The test of the 156.16 price level coincided with the MACD indicator starting its downward movement from the zero mark, confirming a valid entry point for selling USD. As a result, the pair dropped by 50 pips to the target level of 155.52. Buying on a rebound from this level provided an additional profit of around 30 pips.

According to economists at Nomura, a potential hike in the Bank of Japan's key interest rate during the meeting on January 24 could significantly impact the currency market. Investors are closely monitoring this development, as a stronger yen might lead to changes in asset allocation and trading strategies amid rising interest rates. In the context of global economic instability, these changes are particularly important. The strengthening of the Japanese yen against the dollar is already being factored into the market; however, whenever the USD/JPY pair falls, it is typically influenced by various factors related to the U.S. The BOJ's decision to raise interest rates could alter the economic landscape of the country, which is crucial for both local and international markets. In the upcoming weeks, investors will be vigilant about the movement of the yen and the resulting reactions in global financial markets.

The focus will be on implementing Scenario #1 and Scenario #2 for buying and selling opportunities.

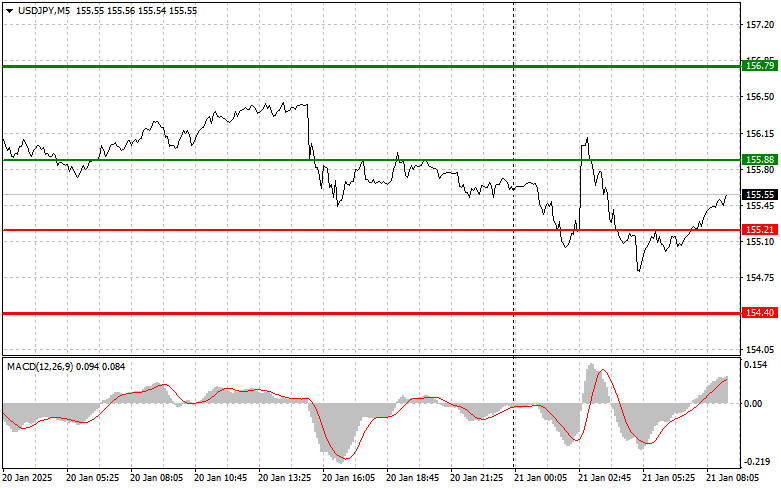

Scenario #1: Buy USD/JPY near 155.88 (green line on the chart) with a target of 156.79 (thicker green line). Near 156.79, I plan to exit the buy trade and open a sell trade in the opposite direction, aiming for a retracement of 30–35 pips. Important! Before buying, ensure the MACD indicator is above the zero mark and beginning its upward movement.

Scenario #2: Buy USD/JPY if the price tests 155.21 twice consecutively while the MACD indicator is in the oversold area. This will limit the pair's downside potential and trigger an upward reversal. Expected targets: 155.88 and 156.79.

Scenario #1: Sell USD/JPY after a break below 155.21 (red line on the chart), which will likely trigger a rapid decline. The key target for sellers will be 154.40, where I plan to exit the sell trade and immediately open a buy trade in the opposite direction, aiming for a retracement of 20–25 pips. Important! Before selling, ensure the MACD indicator is below the zero mark and starting to decline.

Scenario #2: Sell USD/JPY if the price tests 155.88 twice consecutively while the MACD indicator is in the overbought area. This will limit the pair's upward potential and likely trigger a reversal downward. Expected targets: 155.21 and 154.40.

RÁPIDOS ENLACES