Italský ministr obrany Guido Crosetto prohlásil, že jakákoli dohoda s firmou Starlink ohledně šifrované satelitní komunikace by měla být posuzována čistě z technického hlediska. Vyjádřil obavu z toho, že otázka byla zbytečně politizována, a zdůraznil potřebu oddělovat technická a politická hlediska. Jednání mezi vládou premiérky Meloniové a firmou Elona Muska kritizuje opozice, která varuje před zadáváním bezpečnostních kontraktů firmě blízké prezidentu Trumpovi.

This is how one could describe what happened on Friday in the context of U.S. President Donald Trump. For two weeks straight, almost every day, the media was celebrating Trump's victories — and with good reason. He signed several trade deals favorable to the U.S., including with Japan and the European Union. The U.S. economy fully recovered in the second quarter after the failure of the first. JOLTS job openings exceeded forecasts. ADP job creation numbers beat market expectations. Riding this wave of success, Trump went ahead with more tariffs. Everyone believed the U.S. economy had entered that very "era of greatness" the president spoke of at the start of his second term. But it all came crashing down on Friday.

Had the Nonfarm Payrolls report simply been negative, there wouldn't have been much excitement or panic. After all, what's so unusual about a report coming in below expectations? That happens every week in every country. The problem wasn't the report itself or its weak result — the problem was the trend, which became visible once the U.S. Bureau of Labor Statistics revised its figures for June and May.

In my opinion, this is an extraordinary situation. I can't recall the last time the BLS didn't just revise previous numbers, but changed them by a factor of ten. It turned out that the pace of nonfarm job growth was the weakest in the last five years. And if not for the pandemic in 2019, these figures would have been the weakest in several decades. So Trump, who had been basking in praise for the last 2–3 weeks, suddenly appeared a failure in the eyes of the public. Market participants saw the downside of high GDP growth in the second quarter and the first positive monthly budget balance in eight years. The cost? American jobs.

In other words, instead of creating jobs and bringing business and manufacturing back home, Donald Trump is, so far, doing everything that leads to Americans losing their jobs. On top of that, he's cutting welfare programs for low-income citizens and increasing the national debt. Perhaps this is in the interest of the U.S. as a whole, but it's hardly in the interest of half the country's population.

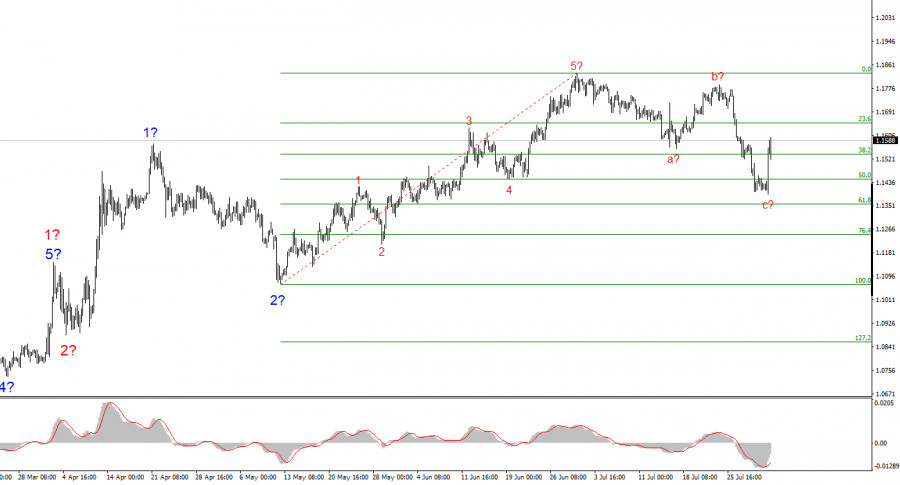

Based on my analysis, EUR/USD continues to form an upward trend segment. The wave structure is still entirely dependent on news developments related to Trump's decisions and U.S. foreign policy. The targets of this trend segment could extend as far as the 1.25 area. Therefore, I continue to consider buying, with targets near 1.1875 (which corresponds to the 161.8% Fibonacci level) and beyond. Presumably, Wave 4 has been completed. Therefore, this is a good time to buy.

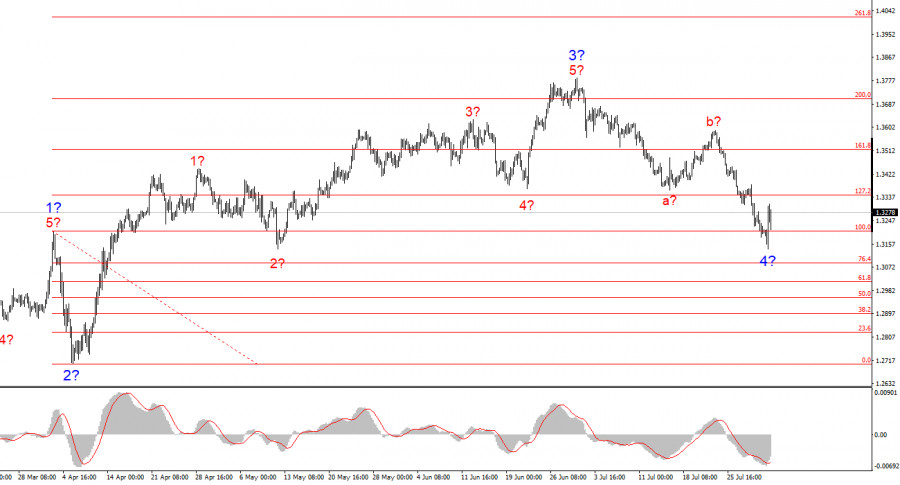

The wave pattern of GBP/USD remains unchanged. We are dealing with an upward, impulsive trend segment. Under Trump, markets could face many more shocks and reversals that may significantly affect the wave structure, but for now, the main scenario remains intact. The targets of this upward trend segment are now located near the 1.4017 mark. I currently assume that the corrective Wave 4 has been completed. Accordingly, I expect the upward wave formation to resume and am considering buy positions.

RÁPIDOS ENLACES