The GBP/USD currency pair traded fairly calmly on Tuesday, and the inflation report showed a bland 2.7% — the same as a month earlier. In the first Trump administration, we often used the phrase "theatre of the absurd." Everything happening now in the US very much resembles some ironic-fantastic novel. It's not Orwell yet, but it's getting close. Jerome Powell openly states that the US president is putting pressure on him. This has never happened before, because Fed chairs have always preferred to ignore insults and presidential criticism. However, when you are served with a court summons, keeping silent becomes quite difficult. Recall that last year, Trump decided to remove Monetary Policy Committee member Lisa Cook. More precisely, Trump simply announced the dismissal of a committee member on his own social network. And only one question arises: why did he not dismiss the entire Committee in the same way?

This is, of course, a bitter joke for Jerome Powell. American courts are currently not even between two fires, but between two infernos. On the one hand, US legislation, which should be enforced in accordance with the dozens of written laws. On the other hand, Donald Trump — the US president — typically demands decisions contrary to those laws or is himself the subject of another proceeding for blatant abuse of power or violation of the law. And courts, instead of handing down an obvious and lawful verdict, simply drag out time, which plays into Trump's hands.

Two US courts have already recognized Trump's tariffs as illegal — and what happened? Were they repealed? The US Supreme Court was supposed to rule on the tariffs back on November 9 last year! It is mid-January, a new "shutdown" is approaching, and the Supreme Court still cannot decide whether Trump had the right to impose tariffs on half the countries of the world, even though the relevant law does not mention tariffs once. Absurdity and wordplay.

Unfortunately, Powell — who has only a few months left to serve as Fed chair — may also be drawn into this theatre of the absurd and play one of the leading roles in one of the acts. We do not know how the estimate for the Fed buildings' reconstruction was compiled, nor do we know what Powell said to Congress when asked about the expenses, but does that even matter? Sometimes it seems this is not about renovating a government institution but about repairing Powell's private house at public expense. Another question arises — why is Powell solely blamed for the alleged budget overspending? As far as we know, Powell is the Fed chair, not a foreman. The most interesting thing is that Powell's dismissal or even jailing will not change Trump's influence on Fed monetary policy. And if/when it does change, confidence in the US central bank — once independent and trusted worldwide — will fall to levels comparable to trust in the Central Bank of Nicaragua.

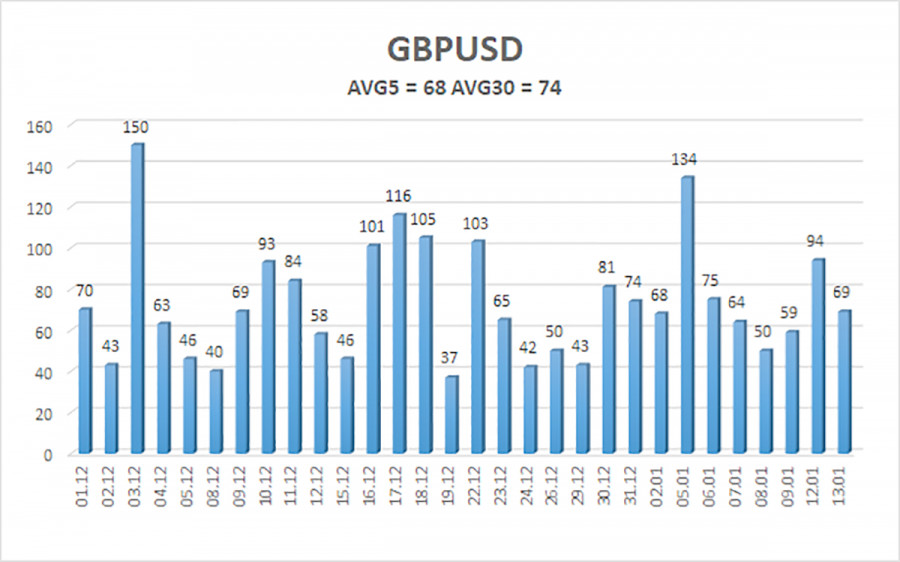

Average volatility of the GBP/USD pair over the last 5 trading days is 68 pips. For the pound/dollar pair, this value is "medium." On Wednesday, January 14, therefore, we expect movement within a range bounded by levels 1.3363 and 1.3499. The higher linear regression channel has turned upward, indicating trend recovery. The CCI indicator entered the oversold area 6 times over recent months and formed numerous "bullish" divergences, which have consistently warned traders of a continuation of the uptrend.

S1 – 1.3428

S2 – 1.3306

S3 – 1.3184

R1 – 1.3550

R2 – 1.3672

R3 – 1.3794

The GBP/USD pair is trying to resume the 2025 uptrend, and its long-term outlook has not changed. Donald Trump's policies will continue to put pressure on the US economy, so we do not expect the US currency to strengthen. Thus, long positions with targets at 1.3550 and 1.3672 remain relevant in the near term while the price stays above the moving average. A price below the moving average line allows considering small shorts with a target of 1.3363 on technical grounds. From time to time, the US currency shows corrections (in the global sense), but for a trend to strengthen, it needs global positive factors.

LINKS RÁPIDOS