To Open Long Positions on GBP/USD

In addition to the Core Personal Consumption Expenditures (PCE) Index in the U.S., which the Fed closely monitors, data on consumer sentiment from the University of Michigan and inflation expectations will be published. FOMC member Mary Daly is also scheduled to speak later. Any reminder that the Fed will not aggressively cut rates next year could pressure the pound, which I plan to capitalize on.

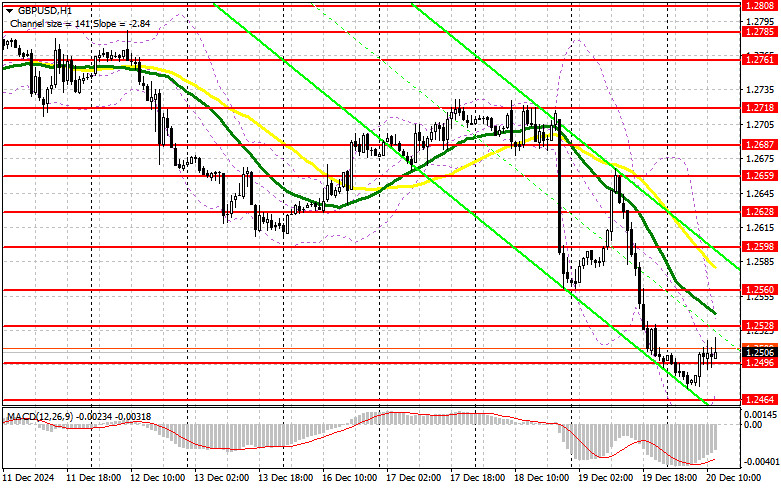

A false breakout around 1.2496 would provide an excellent buying opportunity, aiming for further recovery toward 1.2528 resistance. A breakout and retest of this range from above would create another entry point for long positions, targeting 1.2560, where buyers are likely to encounter challenges. The ultimate target will be 1.2598, where I plan to take profits.

If GBP/USD declines and no buyer activity is observed around 1.2496, it will indicate lost momentum among bulls. In this case, a false breakout near the next support at 1.2464 would be a suitable condition for opening long positions. I plan to buy GBP/USD on a rebound from 1.2424, targeting a 30-35 point intraday correction.

Pound sellers have slightly retreated but have not lost control. Positive U.S. data, especially on inflation, combined with strong resistance at 1.2598, would provide good reasons to increase short positions, continuing the downward trend. The target would be the 1.2496 level. A break and retest from below at this range would lead to a stop-loss sweep, opening the way to 1.2464, dealing a significant blow to bulls. The ultimate target will be 1.2424, where I plan to take profits.

If demand for the pound persists in the second half of the day after weak U.S. data and sellers fail to defend 1.2528—where moving averages also align, favoring bears—buyers may seize the opportunity for a new wave of growth. In this scenario, bears will retreat to 1.2560 resistance. I will sell there only after a false breakout. If there is no downward movement there, I will look for short positions on a rebound from 1.2598, targeting a 30-35 point intraday correction.

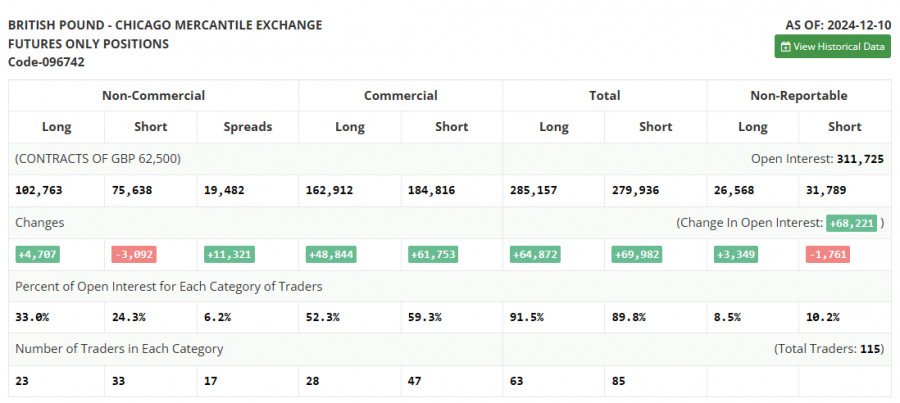

The COT report for December 10 showed a decrease in short positions and an increase in long positions. Overall, the balance of power in the market remained unchanged as many traders adopted a wait-and-see approach ahead of the Bank of England's final meeting of the year. How the BoE will handle interest rates remains a complex question. Recent GDP and inflation data have put the central bank in a challenging position, forcing traders to act cautiously. The latest COT report indicates that long non-commercial positions rose by 4,707 to 102,763, while short non-commercial positions decreased by 3,092 to 75,638. As a result, the gap between long and short positions widened by 11,321.

Moving AveragesTrading is occurring below the 30 and 50-day moving averages, signaling the potential for further declines in the pair.

Note: The moving averages' periods and prices are based on the hourly (H1) chart and differ from the classical daily averages on the daily (D1) chart.

Bollinger BandsIn the event of a decline, the lower boundary of the indicator near 1.2485 will serve as support.

Indicator Descriptions

RÁPIDOS ENLACES