The GBP/USD pair continued to trade higher throughout Thursday. Even at its peak levels, the British pound shows no intention of correcting. There were no notable events in the UK yesterday, although interesting reports were published on Tuesday and Wednesday. Yet, they had no apparent impact on the currency pair's movements. As a result, the macroeconomic backdrop currently has virtually no influence on price action. Several secondary reports in the US were released yesterday that had no chance of affecting market sentiment. Today, the economic calendar is empty. The only hope lies with Donald Trump, yet the British pound continues to rise even without his intervention.

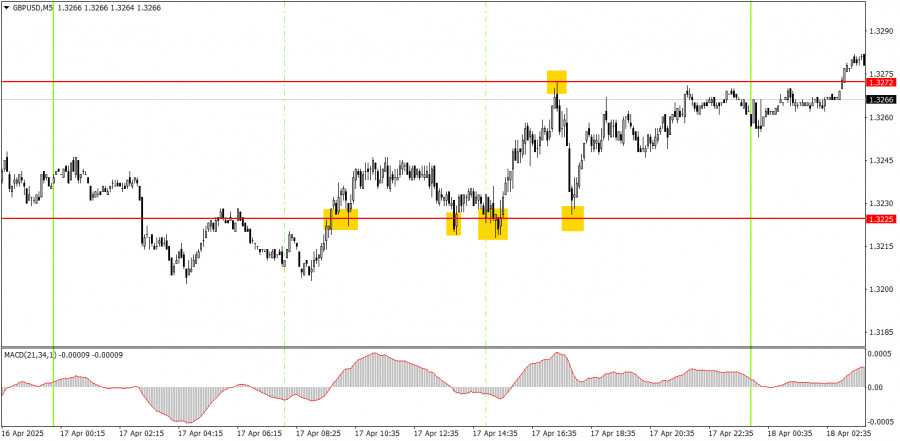

On Thursday's 5-minute timeframe, quite a few trading signals were formed. Four buy signals were generated around the 1.3225 level, which, by the end of the day, shifted to 1.3203. Novice traders could have opened long positions on all these signals. At least two delivered solid profits, as the nearest target level at 1.3272 was reached. Short positions could also have been opened after a bounce from 1.3272, hitting its target.

On the hourly timeframe, the GBP/USD pair should have long since entered a downward trend, but Trump continues doing everything possible to push the dollar lower. After the official start of the global trade war, we no longer attempt to predict long-term price movements. The market remains under Trump's control. Trump announces new tariffs – the dollar falls. Trump raises existing tariffs – the dollar falls again. A pause in escalation – the market ranges, or the dollar still falls.

On Friday, GBP/USD may once again trade with upward momentum. As we can see, the market is not fazed by falling UK inflation or Jerome Powell's hawkish stance. The pound may continue to rise even without any justification. Therefore, trading should be based solely on technical levels and only when clear and precise signals are present.

On the 5-minute TF it is now possible to trade at 1.2613, 1.2680-1.2685, 1.2723, 1.2791-1.2798, 1.2848-1.2860, 1.2913, 1.2980-1.2993, 1.3043, 1.3102-1.3107, 1.3145-1.3167, 1.3203, 1.3272, 1.3365, 1.3428-1.3440. No significant events are scheduled for Friday in the US or the UK. Volatility is likely to remain low, but even so, the pound may continue its upward movement.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

LINKS RÁPIDOS