Investiční banka Evercore ISI zařadila Home Depot (HD) na svůj seznam „taktických nadvýkonných titulů“ před zveřejněním výsledků za první čtvrtletí 20. května.

Banka očekává, že Home Depot potvrdí výhled pro rok 2025, který počítá s poklesem zisku na akcii o 2 % na přibližně 14,95 USD, což odpovídá očekávání trhu.

Ačkoli akcie společnosti klesly od začátku roku o 2 %, Evercore věří, že potvrzení výhledu a známky zlepšujících se trendů by mohly akcie vrátit k hranici 400 USD.

„Pokud se potvrdí zlepšení trendů na jaře, mohli bychom vidět reakci trhu podobnou jako u Walmartu – jen s větším efektem,“ uvedl analytik Greg Melich.

Evercore odhaduje pokles srovnatelných tržeb o 0,5 %, mírně pod tržním očekáváním, a pokles hrubé marže o 30 bazických bodů kvůli akvizici SRS Distribution, která by však mohla být později přínosem.

Home Depot pokračuje v investicích do technologií, služeb i rozšiřování poboček, čímž se připravuje na případné oživení trhu s bydlením v roce 2025.

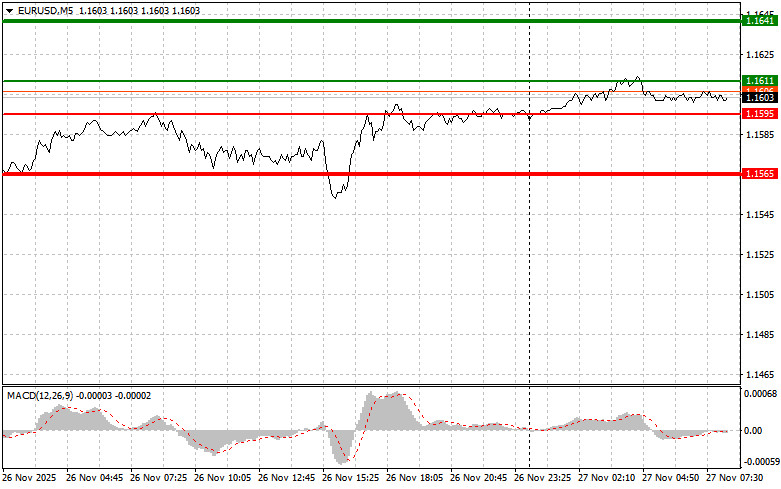

The price test at 1.1565 occurred when the MACD indicator was just starting to move down from the zero mark, confirming the correct entry point for selling the pound. As a result, the pair declined by 15 pips, and that was the end of it.

The brief rise in the dollar, driven by news of a decline in new jobless claims in the United States, failed to reverse the overall downward trend in the American currency. The expectation of further monetary policy easing by the Federal Reserve remains the main factor weighing on the dollar.

Today, a rather interesting set of reports is expected in the first half of the day. The GfK consumer climate leading index from Germany will be an important indicator of consumer sentiment, which largely determines retail sales dynamics and, ultimately, GDP growth in the country. Positive data could support market optimism, allowing the euro to continue rising. Figures on private-sector credit and changes in the M3 money supply aggregate are also of interest, as they provide insights into credit dynamics and liquidity in the economy. An increase in lending may indicate strengthening economic activity, while an increase in the money supply may signal inflationary risks. The European Central Bank report from the last meeting is unlikely to change the market direction for the euro since we won't hear anything new from ECB representatives.

Regarding the intraday strategy, I will continue to rely on the implementation of scenarios №1 and №2.

Scenario #1: Today, I plan to buy euros when the price reaches around 1.1611 (green line on the chart), targeting a move to 1.1641. At 1.1641, I plan to exit the market and sell euros on the rebound, aiming for a 30-35-pip move from the entry point. Expecting a rise in the euro can only be based on positive data. Important! Before buying, ensure the MACD indicator is above the zero mark and just beginning to rise.

Scenario #2: I also intend to buy euros today if there are two consecutive tests of 1.1595 when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a market reversal upwards. An increase can be expected towards the opposite levels of 1.1611 and 1.1641.

Scenario #1: I plan to sell euros once the price reaches 1.1595 (red line on the chart). The target will be the level of 1.1565, where I intend to exit the market and buy immediately in the opposite direction, aiming for a movement of 20-25 pips in the reverse direction from the level. Pressure on the pair will return with weak data. Important! Before selling, ensure the MACD indicator is below the zero mark and just beginning to decline.

Scenario #2: I also intend to sell euros today if there are two consecutive tests of 1.1611 when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downwards. A decline can be expected towards the opposite levels of 1.1595 and 1.1565.

Important: Beginner traders in the Forex market must be very cautious when making trading entry decisions. It is best to remain out of the market before the release of important fundamental reports to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade with large volumes.

And remember that successful trading requires having a clear trading plan, similar to the one I presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for intraday traders.

LINKS RÁPIDOS