A significant number of macroeconomic events are scheduled for Friday. While none of these events are of ultra-high importance individually, their combined impact could greatly influence the movement of currency pairs throughout the day. Business activity indices for the services and manufacturing sectors for February will be released in Germany, the United Kingdom, the Eurozone, and the United States. It is important to note that these indices are particularly significant for European countries, as the U.S. has more critical ISM indices. Additionally, the UK will release a retail sales report, while the U.S. will publish the University of Michigan Consumer Sentiment Index. Given the abundance of reports today, price movements may shift direction several times throughout the day.

Among the fundamental events on Friday, the speech by European Central Bank Chief Economist Philip Lane is particularly noteworthy. He is expected to discuss the current state and outlook of the EU economy. Additionally, he may provide insights into potential future changes in monetary policy, although this topic is already quite clear at the moment. In the US, Federal Reserve representative Mary Daly is also scheduled to speak. However, after a week filled with statements from various Fed officials, there is currently little uncertainty regarding the Fed's policy.

We can anticipate stronger movements during the final trading day of the week, though it may also be more volatile. If the day's reports predominantly favor either the euro and the pound or the dollar, we could see a one-sided movement. However, as history suggests, such scenarios are quite rare. Therefore, it is more likely that both currency pairs will experience fluctuations, showing both gains and losses throughout the day.

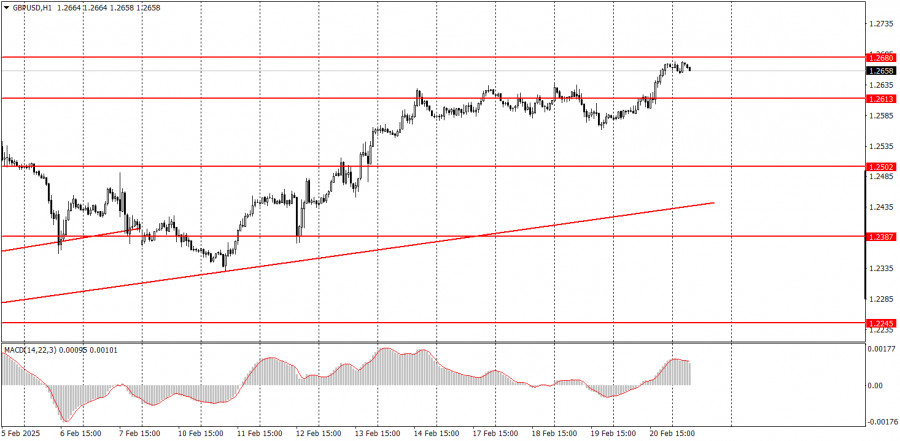

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.

RÁPIDOS ENLACES