Trade Review and Tips for Trading the British Pound

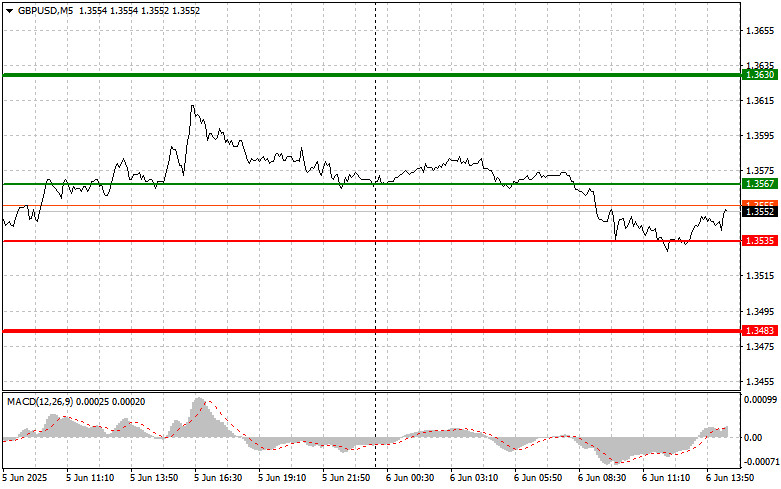

The price test at 1.3546 in the first half of the day occurred when the MACD indicator had already moved significantly below the zero mark, which limited the downward potential of the pair. For this reason, I did not sell the pound. A second test shortly afterward led to a buying opportunity for the pound under Scenario #2, but no significant upward movement followed.

Today, the focus is on the release of key U.S. labor market data. Investors and analysts are closely monitoring three crucial indicators: changes in nonfarm payroll employment, the unemployment rate, and average hourly earnings dynamics. These figures act as a litmus test, reflecting the state of the U.S. economy and guiding the future course of the Federal Reserve's monetary policy. Market expectations are fairly cautious. After several months of steady job growth, experts predict a slight slowdown. However, even a minor outperformance could trigger a sharp jump in the dollar's exchange rate.

As for the intraday strategy, I will rely more on the implementation of scenarios #1 and #2.

Scenario #1: Today, I plan to buy the pound upon reaching the entry point around 1.3567 (green line on the chart), targeting a rise to 1.3630 (thicker green line on the chart). Around 1.3630, I plan to exit the long positions and open short positions, aiming for a 30–35 points reversal move. Pound growth today can be expected only after weak U.S. data. Important! Before buying, ensure the MACD indicator is above the zero mark and just starting to rise from it.

Scenario #2: I also plan to buy the pound today in case of two consecutive tests of the 1.3535 level while the MACD indicator is in the oversold zone. This would limit the pair's downward potential and trigger a reversal upward. A rise toward the opposite levels of 1.3567 and 1.3630 can be expected.

Scenario #1: I plan to sell the pound after a breakout below 1.3535 (red line on the chart), leading to a quick drop in the pair. The primary target for sellers will be the 1.3483 level, where I plan to exit short positions and immediately switch to buying, aiming for a 20–25 points reversal move. Sellers will show up if U.S. statistics are strong. Important! Before selling, ensure the MACD indicator is below the zero mark and just starting to decline from it.

Scenario #2: I also plan to sell the pound today in case of two consecutive tests of 1.3567 while the MACD indicator is in the overbought zone. This would limit the pair's upward potential and trigger a reversal downward. A decline toward the opposite levels of 1.3535 and 1.3483 can be expected.

What's on the chart:

Important: Beginner traders in the Forex market must be very cautious when making market entry decisions. It is better to stay out of the market before important fundamental reports are released to avoid sharp price fluctuations. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-loss orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember, successful trading requires a clear trading plan like the one presented above. Spontaneous trading decisions based on the current market situation are initially a losing strategy for an intraday trader.

RÁPIDOS ENLACES