Since geopolitical risks continue to push precious metal prices into uncharted territory, the latest weekly gold survey showed that Main Street and Wall Street are practically unanimous regarding the prospects for the precious metal.

Darin Newsom, Senior Market Analyst at Barchart.com, said gold is currently overbought; however, he has no plans to sell it because he follows the market rule: do not cross the trend, and the trend is currently bullish.

Colin Cieszynski, Chief Market Strategist at SIA Wealth Management, is optimistic about the yellow metal this week.

Frank McGhee, head precious metals dealer at Alliance Financial, previously doubted the recent gold rallies, but now believes in them because the market is finally taking geopolitical events into account. He also said central banks also support the precious metal again against the backdrop of geopolitics.

McGhee added that in the 1970s, when there were price spikes in the U.S., the dollar simply collapsed, supporting the gold rally. Now there has been a return to the status of net oil exporter, so every dollar earned from crude oil now affects the strength of the dollar.

Senior Market Strategist at Forex.com, James Stanley, expects the yellow metal to continue rising this week. From a macroeconomic point of view, he believes that the Fed will remain dovish, even against the backdrop of last week's Consumer Price Index figures. Accordingly, gold will rise.

The rise in gold amid a strengthening dollar is the influence of geopolitics.

According to Mark Leibovit, publisher of the VR Metals/Resource Letter, the precious metal will approach $2,700 in May or June.

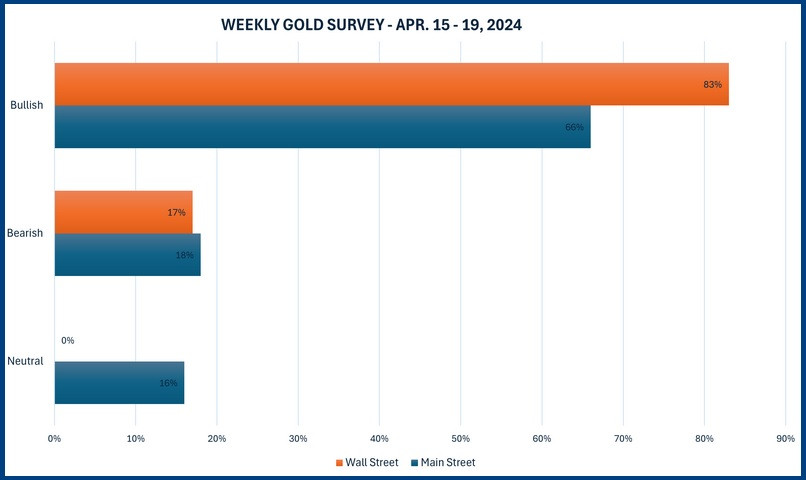

Twelve Wall Street analysts participated in the gold survey, and even more analysts than last week were optimistic. Nine of them, or 83%, expect prices to rise, while the remaining two analysts, representing 17%, predict a decline. No one expected prices to remain at the current level.

In the online survey, 168 votes were cast, with 82% of Main Street investors expecting further growth or sideways trading. 111 retail investors, constituting 66%, are anticipating price increases. 30, or 18%, expect a decline, and 27 respondents, or 16%, believe the precious metal will trade sideways.

Economic data flow will slow down this week. On Monday, retail sales data for March and the Empire State Manufacturing Index for April will be released. On Tuesday, preliminary data on housing starts and building permits for March will be released. Then data on existing home sales for March and April will follow. The Philadelphia Fed survey will be released on Thursday.

RÁPIDOS ENLACES