The EUR/USD currency pair maintained its upward bias throughout the day, right up until the Fed meeting. Trading showed extremely low volatility, as no one in the market wanted to take risks before the central bank's decision. The results of the meeting and all subsequent market moves will be analyzed tomorrow. For today, it's enough to note that the U.S. economy continues to weaken in the "Trump era."

Recall that Donald Trump promised "explosive economic growth," but he never clarified when this explosive growth would arrive. Most likely—not anytime soon. In recent months, only activity in the services sector has remained afloat. Unemployment is rising, industrial output is falling, retail sales are weak, and inflation is climbing. Yesterday, it also became known that new housing starts are declining in the U.S., along with building permits. In short, nearly all indicators are pointing downward. Experts are once again speaking openly about a recession.

The dollar continues to fall under Trump's policies and will likely remain out of favor with traders for a long time. On all timeframes, the trend is upward. Thus, even in the very short term, there's little reason to expect dollar strength. Of course, certain events may trigger temporary rebounds, but the overall macro and fundamental background remains firmly against the greenback.

On the 5-minute TF, only one formal trading signal was formed yesterday. During the European session, the price briefly moved away from the 1.1846–1.1857 area, only to return to it within a couple of hours. Daily volatility was "below the floor."

The latest COT report (as of September 9) shows the net position of non-commercial traders has been "bullish" for a long time, with bears only barely taking the upper hand at the end of 2024, and quickly losing it. Since Trump took office as US President, the dollar has been the only currency to fall. We can't say with 100% certainty that the dollar will keep declining, but current events globally do point in that direction.

We still see no fundamental reasons for euro strength, but plenty are supporting the dollar's drop. The global long-term downtrend remains, but what does the last 17 years' price action matter now? Once Trump ends his trade wars, the dollar may rally, but recent events show that won't happen anytime soon. Potential loss of Fed independence is another major pressure point for the US currency.

The red and blue lines of the indicator keep pointing to a persistent "bullish" trend. In the last reporting week, the number of longs in the Non-commercial group rose by 2,400 contracts, while shorts fell by 3,700. Thus, the net position increased by 6,100 contracts, which isn't a significant change.

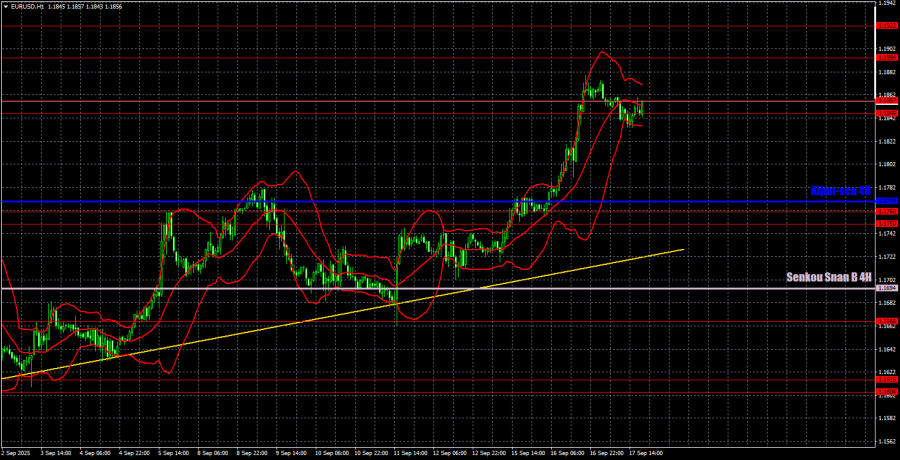

On the hourly timeframe, EUR/USD continues to trend upward. Yesterday, the upward move gained momentum, and on the daily TF, it's clear that the 2025 uptrend has officially resumed. Traders are thus justified in expecting the euro to climb another 500–600 points. There is no limit to the dollar's decline, given Trump's current policies.

For September 18, the key trading levels are: 1.1234, 1.1274, 1.1362, 1.1426, 1.1534, 1.1604–1.1615, 1.1666, 1.1750–1.1760, 1.1846–1.1857, 1.1922, 1.1971–1.1988, along with Senkou Span B (1.1694) and Kijun-sen (1.1770). Lines of the Ichimoku indicator may shift during the day, which should be considered when identifying signals. Don't forget to set Stop Loss to breakeven once the price moves 15 pips in the right direction—this will protect against false signals.

On Thursday, Christine Lagarde will deliver yet another speech in the eurozone, while the U.S. will publish the relatively minor jobless claims report. From Lagarde's third speech this week, expectations are the same as the first two—nothing new. The ECB meeting took place last week, and the market has already received all the necessary information.

On Thursday, the pair may continue/resume its move north. Whatever the Fed decides, and however the market reacts, the situation for the U.S. dollar remains unchanged—and will not change anytime soon.

RÁPIDOS ENLACES