Trade Review and Tips for the British Pound

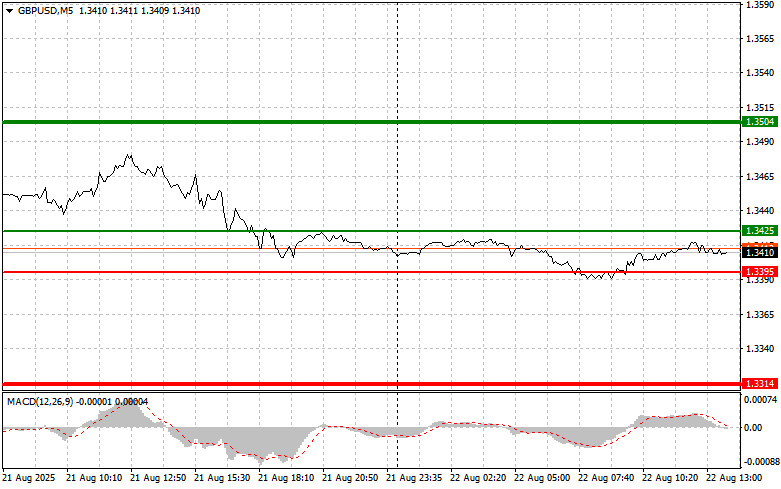

The price test at 1.3405 coincided with the moment when the MACD indicator had just started moving upward from the zero line, confirming the correct entry point for buying the pound. As a result, the pair rose by only 12 points, and that was the end of the move.

The absence of U.K. statistics allowed the pound to gain slightly in the first half of the day. Investors, lacking fresh data to assess the current state of the British economy, temporarily refrained from active selling of the pound. This created favorable conditions for a modest upward correction after the recent decline. However, optimism was limited. The lack of data is only a temporary reprieve, not a fundamental change in the situation. Market participants remain concerned about the Bank of England's stance on interest rates and the potential impact of this factor on economic growth.

Next, attention will shift to the speech by Federal Reserve Chair Jerome Powell. In addition to the immediate market reaction, Powell's remarks will serve as an important indicator for assessing the Fed's medium-term position. A more hawkish tone could lead to a stronger dollar and a weaker pound, while a dovish bias could, on the contrary, provoke a rise in GBP/USD.

As for intraday strategy, I will mainly rely on Scenarios #1 and #2.

Buy Signal

Scenario #1: Today I plan to buy the pound at the entry point around 1.3425 (green line on the chart), targeting growth toward 1.3504 (thicker green line on the chart). Around 1.3504 I will exit long positions and open shorts in the opposite direction (expecting a 30–35-point move back from the level). A strong rise in the pound today is possible if the Fed maintains a dovish stance. Important! Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I also plan to buy the pound today in case of two consecutive tests of the 1.3395 level while the MACD indicator is in the oversold area. This would limit the downward potential of the pair and lead to a reversal upward. Growth toward the opposite levels of 1.3425 and 1.3504 can then be expected.

Sell Signal

Scenario #1: Today I plan to sell the pound after a breakout of 1.3395 (red line on the chart), which will trigger a quick decline in the pair. The key target for sellers will be 1.3314, where I will exit short positions and immediately open longs in the opposite direction (expecting a 20–25-point rebound from the level). Sellers may push the pound lower if Powell takes a hawkish stance. Important! Before selling, make sure the MACD indicator is below the zero line and just beginning to decline from it.

Scenario #2: I also plan to sell the pound today in case of two consecutive tests of the 1.3425 level while the MACD indicator is in the overbought area. This would limit the pair's upward potential and trigger a reversal downward. A decline toward the opposite levels of 1.3395 and 1.3314 may then be expected.

Chart Notes:

Important: Beginner Forex traders must be very cautious when deciding on market entries. Before the release of important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you do trade during news releases, always place stop orders to minimize losses. Without stop orders, you can lose your entire deposit very quickly, especially if you do not apply money management and trade large volumes.

And remember: for successful trading you need a clear plan, like the one presented above. Spontaneous trading decisions based solely on the current market situation are an inherently losing strategy for an intraday trader.

LINKS RÁPIDOS