Americká cla mohou zpomalit český hospodářský růst, není ale pravděpodobné, že by způsobila také rychlejší růst spotřebitelských cen. Riziko takzvané stagflace, tedy hospodářské stagnace za zvýšené inflace, panuje především ve Spojených státech.

The New Zealand dollar remains under pressure for the third consecutive day, with the NZD/USD pair trading below the key 0.6000 level and attempting to hold near the 0.5975 support, amid continued strengthening of the U.S. dollar.

The U.S. Dollar Index, which tracks the performance of the greenback against a basket of major world currencies, is rising for a third straight day, supported by expectations that the Federal Reserve will maintain high interest rates for an extended period. These expectations are reinforced by last week's strong U.S. macroeconomic data, which point to a resilient labor market. It is also anticipated that the Fed will maintain the status quo at its upcoming meeting due to rising concerns that newly introduced U.S. tariffs could increase inflationary pressure in the second half of the year. As a result, the dollar continues its upward movement, weighing on NZD/USD.

At the same time, U.S. President Donald Trump has repeatedly criticized Fed Chair Jerome Powell for his decision to keep interest rates at current levels. This has raised concerns about potential interference with the central bank's independence and the risk of political pressure that could hinder the dollar's upward momentum.

On the other hand, increased risk appetite, supported by optimism over trade negotiations, could limit the dollar's strength as a safe-haven currency and provide some support for the NZD/USD pair. In recent developments, the U.S. and the European Union announced a major trade agreement that includes the introduction of baseline tariffs of 15% on most European goods exported to the U.S. This adds to the recent U.S.-Japan trade deal and reports of resumed talks between the U.S. and China on Monday to extend the current trade truce — developments that are boosting investor interest in riskier assets.

Meanwhile, market participants are awaiting the two-day FOMC meeting beginning Tuesday, which could influence further exchange rate dynamics. However, fundamental factors call for caution: the absence of significant U.S. macroeconomic data limits the potential for further NZD/USD declines unless there are clear signals of a shift in sentiment.

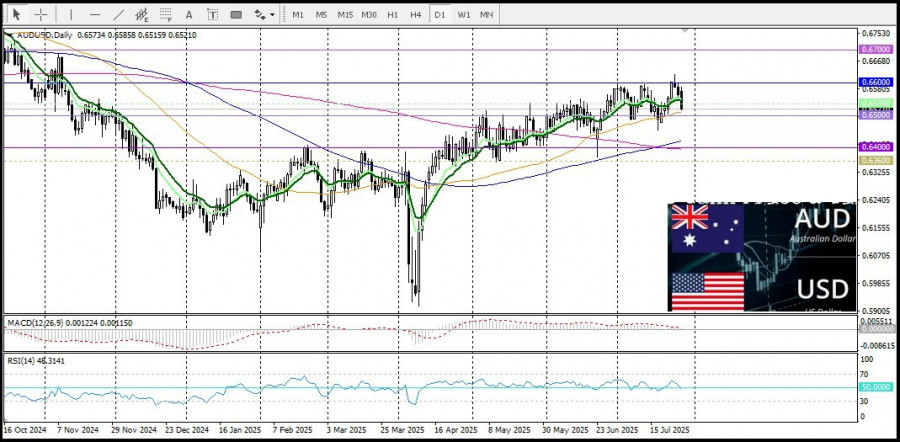

From a technical standpoint, daily chart oscillators have moved into negative territory, indicating the potential for further downside. Moreover, the 9-day EMA is falling below the 14-day EMA, confirming the bearish outlook.

The table below shows today's percentage change in the U.S. dollar against major currencies.

The U.S. dollar was strongest today against the Australian dollar.

RÁPIDOS ENLACES