Where does the US economy stand? Judging by the cooling labor market, it is approaching a recession. The acceleration of August inflation will allow talk of stagflation. Both are bad for the S&P 500. So why is the stock market rising? A combination of fiscal and monetary stimulus alongside improved corporate reports usually emerges as the US economy exits a downturn. Under such conditions, the broad equity index typically soars. Investors can afford to keep buying the dips.

A record negative BLS revision to employment data for the 12 months through March—down by 911,000—convinced investors of labor market weakness. If non-farm payrolls grew by 76,000 per month instead of the previously assumed 147,000, the Federal Reserve really should have continued the monetary easing cycle that began in September 2024. The US economy began to weaken under Joe Biden, which gives Donald Trump reason to wash his hands of the problem.

But instead of increasing the anticipated pace of Fed monetary easing, the futures market reduced it. Derivatives now expect only a 6% chance of a 50 bp rate cut in September, down from 10%. The odds of three rounds of policy easing fell from 73% to 65%. The key was the federal judge's decision allowing Lisa Cook to continue serving as an FOMC governor.

Otherwise, Trump would have replaced not one but two "doves" in the Fed's top ranks.

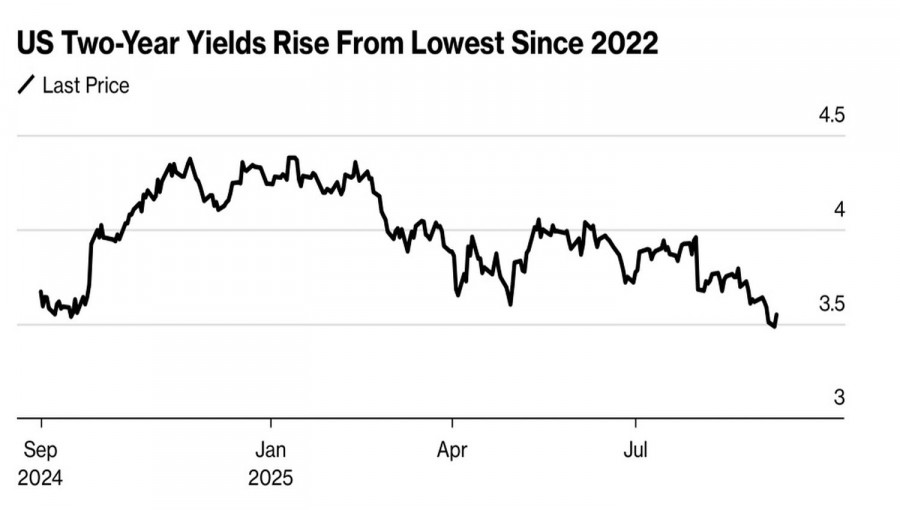

Investors aren't particularly worried, since the central bank has ample reasons to cut the fed funds rate. Anticipation of a renewed easing cycle led to Treasury yields dropping to their lowest levels since 2022. Lower borrowing costs are great news for S&P 500 companies, as costs decrease and profits rise.

The "Magnificent Seven" stocks showed mixed performance. While Apple's shares fell 1.5% after its new mobile phone lineup disappointed investors, Alphabet rose on rumors that Google would increase its investment in the cloud business by $59 billion.

Thus, markets are behaving as they do when the US economy is emerging from recession, but are prepared to shift sentiment to stagflation if the upcoming US PPI and CPI data beat forecasts. On the other hand, a slowdown in producer and consumer prices will open the door to a 50 bp Fed cut in September. This would further fuel the US equity market rally.

Technically, on the daily S&P 500 chart, an inside bar was clearly played out. This allowed for an increase in long positions formed from 6415. Only a drop of the broad equity index below 6480 and 6460 would justify talk of a correction. For now, focus should remain on buying.

RÁPIDOS ENLACES