Washington – Americký prezident Donald Trump v pátek večer (v noci na dnešek SELČ) prohlásil, že dluhopisový trh měl tento týden „slabší chvilku“, kterou on však rychle vyřešil, a že věří, že jeho ekonomický plán povede k posilování dolaru. Informovala o tom agentura Reuters.

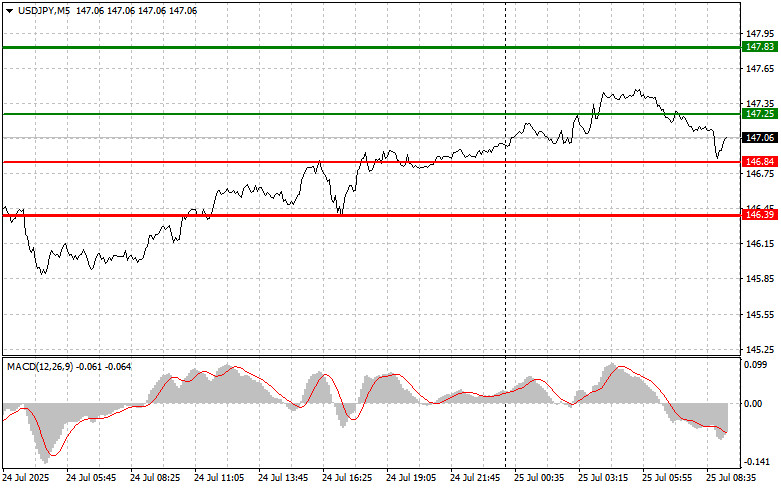

The test of the 146.75 level coincided with the moment when the MACD indicator had just started to move upward from the zero line, confirming a valid entry point for buying the dollar. As a result, the pair rose by 20 pips.

Today's data showing a decline in the Tokyo Consumer Price Index and a drop in Japan's Leading Economic Index put pressure on the yen. Signs of deflation in Tokyo—a barometer for the national economy—undermine expectations for further interest rate hikes by the Bank of Japan. The leading index, designed to forecast future economic activity, signaled a slowdown in growth, adding to investor pessimism. The fall in consumer prices in Tokyo raises concerns about the effectiveness of the Bank of Japan's current monetary policy. Despite scaling back large-scale stimulus programs, the BoJ still struggles to sustainably raise interest rates according to the roadmap laid out earlier this year. Low inflation is holding back this process. The decline in the leading index also supports fears of deteriorating economic prospects in Japan.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Scenario #1: I plan to buy USD/JPY today when the price reaches 147.25 (indicated by the green line on the chart), targeting a rise to 147.83 (represented by the thicker green line on the chart). Around 147.83, I plan to exit long positions and open short positions in the opposite direction, expecting a 30–35 pip reversal from that level. It is best to return to long positions in this pair during corrections and deep pullbacks in the USD/JPY pair.

Important! Before buying, ensure the MACD indicator is above the zero line and is just beginning to rise.

Scenario #2: I also plan to buy USD/JPY today in the case of two consecutive tests of the 146.84 level while the MACD is in oversold territory. This would limit the pair's downside potential and lead to an upward reversal. A rise toward 147.25 and 147.83 can then be expected.

Scenario #1: I plan to sell USD/JPY today only after a move below 146.84 (red line on the chart), which could lead to a rapid decline. The key target for sellers will be 146.39, where I plan to exit short positions and open long positions in the opposite direction, expecting a 20–25 pip rebound from the level. Downward pressure on the pair could return at any moment.

Important! Before selling, ensure the MACD indicator is below the zero line and is just beginning to decline.

Scenario #2: I also plan to sell USD/JPY today in the event of two consecutive tests of the 147.25 level, while the MACD remains in overbought territory. This would cap the pair's upside potential and lead to a downward reversal. A decline toward 146.84 and 146.39 can then be expected.

RÁPIDOS ENLACES