I also plan to buy the euro today if the price 1.0477 is tested twice consecutively while the MACD indicator is in the oversold zone. This will limit the pair's downside potential and lead to an upward market reversal. A rise to the opposite levels of 1.0503 and 1.0537 can be expected.

Scenario #1: I plan to sell the euro after reaching 1.0477 (red line on the chart). The target will be 1.0449, where I plan to exit the market and immediately buy in the opposite direction, expecting a 20-25 pip move back from the level. Selling pressure on the pair will return if the data releases today are very weak. Important! Before selling, ensure that the MACD indicator is below the zero mark and starting to decline.

Scenario #2: I plan to sell the euro today if the price 1.0503 is tested twice consecutively while the MACD indicator is in the overbought zone. This will limit the pair's upside potential and lead to a market reversal downward. A decline to the opposite levels of 1.0477 and 1.0449 can be expected.

LINKS RÁPIDOS