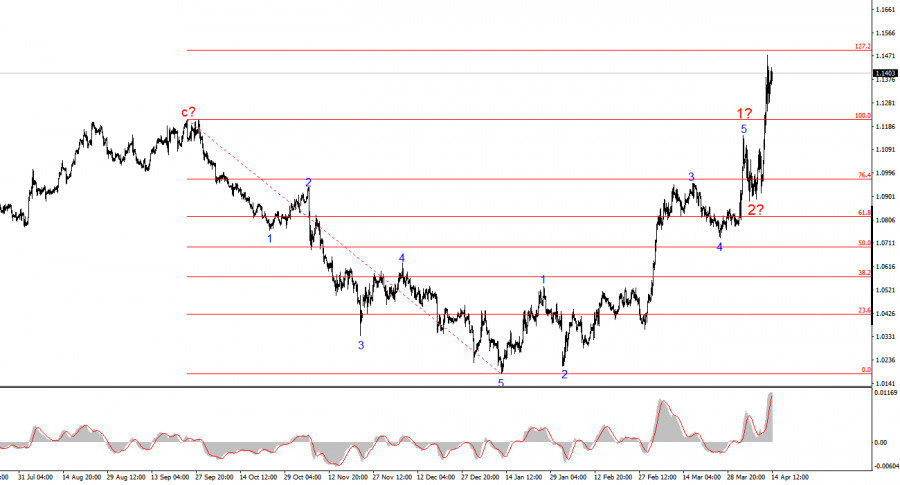

The wave structure on the 4-hour chart for the EUR/USD pair has transitioned into a bullish formation. I believe there is little doubt that this shift occurred solely due to the new trade policy of the United States. Up until February 28, when the sharp decline of the U.S. dollar began, the entire wave pattern resembled a clear downward trend. It was forming a corrective wave 2. However, Trump's weekly announcements of various tariffs have done their job. Demand for the U.S. currency began to fall rapidly, and now the entire trend segment, which started on January 13, has taken on the appearance of a five-wave impulse.

Moreover, the market did not even manage to form a convincing wave 2 within the new upward trend. We only saw a minor pullback, smaller than the corrective waves within wave 1. However, the U.S. dollar may continue to weaken unless Donald Trump completely reverses his adopted trade policy. We have already seen a case where the news background altered the wave structure. A second instance is quite possible.

The EUR/USD pair gained another 100 basis points on Monday. On Friday, it might have seemed like the market was taking a breather from the dollar's endless decline, but Monday showed that it's not time to rest yet. Demand for the U.S. currency started falling again as soon as markets opened overnight, due to new shocking statements from Trump. The situation strongly resembles what happened a week ago, when Trump announced a 90-day grace period and then immediately raised tariffs on Chinese imports to 145%. This time, Trump announced an exemption for imported phones, laptops, and some other electronics—but simultaneously promised to impose tariffs on all semiconductor imports. As much as I'd like to say the trade war isn't escalating further, I simply can't.

It seems many market participants share this view. No one takes Trump's word at face value anymore. If the U.S. president talks about relief today, unpleasant surprises can be expected tomorrow. Therefore, the dollar would not be able to show growth now, even if Trump announced trade talks with China. We should also not forget the speculative factor. The U.S. dollar is falling every day, and many market participants simply want to jump on the trend to profit from the price movement.

Based on the analysis of EUR/USD, I conclude that the pair continues forming a new upward trend segment. Donald Trump's actions have reversed the bearish trend. Therefore, in the near future, wave structure will be entirely dependent on the position and actions of the U.S. president. This must be kept in mind at all times. Based purely on wave analysis, we should now expect the formation of a corrective wave set, which typically consists of three waves. However, wave 2 might already be complete. If this assumption is correct, wave 3 of the upward trend is now forming, with potential targets stretching up to the 1.25 area.

On a larger wave scale, it is evident that the wave structure has shifted into an upward formation. A long-term bullish wave cycle is likely ahead—but the news background from Donald Trump personally could once again turn everything upside down.

Core Principles of My Analysis:

RÁPIDOS ENLACES