Analysis of trades and tips for trading the British pound

The levels I indicated for testing in the first half of the day did not materialize, so I did not find suitable entry points. The rather mixed data on manufacturing activity in the UK, which turned out worse than economists' forecasts but still managed to stay above the 50-point mark, led to a decline in the pound, limiting its morning upward potential. Now, the focus will shift to manufacturing statistics in the US. The US ISM Manufacturing Index figures may also disappoint, giving pound buyers a chance to continue the upward trend seen earlier this week. As for the intraday strategy, I plan to act based on the implementation of scenarios No. 1 and No. 2.

Buy Signal

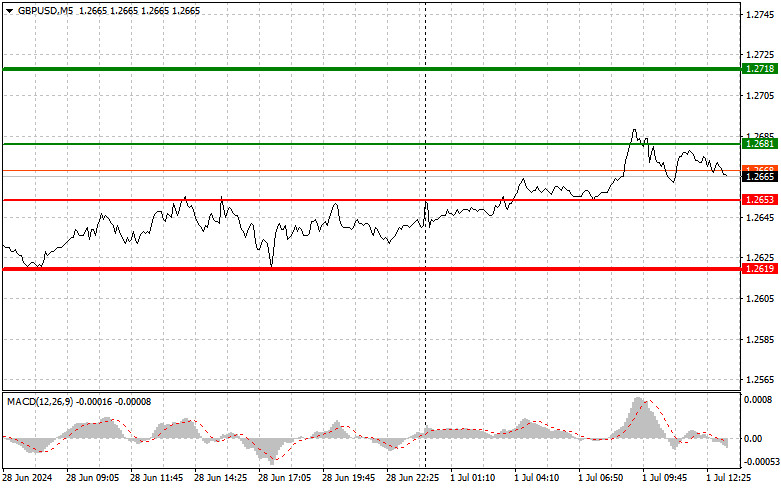

Scenario No. 1: I plan to buy the pound today upon reaching the entry point around 1.2681 (green line on the chart) with a target of rising to 1.2718 (thicker green line). At the 1.2718 area, I will exit the purchases and open sales in the opposite direction (expecting a movement of 30-35 points in the opposite direction from the level). The rise of the pound today can be expected only after weak US data, similar to the UK statistics. Important! Before buying, ensure the MACD indicator is above the zero mark and just starting its upward move.

Scenario No. 2: I also plan to buy the pound today if the price at 1.2653 is tested twice consecutively when the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to a market reversal upwards. An increase can be expected to the opposite levels of 1.2681 and 1.2718.

Sell Signal

Scenario No. 1: I plan to sell the pound today after updating the level at 1.2653 (red line on the chart), leading to a quick decline of the pair. The key target for sellers will be the level at 1.2619, where I will exit the sales and immediately open purchases in the opposite direction (expecting a movement of 20-25 points in the opposite direction from the level). Sellers will assert themselves after strong figures for manufacturing activity in the US, leaving no chance for the pound to return to growth. Important! Before selling, make sure the MACD indicator is below the zero mark and just starting its downward move.

Scenario No. 2: I also plan to sell the pound today if the price at 1.2681 is tested twice consecutively when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline can be expected to the opposite levels of 1.2653 and 1.2619.

What is on the chart:

Important: For novice traders in the forex market, deciding on market entry is crucial. Before releasing significant fundamental reports, staying out of the market is best to avoid sudden exchange rate fluctuations. If you decide to trade during the news release, always set stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

Remember, for successful trading, you need a clear trading plan similar to the one presented above. Spontaneous trading decisions based on the current market situation are an initially losing strategy for intraday traders.

RÁPIDOS ENLACES