Společnost Novo Energy, patřící Volvo Cars, v pondělí oznámila, že sníží počet zaměstnanců o 50 %, aby snížila náklady po vyhodnocení své situace po bankrotu švédské firmy Northvolt, která byla původně spolumajitelem podniku.

Nebylo okamžitě jasné, kolika pracovních míst se snížení dotkne.

„Navzdory našemu maximálnímu úsilí o zajištění našeho podnikání a rozsáhlému hledání vhodného technologického partnera, současné ekonomické výzvy a tržní podmínky znemožnily udržet naše operace v současném rozsahu,“ uvedl generální ředitel Novo Energy Adrian Clarke ve svém prohlášení.

Společnost uvedla, že jejím hlavním dlouhodobým cílem zůstává výroba baterií s novým technologickým partnerem v oblasti švédského Göteborgu. Společnost Volvo Cars (OTC:VLVLY) se v únoru dohodla s firmou Northvolt na převzetí jejího 50% podílu v Novo Energy, včetně plánované továrny na výrobu bateriových článků v Göteborgu, přičemž zaplatila pouze symbolickou částku.

Northvolt, kdysi považovaný za největší naději Evropy na bateriového lídra, vyhlásil v březnu bankrot.

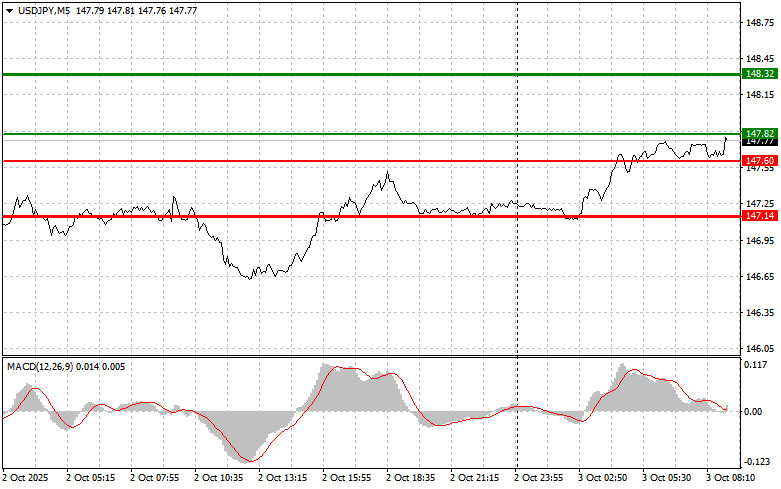

The test of the 146.82 price level occurred just as the MACD indicator began moving upward from the zero line, confirming a valid entry point for buying the dollar and resulting in the pair rising toward the target level of 147.22.

Hawkish remarks from Federal Reserve officials—highlighting that the U.S. economy is in good shape and the fight against inflation is not yet over—led to dollar purchases and yen sell-offs. This reaction was neither unexpected nor accidental. It was a logical reflection of the diverging monetary policies between the Federal Reserve and the Bank of Japan. While the Fed may cautiously continue cutting interest rates, the BoJ is sticking rigidly to a wait-and-see approach, merely hinting at the potential for tightening policy in the future.

Today's news of a sharp rise in Japan's unemployment rate to 2.6% triggered further yen selling and strengthened the dollar. The only bright spot came from stronger-than-expected activity in the services sector. However, this positive signal failed to outweigh the negative impact of the rising jobless rate, sparking concerns among investors.

An increase in unemployment is a warning signal for Japan's already struggling economy. A higher number of jobless individuals could dampen consumer spending and slow economic growth further, deepening the existing challenges.

As for my intraday strategy, I will focus on executing Scenario #1 and Scenario #2.

Scenario #1: I plan to buy USD/JPY today at the entry point near 147.82 (indicated by the green line on the chart) with a target of rising toward 148.32 (indicated by the thicker green line on the chart). Around 148.32, I'll exit the long position and open a short trade in the opposite direction—anticipating a 30–35 pip correction. It's best to return to long positions on pullbacks and significant dips in USD/JPY. Important: Before buying, ensure the MACD indicator is above the zero line and is just beginning its upward movement.

Scenario #2: I also plan to buy USD/JPY if the price tests the 147.60 level twice while the MACD indicator is in the oversold zone. This would limit the pair's downside potential and lead to an upward reversal. You can expect growth toward the opposite levels of 147.82 and 148.32.

Scenario #1: I plan to sell USD/JPY today only after the price breaks below 147.60 (red line on the chart), which could lead to a sharp decline in the pair. The key target for sellers will be 147.14, where I intend to exit short positions and immediately open a buy trade in the opposite direction—expecting a 20–25 pip correction from that level. It's best to sell from as high a level as possible. Important: Before selling, ensure the MACD indicator is below the zero line and just starting its downward move.

Scenario #2: I also plan to sell USD/JPY today in the event of two consecutive tests of the 147.82 level while the MACD indicator is in the overbought zone. This would limit the pair's upward potential and lead to a reversal downward. A drop toward the opposite levels of 147.60 and 147.14 can be expected.

Beginner traders should exercise extreme caution when deciding to enter the market. It is best to avoid trading during important economic data releases to prevent being caught in sharp price movements.

If you choose to trade during news events, always use stop-loss orders to minimize potential losses. Without stop-losses, you can quickly lose your entire deposit—especially if you ignore money management and trade with large volume sizes.

And remember: to succeed in trading, you need to have a clear trading plan—just like the one I've outlined above. Making spontaneous trading decisions based on the current market situation is a losing strategy for intraday traders.

LINKS RÁPIDOS