Trade Analysis and Tips for the British Pound

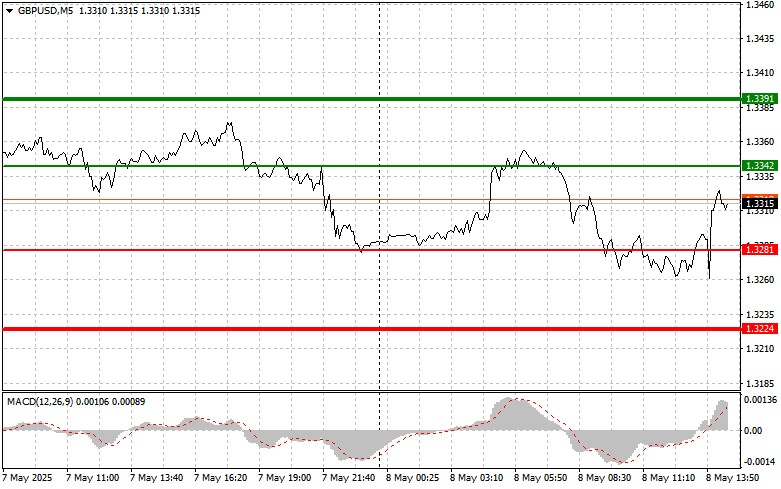

The price test at 1.3330 in the first half of the day coincided with the MACD indicator just beginning to move down from the zero level, confirming a valid entry point for selling the pound. As a result, the pair dropped by 40 points.

As expected, the Bank of England cut interest rates. However, traders seemed prepared for this move, and the market paused in anticipation. Investors will now closely analyze every word from Bank of England officials, looking for clues about future policy. The main question on everyone's mind is: how dovish does the Bank of England intend to be? Will this be a one-off cut, or the start of a series in the coming months? The answers will determine the pound's short-term prospects.

As for U.S. data, figures on weekly jobless claims and productivity in the non-manufacturing sector are unlikely to have a significant impact on GBP/USD. Market focus is squarely on the Bank of England's actions and comments, which will be the primary driver of pound volatility.

Intraday Strategy: I will rely primarily on the execution of Scenarios #1 and #2.

Buy Signal

Scenario #1: I plan to buy the pound today if the price reaches 1.3342 (green line on the chart), targeting a rise to 1.3391 (thicker green line). At 1.3391, I plan to exit the buy position and open a sell position in the opposite direction, expecting a 30–35 point pullback. The pound's growth today is only likely if the Bank of England strikes a cautious tone. Important! Before buying, ensure the MACD indicator is above the zero mark and just starting to rise.

Scenario #2: I also plan to buy the pound if there are two consecutive tests of the 1.3281 level while MACD is in oversold territory. This would limit downward potential and trigger a bullish reversal. The pair could then climb toward the 1.3342 and 1.3391 levels.

Sell Signal

Scenario #1: I plan to sell the pound after a break below 1.3281 (red line on the chart), which could lead to a rapid drop. The key target for sellers will be 1.3224, where I'll exit and open a buy trade in the opposite direction (expecting a 20–25 point rebound). Sellers are more likely to emerge if U.S. data surprises to the upside. Important! Before selling, ensure the MACD is below zero and just beginning to fall.

Scenario #2: I also plan to sell the pound after two consecutive tests of 1.3342 while MACD is in overbought territory. This would cap the upside and prompt a bearish reversal. The pair could then fall toward 1.3281 and 1.3224.

Chart Guide:

Important: Beginner Forex traders should be extremely cautious when deciding to enter the market. It's best to stay out ahead of key economic reports to avoid sudden price swings. If you choose to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't practice sound money management and trade with large volume.

And remember: successful trading requires a clear trading plan—like the one presented above. Making impulsive decisions based on current market conditions is a losing strategy for any intraday trader.

RÁPIDOS ENLACES