Berlín – Německá ekonomika se v letošním prvním čtvrtletí vrátila k růstu, hrubý domácí produkt (HDP) se proti předchozím třem měsícům zvýšil o 0,2 procenta. Vyplývá to z předběžných údajů, které zveřejnil spolkový statistický úřad. V posledním čtvrtletí loňského roku se HDP o 0,2 procenta snížil.

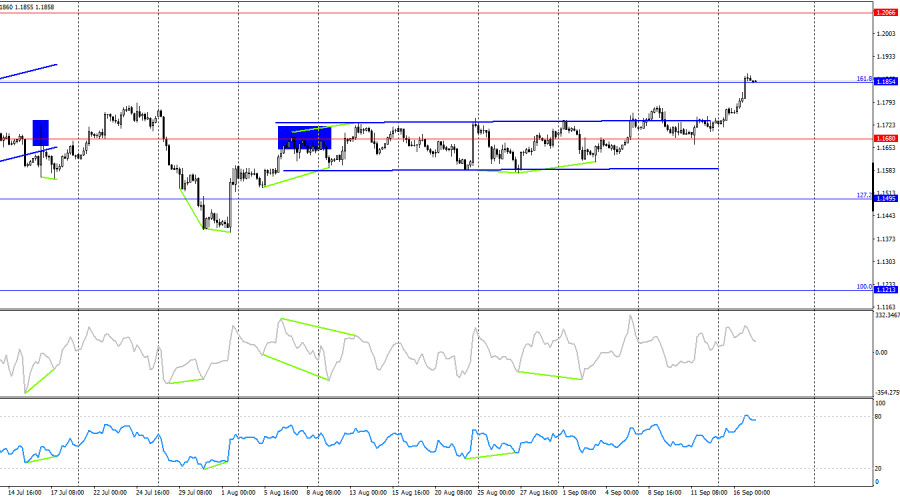

On Tuesday, the EUR/USD pair consolidated above the resistance zone of 1.1789–1.1802 and continued its upward movement toward the 127.2% Fibonacci retracement level at 1.1896. Today, a rebound from this level would work in favor of the U.S. currency and lead to some decline toward 1.1802. A consolidation above 1.1896 would increase the probability of further growth toward the next Fibonacci level of 161.8% at 1.2034.

The wave structure on the hourly chart remains straightforward and clear. The last upward wave broke the peak of the previous one, while the last completed downward wave failed to break the previous low. Thus, the trend is currently "bullish." The latest labor market data and the changed outlook for the Fed's monetary policy support only bullish traders, while the bears are left with nothing.

On Tuesday, the bulls did not have many reasons for a new attack, but the market decided to act in advance. Today, the Fed meeting will be held, where an interest rate cut will be announced, and traders already priced in this event yesterday. Was it justified that the dollar fell again? Most likely, yes. Today's Fed decision will only be the first step, so the market is logically pricing in further rate cuts, of which there may be quite a few. Of course, if Jerome Powell this evening once again emphasizes the importance of economic data and states that there is no planned rate-cutting strategy, this may work against the bulls, who already traded on the "dovish" scenario. However, one way or another, the dollar faces nothing favorable in the near future. Everyone in the market understands this, so any new corrective pullback will be used by traders only for fresh EUR/USD purchases. It is also worth noting that, in principle, fairly good reports on industrial production and retail sales in the U.S. yesterday caused no reaction. The market is fully focused on Powell's speech and the signals the Fed will deliver.

On the 4-hour chart, the pair consolidated above the horizontal corridor, allowing traders to expect further growth. A consolidation above the 161.8% Fibonacci level at 1.1854 will increase the chances of continued growth toward the next level at 1.2066, while a rebound from this level would allow for a decline toward 1.1680. Needless to say, I do not particularly believe in the second scenario. The CCI indicator is shaping up for a "bearish" divergence, but everything today will depend on the Fed.

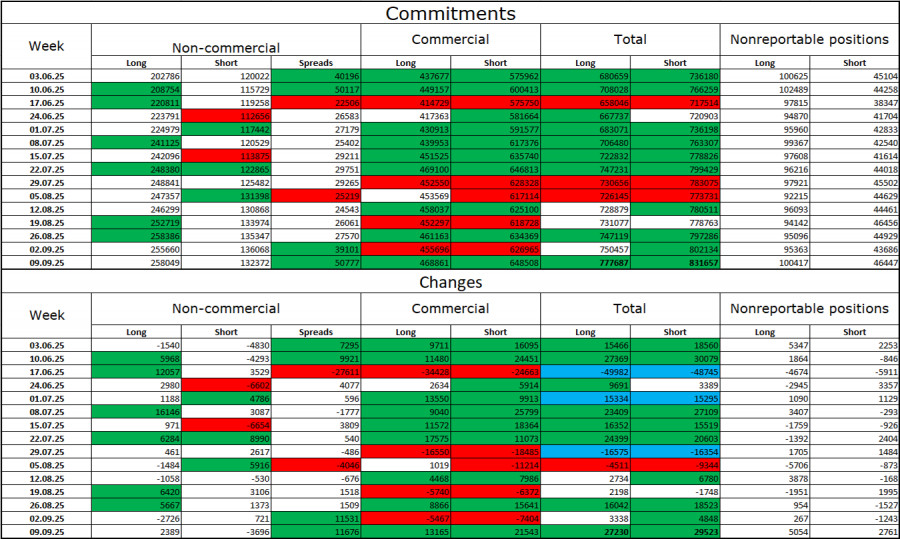

Commitments of Traders (COT) report:

During the last reporting week, professional traders opened 2,389 long positions and closed 3,696 short positions. The sentiment of the "Non-commercial" group remains bullish, thanks to Donald Trump, and is strengthening over time. The total number of long positions held by speculators now stands at 258,000, compared to 132,000 short positions. The gap is effectively twofold. Also, note the number of green cells in the table above, which show strong increases in positions on the euro. In most cases, interest in the euro continues to grow, while interest in the dollar declines.

For thirty-one consecutive weeks, large traders have been reducing short positions and increasing longs. Donald Trump's policies remain the most significant factor for traders, as they may create many problems of a long-term and structural nature for America. Despite the signing of several important trade agreements, many key economic indicators continue to show declines.

News calendar for the U.S. and the Eurozone:

Eurozone – Speech by ECB President Christine Lagarde (07:30 UTC). Eurozone – Consumer Price Index (09:00 UTC). U.S. – Building permits (12:30 UTC). U.S. – Housing starts (12:30 UTC). U.S. – FOMC decision on interest rate (18:00 UTC). U.S. – FOMC economic projections (18:00 UTC). U.S. – Fed press conference (18:30 UTC).

On September 17, the economic calendar contains seven entries, of which the last three are the most significant. The impact of the news background on market sentiment on Wednesday may be strong.

EUR/USD forecast and trader recommendations:

Short positions in the pair can be considered today on the hourly chart if there is a rebound from 1.1896, with a target at 1.1802. Long positions could have been taken after consolidation above the 1.1789–1.1802 zone with a target at 1.1896. Today, it is better to close these trades in profit and wait for new signals. However, the bulls may continue their attacks today.

The Fibonacci grids are built between 1.1789–1.1392 on the hourly chart and between 1.1214–1.0179 on the 4-hour chart.

RÁPIDOS ENLACES